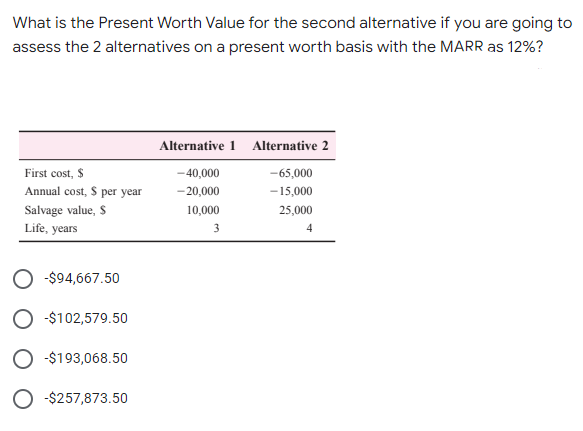

What is the Present Worth Value for the second alternative if you are going to alternatives on a present worth basis with the MARR as 12%? assess the 2

Q: If an insured fails to pay the premium when due, the insured's heallh policy will remain in force…

A: Health insurance is a type of insurance that helps to pays for medical costs incurred as a result of…

Q: 1. Lilibeth borrowed $1,200 from her aunt to buy a book. She promised to pay her after a month. Her…

A: Simple Interest may be defined as Interest that is calculated as a simple percentage of the original…

Q: A company's current ratio is 2.0. Which of the following actions would lower the current ratio,…

A: Current ratio is one of the liquidity ratio of the business, which shows ratio between current…

Q: 8. A street-level road traffic estimates has been conducted at the intersection from Monday to…

A: Given data for Question 8 Road traffic estimate for Monday to Friday are 48, 52, 40 , 55, 60 To…

Q: Suppose Autodesk stock has a beta of 2.17, whereas Costco stock has a beta of 0.71. If the…

A: Autodesk beta = 2.17 Costco beta = 0.71 Risk free rate = 6% Market return = 11.5% Autodesk weight =…

Q: An organization has current assets of $365,725,000 and current liabilities of $131,339,000. Note:…

A: Question 10 a) Working capital=Current assets-Current…

Q: The pecking order theory of capital structure suggests that managers will choose to utilise retained…

A: Pecking Order theory is an important theory in finance. It tells that the for funding purposes…

Q: 10 [9] Tory signed a 10-yr contract to play for a football team at a salary of $5,000,000 per year.…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: An engineer decided to put up a trust fund for her daughter with the condition that his daughter…

A: Discounting is a technique which is used to compute the present value (PV) of future cashflows by…

Q: Which one of the following will decrease the current yield of a bond? changing the frequency of…

A: Current yield refers to a method which shows the relationship between the coupon payment and current…

Q: 1,356.95 2,618.83 5,237.66

A: The yearly cost of acquiring, running, and sustaining an project beyond its entire life is known as…

Q: How can a small-business owner or corporate manager use financial leverage to improve the firm’s…

A: Financial leverage is a kind of investment strategy.In this strategy borrowed money is used such as…

Q: You are considering a project that requires a $1000 investment today and returns $550 at the end of…

A: NPV or Net present value of an investment proposal is the difference between the present value of…

Q: 20. Which of the following does not represent compensation income? * a. Honorarium as a guest…

A: In this question, we have two sub-questions, (20) Detailing the types of compensation income &…

Q: Explain how Family firm image drives financial performance?

A: Financial management is a department inside a company or organisation that manages cash flow,…

Q: An annual perpetuity of $10,000 has a present value of $250,000. What is the annual interest rate?

A: Present value of an annual perpetuity = Annual cash flow/Interest rate Interest rate = Annual cash…

Q: a. Nominal interest rate compounded quarterly that is equivalent to an effective interest rate of 8%…

A: Effective Annual Rate: The effective annual rate of interest is the actual or the real rate of…

Q: I did not understand how you got the figure of $600,000 at the following part

A: Net Present Value: It represents the investment's or project's profitability in absolute terms. It…

Q: If $13,376.39 was the interest earned on lending $101,000.00 for 9 years, what was the quarterly…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Which of the following statement regarding ratio analysis is incorrect? Select one: a. Ratios…

A: Financial ratios are an important concept in the world of finance. We use financial ratios like…

Q: bt financing is likely to appeal most strongly to organizations that have predictable profits and…

A: In Debt financing there are interest payment to be made each period but there are tax deductions for…

Q: Explain the flow of funds within an organization

A: Flow of Funds refers to the flow of money in the business organization. Finance is the blood of the…

Q: (a) An investor purchased the share of Neptune Corp on 1 Jan 2017 and held the investment until 31…

A: Arithmetic rate of return Arithmetic rate of return for a year is calculated as shown below.…

Q: What is the most you would pay for this investment if you require a 10% return? answer in dollars…

A: Time value of money (TVM) refers to the method or technique which is used to measure the amount of…

Q: Blaxo Balloons manufactures and distributes birthday balloons. At the beginning of the year Blaxo's…

A: Given: Particulars Amount Beginning price $21.32 Ending price $20.17 Cash dividend $2.49

Q: Long-term and short-term finance tends to be differentiated by: the amount of finance raised.…

A: Companies can raise finance for long term or for short term. As the name indicates it is the word…

Q: American Express sells a call option on euros (contract size is €500,000) at a premium of $0.04 per…

A: Here, Contract size = €500,000 Call Premium = $0.04 per euro. Exercise price = $0.91 Spot price of…

Q: Hak Young has accumulated some credit card debt while he was in college. His total debt is now…

A: Loan Amount = $13,864.82 Interest Rate = 9% Time Period = 10 Years

Q: Provide answers 2. What is the significance of understanding the economic role of financial…

A: A bank is a financial institution that is allowed to accept deposits and provide loans. Banks may…

Q: Ishan and Hazel plan to retire at age 60 with a retirement income of $48,000 a year from their…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: please show a clearer solution

A: Here, Investment Amount (PV) is P100 Value of Investment Amount after one year (FV) is P112.55…

Q: 8. Ace Ltd. Manufactures a product and the following particulars are collected for the year ended…

A: 8. i) Formula for Re-order quantity= √2x A x P /S Where, A= Annual consumption (units) during the…

Q: How much money should you deposit every year in your savings account starting 3 years from now at 7…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: You are a manager at Permeable Fiber, which is considering adding a new product line. Your boss said…

A: Relevant cash flows while evaluating a capital project are the cash flows, to be resulted due to the…

Q: You are looking at an investment that will pay $1200 in 5 years if you invest $1000 today. What is…

A: Here, Investment Amount (PV) is $1,000 Accumulated Amount (FV) is $1,200 Time Period (n) is 5 years

Q: kura would like to buy a house and their dream home costs $500,000. Their goal is then to save…

A: Future value of money includes the amount of money invested and amount of interest collected over…

Q: Q7. a) Explain the difference between full-absorption costing and direct costing and how does…

A: First of all we need to understand the basic meaning of Full absorption costing and Direct costing.…

Q: ncrete pavement on a street would cost P 2M and would lasts for 3 years. Minor maintenance cost is P…

A: Capitalized cost is the present value of all cost that are going to occur during the life of road…

Q: vative Group Ltd, an IT company, is undertaking a new project to develop software for Fair…

A: The price of stock can be found out from the constant growth dividend model approach from the…

Q: Our clients saved $2,500,000 for retirement. They wish to withdraw $20,000 from the fund each month…

A: An annuity is a contract where periodic payments are made in the future in return for a lump-sum…

Q: A corporation's first offering of shares of stock to the public is called ________. a…

A: When a private firm issues shares to the general public for about the first time, it is known as an…

Q: The town's savings and loan association granted Mariella a loan that has maturity value of $2,400…

A: Here, Maturity Value (FV) = P 2,400 Interest rate (r) = 13% Time period (t) = 2 years To Find:…

Q: A honda generator (2KVA) has a list of price of P45,000 but can be purchased for either alternative…

A: List price is P 45,000 Alternative-1 Cash price of P40,000 Alternative -2 Down payment of P 5,000…

Q: David Ortiz Motors has a target capital structure of 40% debt and 60% equity. The yield to maturity…

A: Weighted average cost of capital, WACC, is a company’s average cost of capital. A company gets…

Q: Anna and Bob have decided to buy an apartment. The cost of the apartment is RM150,000. They can get…

A: Monthly mortgage payment will depend on the amount of loan, interest rate and the payment period.…

Q: Which of the following point is not consistent with the decision of undertaking a merger and…

A: Merger: It is an agreement in which one or more companies will convert into single company. There…

Q: Monroe Milk Company has a gross margin of 31.7% on net sales of $9,865,214 and total assets of…

A: Days sales outstanding is one of the calculation made in ratio analysis of the company. This is used…

Q: Lomack Company's bonds have a 8-year maturity, a 9% coupon, paid semiannually, and a par value of…

A: Given, Par value of bond is $1000 Market rate is 4% Coupon rate is 9%

Q: The maintenance costs of a new boiler are estimated as follows: P 600 per year for the first 3…

A: The time value of money is a concept that states that the same amount of money has more value today…

Q: Based on the information below, calculate the profit margin for Starbuck’s and Dunkin and choose the…

A: Profit margin is one of the important ratio being used by the business. This is used for analysing…

Provide solution please

Step by step

Solved in 2 steps with 2 images

- How much would you invest today in order to receive $30,000 in each of the following (for further Instructions on present value In Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at 15% D. 19 years at 18%Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 20 percent. Year Project M Project N 0 -$142,000 -$363,000 1 64,300 148,500 2 82,300 188,000 3 73,300 133,500 4 59,300 118,000 a. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Which, if either, of the projects should the company accept? % a. Project M % Project N b. Project M Project N c. Accept projectLipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate the IRR for Product V only using 1% and 17% to 2 d.p.

- Compare the alternatives below on the basis of their capitalized costs with adjustments made for inflation. Use i =12% per year and f = 3% per year. Alternative X Y First cost, $ −18,500,000 −9,000,000 AOC, $ per year −25,000 −10,000 Salvage value, $ 105,000 82,000 Life, years ∞ 10Approximately, what is the value of the total Present worth (where Ptotal= PA + PG) if G (arithmetic gradient) =160, n=2 years, A=240 and i= 2.5% per year? Select one: a. 738 b. 511 c. 615 d. 825 not use excelBausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 13 percent. Year Project M Project N 0 –$144,000 –$351,000 1 63,100 154,500 2 81,100 176,000 3 72,100 139,500 4 58,100 106,000 a. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Which, if either, of the projects should the company accept?

- Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 16 percent. Year Project M Project N 0 –$136,000 –$359,000 1 63,900 150,500 2 81,900 184,000 3 72,900 135,500 4 58,900 114,000 a. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) PROJECT M IS 36.69% PROJECT N IS 24.21% b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) PROJECT M IS $59,185.14 PROJECT N IS $57,253.65 c. Which, if either, of the projects should the company accept?The following information relates to two projects of which you have to select one to invest in.Both projects have an initial cost of $400,000 and only one can be undertaken.Project X YExpected profits $ $Year 1 160,000 60,000Year 2 160,000 100,000Year 3 80,000 180,000Year 4 40,000 240,000Estimated resale value atthe end of year 4 80,000 80,000i) Profit is calculated after deducting straight line depreciationii) The cost of capital is 16%Required:a) For both projects, calculate the following:i) The payback period to one decimal place ii) The accounting rate of return using average investments iii) The net present value iv) Advise the board which project in your opinion should be undertaken, givingreasons for your decision.Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost P50,000 (nondepreciable) Residual value at the end of 5 years 10,000 Present value of an annuity of 1 at 12% for 5 years 3.60 Present value of 1 due in 5 years at 12% 0.57 39. What would be the annual savings needed to make the investment realize a 12% yield assuming that Para will realize the residual value at the end of year 5?

- Compare the following alternatives based on the rate of return analysis assuming that the MAAR is 15% per year. Project A Project B Initial Cost $60.000 $90.000 Annual cost of operation 15.000 8.000 Annual cost of reparation 5.000 2.000 Annual increase of the repair 1.000 1.500 Salvage value 8.000 12.000 Life, years 15 15Lipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%Project P has a cost of $1,000 and cash flows of $300 per year for3 years plus another $1,000 in Year 4. The project’s cost of capital is15%. What are P’s regular and discounted paybacks? (3.10, 3.55) Ifthe company requires a payback of 3 years or less, would the projectbe accepted? Would this be a good accept/reject decision, consideringthe NPV and/or the IRR? (NPV = $256.72, IRR =24.78%)