Required: (a) Prepare a statement of changes in equity and determine the December 31, 2018 balances of the following: b (1) Preference share capitalIAq oas (2) (3) Ordinary share capital Total additional paid in capital Retained earmings Treasury shares Unrealized gains and losses on non-current equity investments (in equity section; disregard income tax.) Total shareholders' equity 0.000 (4) (5) (6) (7) (b) Compute the following: Average number of ordinary shares that will be used to compute earnings per share Basic earnings per share (8) (9) Prepare the shar (b) financial position at Decen to shareholders' equity 1. The following information relates Preference Share Capital, 12%, P50 par cumulative, 10,000 shares authorized Ordinary Share Capital, P1 stated value, 2,000,000 shares authorized Share Premium - Preference Paid in Capital in Excess of Stated Value Retained Earnings P 400,000 1,000,000 80,000 1,400,000 1,816,000 40,000 Treasury Shares - Ordinary (10,000 shares) During 2018, the corporation had the following transactions and events pertaining to its shareholders' equity: Issued 20,000 ordinary shares for P100,000 Sold 6,000 treasury shares for P28,000. Issued 5,000 shares of ordinary share capital for a piece of equipment with cash price of P25,000. Purchased 1,000 shares of ordinary for the treasury at a cost of P6,000. Declared the annual dividend on preference share and PO.20 cash dividend on ordinary share. Determined that profit for the year was P377,000 Feb. 1 Apr. 30 Sept. 1 Nov. 2 Dec. 31 31 31 The fair value of non-current equity investments at fair value increased from P150,000 to P170,000 from beginning to end of the year. Beginning balance of Unrealized Gains or Losses on Non-current Equiy Investments is P5,000 credit. 4006

Required: (a) Prepare a statement of changes in equity and determine the December 31, 2018 balances of the following: b (1) Preference share capitalIAq oas (2) (3) Ordinary share capital Total additional paid in capital Retained earmings Treasury shares Unrealized gains and losses on non-current equity investments (in equity section; disregard income tax.) Total shareholders' equity 0.000 (4) (5) (6) (7) (b) Compute the following: Average number of ordinary shares that will be used to compute earnings per share Basic earnings per share (8) (9) Prepare the shar (b) financial position at Decen to shareholders' equity 1. The following information relates Preference Share Capital, 12%, P50 par cumulative, 10,000 shares authorized Ordinary Share Capital, P1 stated value, 2,000,000 shares authorized Share Premium - Preference Paid in Capital in Excess of Stated Value Retained Earnings P 400,000 1,000,000 80,000 1,400,000 1,816,000 40,000 Treasury Shares - Ordinary (10,000 shares) During 2018, the corporation had the following transactions and events pertaining to its shareholders' equity: Issued 20,000 ordinary shares for P100,000 Sold 6,000 treasury shares for P28,000. Issued 5,000 shares of ordinary share capital for a piece of equipment with cash price of P25,000. Purchased 1,000 shares of ordinary for the treasury at a cost of P6,000. Declared the annual dividend on preference share and PO.20 cash dividend on ordinary share. Determined that profit for the year was P377,000 Feb. 1 Apr. 30 Sept. 1 Nov. 2 Dec. 31 31 31 The fair value of non-current equity investments at fair value increased from P150,000 to P170,000 from beginning to end of the year. Beginning balance of Unrealized Gains or Losses on Non-current Equiy Investments is P5,000 credit. 4006

