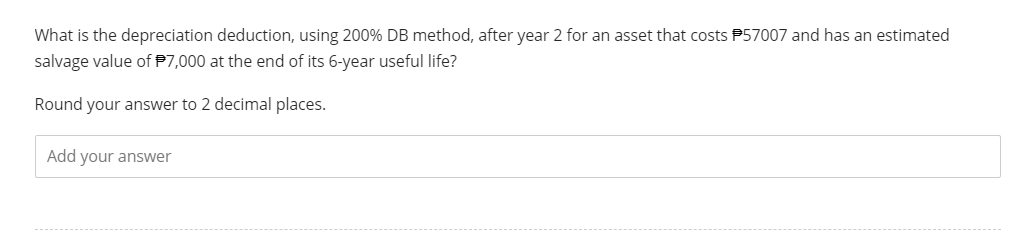

What is the depreciation deduction, using 200% DB method, after year 2 for an asset that costs $57007 and has an estimated salvage value of $7,000 at the end of its 6-year useful life? Round your answer to 2 decimal places. Add your answer

Q: Caesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments…

A: Answer : Prepare sales Journal = Sales journal prepare to record credit sales of merchandise.

Q: Which of the following statements regarding capital investments is not true? a.They involve some of…

A: Capital Investment: A corporation will make a capital investment when it buys tangible assets with…

Q: Smatter Corporation purchased land for a new building. Which of the following costs would not be…

A: Introduction: Plant assets are fixed assets having a lifespan of more than a year that a firm…

Q: A company is considering buying a part that they currently make for one of their products. The costs…

A: Introduction: The tangible elements that go into creating a product are referred to as direct…

Q: 1. 2. 3. 4. Investments in land were sold at cost during 2021. Equipment costing $56,640 was sold…

A: Cash Flow Statement : The statement of cash flow is one of the financial statement of…

Q: The present worth of a multiyear investment with all positive cash flows (incomes) other than the…

A: minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that…

Q: Company expects direct $4 per unit for 100000 hits (a total of $400000 of direct materials costs).…

A: The standard direct materials cost is calculated in per unit cost form and budgeted direct materials…

Q: Prepare a continuity schedule for the plan assets over the three-year period. (Round answers to O…

A: Business Continuity Plan :— it Include step by step Procedure. BCP is only required when there is a…

Q: Required: 1. Prepare Comparative Statement 2017, 2016 & 2015 (Increase, Decrease) 2. Prepare…

A: Comparative statement is a form of analysis under which we compare the financial figures of the…

Q: At the end of 2020, the records of Block Corporation reflected the following. Common stock, $5 par,…

A: By dividing a company's revenue or profit by the total number of outstanding shares, basic EPS is…

Q: During 2021, it costs Bramble, Inc. $24 per unit to produce part T5. During 2022, the unit cost has…

A: Make or Buy Decision :— It is act of selecting lowest cost alternative between making of product or…

Q: Additional Information • Pic uses the cost method to account for its investment in Sic. Any…

A: Number of shares acquired: 7500 Number of additional ordinary shares: 2000 Profit attributable to…

Q: How about the cost of inventory held by the consignee

A: Cost of inventory includes purchase cost of inventory, it's conversation cost and any other expenses…

Q: Jaya works for a securit and is paid an hourly rate of for a 40-hour week. Additionally, she is paid…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts…

Q: Calculate what Jordan Manufacturing Co.'s Flexible Budget would be at an estimate of 9,000 units,…

A: Variable costs are those costs which changes with change in level of activity. Fixed costs are those…

Q: Crane Company manufactures a product with a standard direct labor cost of two hours at $17 per hour.…

A: Variance is difference between actual and standard revenue or expenses. If actual expenses higher…

Q: During May 2022, your company used $400 of cleaning supplies in the factory. When the use of these…

A: The work in process account records the total direct costs include during the production. The…

Q: Audit sampling involves applying an audit procedure to less than 100 percent of the population for…

A: Sampling Risk :- Sampling threat is the opportunity that the objects decided on in a pattern…

Q: create a general ledger account for each account. Post the journal entries. Enter the following…

A: Computation of Supplies expenses for the month of October Supplies Expenses of October Month =…

Q: Fast Wire Incorporated manufactures a scrambling device for cellular phones. The main component of…

A: The productivity ratio can be calculated by dividing the number of phones manufactured by total…

Q: A machine purchased for $315653 has a depreciable life of 7 years, and it has a terminal book…

A: Depreciation is allowed as an expense for cost of machine during the life of machine. Straight line…

Q: 35% 39.6% Standard deduction Exemption (per person) up to $418,400 above $418,400 $6350 $4050 up to…

A: Here discuss about the details of tax bracket and its calculation which are related with this for…

Q: Waupaca Company establishes a $350 petty cash fund on September 9. On September 30, the fund shows…

A: Introduction: A journal entry is used to record a business deal in a company's financial records. A…

Q: Required: 1o. & 1b. Prepare journal entries to record the partners' initial capital investments and…

A: Partnership Firm :— When two or more Individuals Come together to form an business and share profit…

Q: How about the Consolidated Inventory at December 31, 2021?

A: Consolidated inventory is the inventory which has been computed by the company on the consolidation…

Q: Vaughn Manufacturing uses flexible budgets. At normal capacity of 15000 units, budgeted…

A: Solution: Budgeted variable overhead = $90,000 Budgeted nos of units = 15000 units Budgeted variable…

Q: Daley Company prepared the following aging of receivables analysis at December 31. Accounts…

A: Allowance for doubtful accounts - Allowance for doubtful accounts is the provision made by the…

Q: Peachtree Company uses sales journal, purchases journal, cash receipts journal, cash payments…

A: Purchase Journal - Purchase Journal is a form of table used to record all the purchases made on…

Q: A department has budgeted monthly manufacturing overhead cost of $610000 plus $5 per direct labor…

A: Solution: Budgeted fixed overhead = $610,000 Budgeted variable overhead = $5 per Direct labor hour

Q: What are the examples of fixed asset? Apakah contoh asset tetap? i. Land /Tanah ii. Building…

A: Fixed Assets :— Fixed Assets is Capital in Nature. Any Expenditure which gives Long Term Benefits is…

Q: The accounting records of Friends Company provided the data below: Net income Depreciation expense…

A: Cash Flow From Operating Activities :— Cash flow from operating activities does not include long…

Q: Is there a balance sheet for Aunt Ibby's Styling Salon?

A: Given that, Net income = $13,710 Ending capital = $4,475 Drawings= $12,000 Styling supplies = $50…

Q: E. Sum of the Year's Digit Method Problem: A structure costs P120,000. It is estimated to have a…

A: The depreciation is charged on fixed assets as the reduction in the value of fixed assets with usage…

Q: Question 2 Tasty Biscuit prepares its financial statements on every 31 December and incurred the…

A: Depreciation - Depreciation is charged to income statement for the assets used in the business. It…

Q: Global Fiter Corp. completed the following petty cash transactions during May and June in 2014 May…

A: Imprest System of Petty Cash The general ledger account Petty Cash will remain inactive at a fixed…

Q: During Heaton Company's first two years of operations, it reported absorption costing net operating…

A: Req-1 Calculation of unit product cost under variable costing: Direct Materials $7.00…

Q: Throughout this book, emphasis has been placed on the concept of independence as the most…

A: Answer:- Auditor meaning:- An auditor is that person who is authorized to examine and verify the…

Q: If a company plans to sell 40000 units of product but sells 60000 units, the most appropriate…

A: All the budget was made on the planned unit sales of 40000. Actual units sold are 60000. Comparison…

Q: If the required direct materials purchases are 31500 pounds, the direct materials required for…

A: Ending Inventory :— Ending inventory is the value of goods still available for sale and held by a…

Q: Tamarisk Company is considering two different, mutually exclusive capital expenditure proposals.…

A: Net Present Value :— It is the sum of all present value of future cash flows. NPV is used for…

Q: This year, Amber purchased a business that processes and packages landscape mulch. Approximately 20…

A: The costs a business directly incurs to produce a good or provide a service, or to purchase a good…

Q: A method for determining a bonus based upon the performance of the firm is a(n): Multiple Choice…

A: Introduction: A bonus is a monetary reward that is more than the recipient would typically…

Q: The financial statements of Gray Services and Blue Services include the following items: Gray Blue…

A: Working capital is the measure of liquidity position of a business which can be calculated by…

Q: Wright Company's cash account shows a $29,900 debit balance and its bank statement shows $28,200 on…

A: Solution: Bank reconciliation is a process by which the bank account balance in books of account is…

Q: Markets, Incorporated, operates three stores in a large metropolitan area. A segmented absorption…

A: Employment taxes refers to the form of additional tax imposed on the income of an employee which…

Q: Prepare the shar (b) financial position at Decen to shareholders' equity 1. The following…

A: Comment - Multiple Questions Asked. Shares- The business's financial resources are its shares.…

Q: How would I calculate hourly rate for a non exempt employee with hours past 40? How would I factor…

A: Question is asking how to calculate the hourly rate of overtime for non-exempt employees, let's…

Q: Required: a. What is the total manufacturing cost assigned to Job 413? b. What is the unit product…

A: Manufacturing Cost = Total Cost which is Incurred to Manufacturing the product. Total Manufacturing…

Q: Purchase with Trade Discount and Sales Discount On May 30, Cecil Company purchased merchandise on…

A: Cecil Company purchase Goods from Ricci Company on credit Ricci Company provide 25% Trade discount…

Q: Colada Quest Games Inc. adjusts its accounts annually. The following information is available for…

A: Adjustment entries: Adjustment entries can be made at the end of period or each month or according…

Step by step

Solved in 3 steps

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Susquehanna Company purchased an asset at the beginning of the current year for 250,000. The estimated residual value is 25,000. Susquehanna estimates that the asset will be used for 10 years and uses straight-line depreciation. Calculate the depreciation expense per year.Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000

- Using the sum-of-the-years-digits method, how much depreciation expense should Vorst record in 2020 for Asset B? a. 6,000 b. 9,000 c. 11,000 d. 12,000Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.