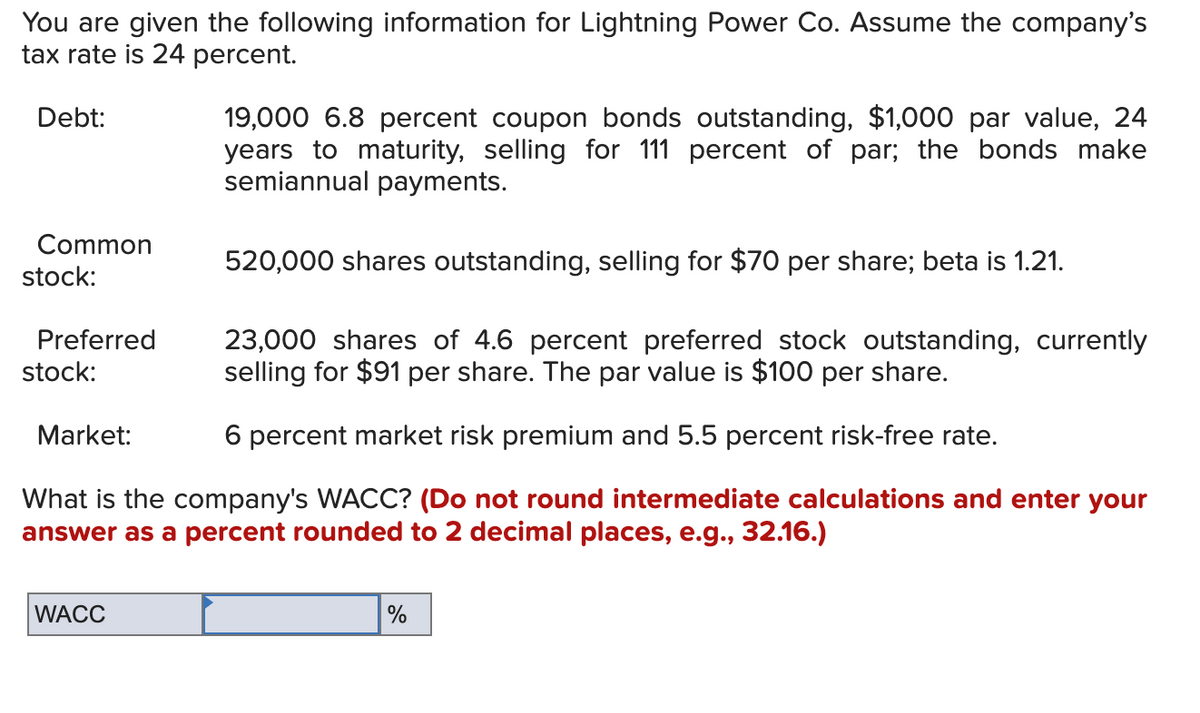

What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC %

Q: A new baking machine costing $10,000 is purchased. Using a declining balance rate of 15 percent,…

A: Depreciation is the systematic allocation of cost of the asset over the useful life of asset. It…

Q: What amount of money invested today at 15% interest can provide the following scholarships: ₱30,000…

A: Interest rate = 15% Annual cash flow in first 6 years = P30,000 Annual cash flow in next 6 years =…

Q: 1. Kind according to purpose (Choose 1) a. Horizontal b. Vertical c. Product Extention d. Market…

A: Merger & Acquisition can be defined as the process or merging and acquiring one or more…

Q: Paula Boothe, president of the Bramble Corporation, has mandated a minimum 9% return on investment…

A: Return on investment = (Return or operating income/Investment)×100

Q: What are the strengths and weaknesses for establishing base pay in international contexts for home…

A: In the home country based approach the pay compensation is based on the payment levels of the home…

Q: Jim takes out a PHP 350,000 bank loan and plans to pay it off in 36 monthly payments. The first…

A: Solution:- When an amount is taken as loan, it is either to be repaid as lump sum payment or in…

Q: Yesterday, John bought a ten-year, $50,000 coupon bond with an annual rate of 5% compounded…

A: A bond pays annual (or in some cases semi-annual) coupons to the bondholders. Besides this the…

Q: Kobe Ltd recently sold 15 million shares in an IPO. The offering price was Sh.25.50, and the…

A: Floatation costs are costs incurred by a company while issuing new equity. These are expressed as a…

Q: An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a…

A: Given: Bond C Bond Z Years 4 4 Face value 1000 1000 Yield to maturity 9.40% 9.40%…

Q: Project A and Project B are independent projects. Investment life of Project A is 4 years and…

A: An independent project is one whose cash flow is unaffected by other projects' accept or reject…

Q: Determine the expected present worth of the following cash flow series if each series may be…

A: Expected present worth can be defined as the mean or average value of the given variables which…

Q: Continue using the data given on the last question. State your answers for IRR with a precisic…

A: IRR is the internal rate of return. It is the rate at which NPV (net present value) becomes nil.

Q: The following are sentences relating to types of mergers and acquisitions. Which is/are true? [S1]…

A: Merger and Acquisition (M&A) is the process of bringing together of two or more companies, where…

Q: At the end of each quarter, a life insurance client deposits Ph 6,366 for 5 years. If money is worth…

A: Solution:- When an equal amount is deposited each period at end of period, it is called ordinary…

Q: Project L requires an initial outlay at t = 0 of $56,000, its expected cash inflows are $10,000 per…

A: Initial outlay = $56,000 Annual cash inflow = $10,000 WACC = 14% Period = 10 years

Q: Phyllis invested 49000 dollars, a portion earning a simple interest rate of 4 percent per year and…

A: Given, Amount invested is $49000 Interest earned on both the investments is $2320

Q: Why does have equity habve a higher vost of capital compared to debt?

A: Reasons why equity have higher cost of capital than debt is 1) Debt has tax advantages I,e tax…

Q: Accounting Use the following table, Present Value of an Annuity of 1 Period 8% 9% 10% 1 0.926 0.917…

A: Solution:- We know, Net Present Value means the difference between the present value of cash inflows…

Q: how a firm might use a commodity derivative to reduce risk in its business? please include a…

A: In the world of derivatives, options etc. commodity derivatives are an important concept.…

Q: what it the firm’s cash conversion cycle?

A: Cash Conversion Cycle: It is a metric used in finance that indicates the time it takes for a firm…

Q: 8) What lump sum should you deposit now at 1.6%, compounded continuously, to attain $750,000? 9) The…

A: Present Amount: It is the present worth of the future sum of the amount and is estimated by…

Q: AC entered into an investment fund four years ago. The investment fund has an interest rate of 3%…

A: Interest rate is 3% compounded quaterly for first 4 years Interest rate for next 5 years us 4.5…

Q: Project X has an initial investment cost of $20.0 million. After 10 years it will have a salvage…

A: Internal rate of return is the return at which present value of cash flow is equal to initial…

Q: Based on the net present value method of capital budgeting, should management undertake this…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: (a) Find their regular monthly payment. (Round your answer to the nearest cent.) $125000 X (b) Find…

A: Mortgage amortization refers to a schedule which is prepared to shows the periodic loan payments,…

Q: Project R has annual cash flows of $6,000 for the next 10 years and then $5,000 each year for the…

A: Annual cash flow for 10 years = $6,000 Annual cash flow in following 10 years = $5,000 IRR = 12.92%…

Q: Suppose the 1-year domestic interest rate is 0.28, keeping in mind that means (100\times×0.28)%.…

A: Domestic Interest rate = 28% Expected exchange rate = 59 Current spot exchange rate = 50

Q: Joo Won receives $480 on the first of each month. Hee Sun receives $480 on the last day of each…

A: Monthly payment (m) = $480 Monthly discount rate (r) = 0.01 (0.12 / 12) Number of payments (n) = 36…

Q: 6. A company is buying a piece of manufacturing equipment now for $45,000. They expect to have to…

A: Cost of equipment now (PV) = $45000 Inflation rate (i) = 3.8% Period (t) = 10 Years

Q: The management of Quest Media Inc. is considering two capital investment projects. The estimated net…

A: Standard Disclaimers“Since you have posted a question with multiple subparts, we will solve the…

Q: nformation concerning the capital structure of the Petrock Corporation is as follows: December…

A: Earnings per share is the amount which is available to the shareholder per share after paying…

Q: 8. Find the net present value of the cash flows shown below. +200 %5 %8 %10 %12 Semiannually…

A: We will calculate the NPV for each period taking 1 year as it has been mentioned for the different…

Q: A corporation decides whether to undertake a project that requires an investment of $150 million now…

A: NPV is the difference between present value of all cash inflows and initial investment. NPV =PV of…

Q: Mr. Sebastian avails the loan offered by his company with a minimal interest of 1.5% every 6 months.…

A: Here, To Find: Semi-annual payments of the loan =?

Q: Outlet has an unlevered cost of capital of 14.2 percent, a tax rate of 35 percent, and expected…

A: Value of Unlevered Firm = EBIT*(1-tax rate)/unlevered cost of capital = [23400*(1-35%)]/14.2% =$…

Q: An engineer wishes to design a test to find the mean resistance of a wire. He wants to determine a…

A: The excel formula sheet of above table is:

Q: At an 8.5% inflation rate, how long until cash deposits earning zero halve in value?

A: Inflation rate (i) = 8.5% Future real value factor required (FVF) = 0.50 Period = n

Q: Flo East has $25,000 to invest in a financial institution for a period of three years. Institution A…

A: Explanation : When we are calculating the Compounded Interest calculation Monthly Compounding…

Q: Given an annual credit sales value of 365 million; accounts receivable beg. 36.5 million, cost of…

A: Average collection period is a ratio that is used in determining the number of days the balance on…

Q: Marie and Danny Would like to buy a house for $220,000. The down payment for the mortgage is 30% of…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: 2 MalkCo is currently an all-equity firm with expected EBIT of Rs. 240,000 in perpetuity. The firm's…

A: Note: Hi! Thank you for the question, As per the Honor Code, we are allowed to answer the three…

Q: Find the compound interest earned if PhP 31,496 is deposited in a bank at 2.6% compounded monthly…

A: Solved using Financial Calculator PV = -31,496 N = 26 I/Y = 2.6/12 = 0.2167 CPT FV = 33,319.17

Q: A tax exempt municipality is considering the construction of a new municipal waste water treatment…

A: Incremental benefit/cost ratio helps in ascertaining the amount by which the other projects are…

Q: Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking…

A: The net present value is the measure of profitability in which we add up the discounted cash flows.…

Q: A company has a $500 000 million loan with a 7% interest rate and a $300,000 loan with an 8% rate.…

A: Loan A amount = $500,000 Interest rate on loan A = 7% Loan B amount = $300,000 Interest rate on loan…

Q: cial terms and performance ratios (see graphic). You want to buy it at an 8.5 cap. What is your , at…

A: Net operating income is the necessary factor to be considered in purchase of property and using cap…

Q: Below are the annual returns provided by TSCM. Calculate average annual return experienced by an…

A:

Q: mutual fund has an offer price of $14.06. If you invested a lump sum of $14,000, how many shares did…

A: Offer price = $14.06 Investment = $14000

Q: Assume that you buy a 1-year, 210,000 peso Philippine bond that pays 7 percent when the exchange…

A: In order to find the gain or loss in currency, we have to observe the fall or rise in the value of…

Q: Bartlett Car Wash Co. is considering the purchase of a new facility. It would allow Bartlett to…

A: Accounting rate of return can be calculated as: = Average Net Profit/ Average Investment * 100 It…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Waylan Sisters Inc. issued 3-year bonds with a par value of $100,000 and a 6% annual coupon when the market rate of interest was 5%. If the bonds sold at 102.438, how much cash did Williams Sisters Inc. receive from issuing the bonds?Smashing Cantaloupes Inc. issued 5-year bonds with a par value of $35,000 and an 8% semiannual coupon (payable June 30 and December 31) on January 1, 2018, when the market rate of interest was 10%. Were the bonds issued at a discount or premium? Assuming the bonds sold at 92.288, what was the sales price of the bonds?Neubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond?

- Consider the following information for Watson Power Co.: Debt: 4,500 7 percent coupon bonds outstanding, $1,000 par value, 18 years to maturity, selling for 103 percent of par; the bonds make semiannual payments. Common stock: 108,000 shares outstanding, selling for $61 per share; the beta is 1.08. Preferred stock: 14,000 shares of 6.5 percent preferred stock outstanding, currently selling for $104 per share. Market: 9 percent market risk premium and 6 percent risk-free rate. Assume the company's tax rate is 34 percent. Find the WACC.Consider the following information for Watson Power Company: Debt: 3, 500 8 percent coupon bonds outstanding, $1,000 par value, 20 years to maturity, selling for 104 percent of par; the bonds make semiannual payments. Common stock: 80, 500 shares outstanding, selling for $59 per share; the beta is 1.09. Preferred stock: 12, 000 shares of 7.5 percent preferred stock outstanding, currently selling for $107 per share. Market: 9.5 percent market risk premium and 7 percent risk - free rate. Assume the company's tax rate is 35 percent. Find the WACC.Consider the following information for Evenflow Power Co., Debt: Common stock: 4,000 7 percent coupon bonds outstanding, $1,000 par value, 17 years to maturity, selling for 102 percent of par; the bonds make semiannual payments. 84,000 shares outstanding, selling for $59 per share; the beta is 1.17. 13,000 shares of 6.5 percent preferred stock outstanding, currently selling for $103 per share. 8.5 percent market risk premium and 6 percent risk-free rate. Preferred stock: Market: Assume the company's tax rate is 31 percent. Required: Find the WACC. (Do not round your intermediate calculations.)

- Consider the following information for Watson Power Company: Debt: 2,500 6 percent coupon bonds outstanding, $1,000 par value, 17 years to maturity, selling for 103 percent of par; the bonds make semiannual payments. Common stock: 50,000 shares outstanding, selling for $64 per share; the beta is 1.1. Preferred stock: 7,500 shares of 5.5 percent preferred stock outstanding, currently selling for $106 per share. Market: 8 percent market risk premium and 5 percent risk-free rate. Assume the company's tax rate is 34 percent. Find the WACC. Multiple Choice 8.83% 8.93% 9.23% 9.59% 8.73%You are given the following information for the Buster Bronco company. There are 9700 bonds outstanding with a 7 percent coupon, $1,000 par value, 21 years to maturity, semiannual payments, and are selling for 105 percent of par. There are 2300 shares of 4.5 percent preferred stock outstanding with a $100 par value and a current price of $97 per share. There are 57,000 shares of common stock outstanding, trading at $73 per share, with a 1.46 beta. The United States has a 21% corporate tax rate, a T-bill return of 4.78 percent, and a 14.5% expected equity market return What is the cost of preferred equity? (percentage)Consider the following information for Evenflow Power Co., Debt: 4,000 7.5 percent coupon bonds outstanding, $1,000 par value, 23 years to maturity, selling for 104 percent of par; the bonds make semiannual payments. Common stock: 100,000 shares outstanding, selling for $61 per share; the beta is 1.1. Preferred stock: 13,000 shares of 6.5 percent preferred stock outstanding, currently selling for $105 per share. Market: 9 percent market risk premium and 6 percent risk-free rate. Assume the company's tax rate is 32 percent. Required: Find the WACC. (Do not round your intermediate calculations.) Multiple Choice 11.21% 10.96% 11.63% 10.71% 10.81%

- Consider the following information for Watson Power Company:Debt: 5,500 5.5 percent coupon bonds outstanding, $1,000 par value, 18 years to maturity, selling for 105 percent of par; the bonds make semiannual payments.Common stock: 115,500 shares outstanding, selling for $59 per share; the beta is 1.19.Preferred stock: 19,500 shares of 4.5 percent preferred stock outstanding, currently selling for $108 per share.Market: 6 percent market risk premium and 4.5 percent risk-free rate.Assume the company's tax rate is 31 percent.Find the WACC.You are given the following information for Watson Power Co. Assume the company's tax rate is 22 percent. Debt: 22,000 7,1 percent coupon bonds outstanding. $1,000 par value, 21 years to maturity, selling for 107 percent of par; the bonds make semiannual payments. Common stock: 550,000 shares outstanding, selling for 573 per share, the beta is 1.17. Preferred stock: 24, 500 shares of 4.9 percent preferred stock outstanding, currently selling for $94 per share. The par value is $100 per share. Market: 6 percent market risk premium and 5.2 percent risk free rate. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)Given the following information for Watson Power Co., find the WACC. Assume the company’s tax rate is 21%. Debt: 15,000 bonds with a 5.8 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par; the bonds make semiannual payments Common Stock: 575,000 shares outstanding, selling for $64 per share; the beta is 1.09. Preferred Stock: 35,000 shares of 2.8 percent preferred stock outstanding, currently selling for $65 per share. Market: 7 percent market risk premium and 3.2 percent risk-free rate. Please complete on excel and show excel formulas!