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

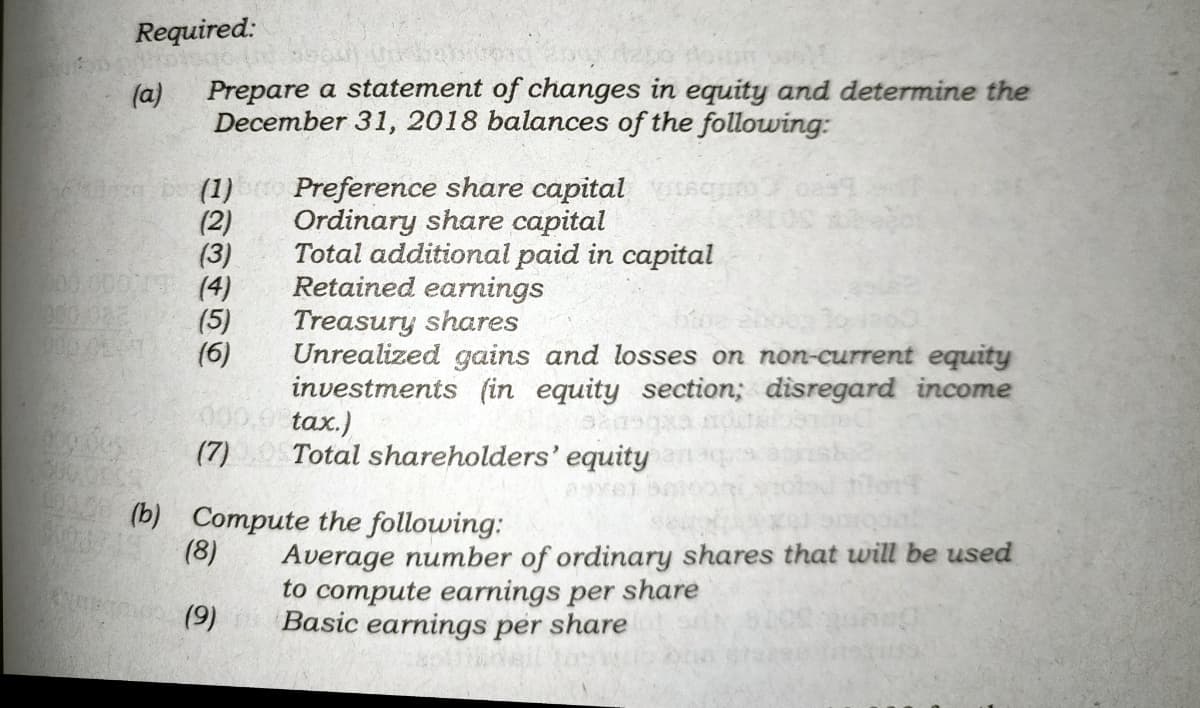

Transcribed Image Text:Required:

(a)

Prepare a statement of changes in equity and determine the

December 31, 2018 balances of the following:

b (1) Preference share capitalIAq oas

(2)

(3)

Ordinary share capital

Total additional paid in capital

Retained earmings

Treasury shares

Unrealized gains and losses on non-current equity

investments (in equity section; disregard income

tax.)

Total shareholders' equity

0.000 (4)

(5)

(6)

(7)

(b) Compute the following:

Average number of ordinary shares that will be used

to compute earnings per share

Basic earnings per share

(8)

(9)

Transcribed Image Text:Prepare the shar

(b)

financial position at Decen

to shareholders'

equity

1.

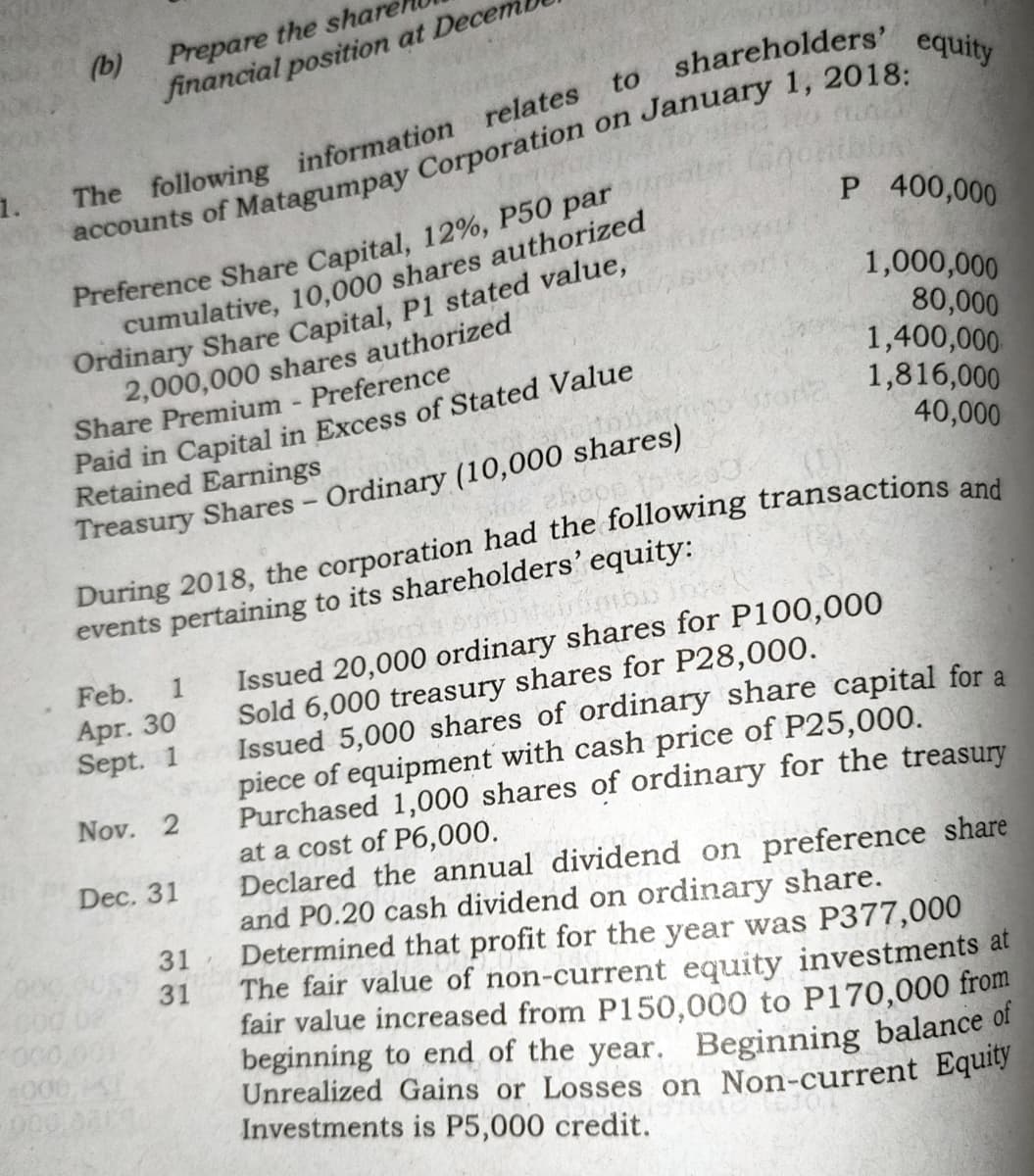

The following information relates

Preference Share Capital, 12%, P50 par

cumulative, 10,000 shares authorized

Ordinary Share Capital, P1 stated value,

2,000,000 shares authorized

Share Premium - Preference

Paid in Capital in Excess of Stated Value

Retained Earnings

P 400,000

1,000,000

80,000

1,400,000

1,816,000

40,000

Treasury Shares - Ordinary (10,000 shares)

During 2018, the corporation had the following transactions and

events pertaining to its shareholders' equity:

Issued 20,000 ordinary shares for P100,000

Sold 6,000 treasury shares for P28,000.

Issued 5,000 shares of ordinary share capital for a

piece of equipment with cash price of P25,000.

Purchased 1,000 shares of ordinary for the treasury

at a cost of P6,000.

Declared the annual dividend on preference share

and PO.20 cash dividend on ordinary share.

Determined that profit for the year was P377,000

Feb.

1

Apr. 30

Sept. 1

Nov. 2

Dec. 31

31

31

The fair value of non-current equity investments at

fair value increased from P150,000 to P170,000 from

beginning to end of the year. Beginning balance of

Unrealized Gains or Losses on Non-current Equiy

Investments is P5,000 credit.

4006

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning