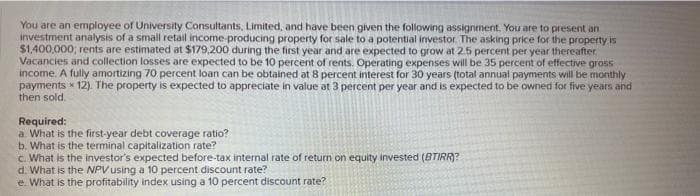

You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,400,000; rents are estimated at $179,200 during the first year and are expected to grow at 2.5 percent per year thereafter Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly payments 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 10 percent discount rate? e. What is the profitability index using a 10 percent discount rate?

You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,400,000; rents are estimated at $179,200 during the first year and are expected to grow at 2.5 percent per year thereafter Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly payments 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 10 percent discount rate? e. What is the profitability index using a 10 percent discount rate?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 22P

Related questions

Question

100%

Transcribed Image Text:You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an

investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is

$1,400,000; rents are estimated at $179,200 during the first year and are expected to grow at 2.5 percent per year thereafter.

Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross

income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly

payments 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and

then sold.

Required:

a. What is the first-year debt coverage ratio?

b. What is the terminal capitalization rate?

c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)?

d. What is the NPV using a 10 percent discount rate?

e. What is the profitability index using a 10 percent discount rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning