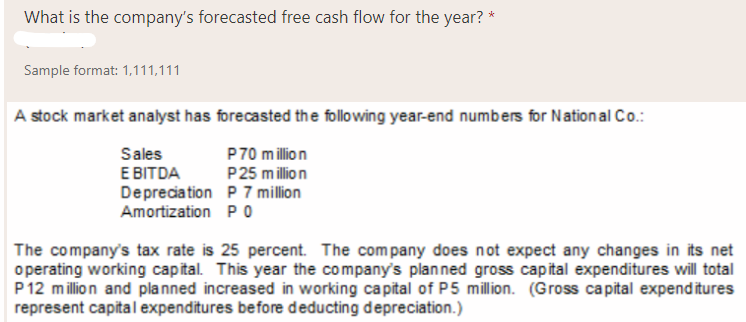

What is the company's forecasted free cash flow for the year? * Sample format: 1,111,111 stock market analyst has forecasted the following year-end numbers for National Co.: Sales P70 million P25 million Depreciation P 7 million E BITDA Amortization P O he company's tax rate is 25 percent. The company does not expect any changes in perating working capital. This year the company's planned gross capital expenditures w 12 million and planned increased in working capital of P5 million. (Gross capital expen

What is the company's forecasted free cash flow for the year? * Sample format: 1,111,111 stock market analyst has forecasted the following year-end numbers for National Co.: Sales P70 million P25 million Depreciation P 7 million E BITDA Amortization P O he company's tax rate is 25 percent. The company does not expect any changes in perating working capital. This year the company's planned gross capital expenditures w 12 million and planned increased in working capital of P5 million. (Gross capital expen

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 27P

Related questions

Question

8

Transcribed Image Text:What is the company's forecasted free cash flow for the year? *

Sample format: 1,111,111

A stock market analyst has forecasted the following year-end numbers for National Co.:

Sales

E BITDA

Depreciation P 7 million

Amortization P O

P70 million

P25 million

The company's tax rate is 25 percent. The company does not expect any changes in its net

o perating working capital. This year the company's planned gross capital expenditures will total

P12 million and planned increased in working capital of P5 million. (Gross capital expenditures

represent capital expenditures before deducting depreciation.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning