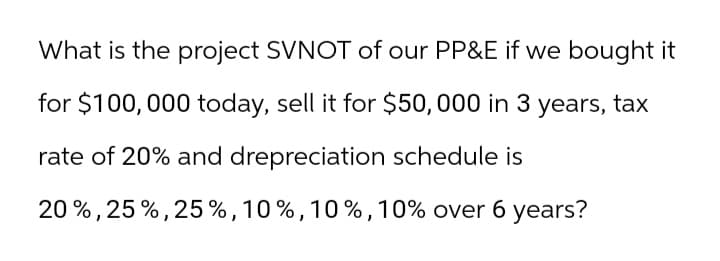

What is the project SVNOT of our PP&E if we bought it for $100,000 today, sell it for $50,000 in 3 years, tax rate of 20% and drepreciation schedule is 20%, 25%, 25%, 10%, 10%, 10% over 6 years?

Q: Choo Choo Corp. is an all- equity firm with a market value of $5, 200, 000. The firm is considering…

A: Earnings Per Share (EPS) is a measure that represents the portion of a company's profit allocated to…

Q: What is the the Finance disciplines?

A: Financial management involves planning, organizing, directing, and controlling an organization's…

Q: Typed plz and asap please take care of plagiarism

A: The objective of the question is to analyze and differentiate between two cases of price fixing…

Q: nded monthly and calls for equal monthly payments over the next 30 years. Her first ment will be due…

A: An amortization table is a tabular representation of the loan repayments to be made throughout the…

Q: You owe $24,000 on student loans at an interest rate of 5.45% compounded monthly. You want to pay…

A: Given loan amount is Interest Rate is Time period since number of payments is monthly total number…

Q: Select and consider real-world assets and their correlation. Identify and discuss two assets or…

A: The objective of this question is to identify and discuss two pairs of assets or variables, one pair…

Q: What is the value of the stock if the current dividend is $1.4, the first-stage growth is 1.4%, the…

A: The share price of the company can be found by using the valuation model, DDM model, etc. As per DDM…

Q: Which one is not an incentive for a bank to securitize its mortgage loans? Reduce insurance premium…

A: The objective of the question is to identify which among the given options is not a reason for a…

Q: a. Fill in the missing values in the table. (Leave no cells blank- be certain to enter O wherever…

A: The capital asset pricing model aids analysts in calculating the expected return. The idea is that…

Q: As an analyst at an investment bank, you are asked to compare the monthly returns of the two stocks…

A: The objective of the question is to compare the monthly returns of Tesla and Apple Inc. stocks from…

Q: ind the present values of the following cash flow streams at a 7% discount rate. Do not round…

A: Present Value:It is the current value of a future sum of money or stream of cash flows given a…

Q: Required: A bank sells a "three against six" $3,000,000 FRA for a three-month period beginning three…

A: To dertermine the value of the FRA and indentity who pays whom, we need to calculate the settlement…

Q: You are planning to save for retirement over the next 30 years. To do this, you will invest $500 a…

A: The future value of an ordinary annuity shows the accumulated value of an equal amount of deposits…

Q: What size loan must we take today with a 14% compound interest rate to have end-of-year payments of…

A: Interest rate = 14%YearAnnual payment1$1,4002$1,3203$1,2404$1,1605$1080

Q: .00 million in 2020. Its assets totaled $5 million at the end of 2019. pussard is already at full…

A: Sales=$7200000Growth rate=25%Total assets=$5000000Account payable=$450000Accrual=$450000Profit…

Q: te.7

A: The objective of the question is to calculate the net present value (NPV) of two investment…

Q: White Lily Company has prior year total assets of $7,111,885, current year total assets of…

A: Equity multiplier is a financial ratio that measures the how much portion of the company's assets is…

Q: Assume you have won a lottery prize of $5,000, which works out great since you want to buy a new…

A: Money has time value and value of money changes with time and is not same again in future this is…

Q: 1. You have two options to purchase a car. Your first option is to purchase the car at $26.200 and…

A: The objective of this question is to compare two options for purchasing a car: financing the car…

Q: Consider a worker, Janice, who has the option to purchase DI (disability insurance) on the private…

A: This scenario involves a decision-making framework regarding disability insurance (DI) for an…

Q: Based on the corporate valuation model, the value of a company's operations is $250 million. The…

A: In corporate valuation model, the value of the company is its value of operations plus…

Q: Capital Allocation Line (Question 1 to Question 5) Suppose that risk-free saving is available at…

A: Risk free rate (rf) =1%Expected return of Asset A (μA) =8%Standard deviation of A( σA) = 10%You have…

Q: David bought 100 shares of a stock for $30 per share on 70% margin. Assume he holds the stock for…

A:

Q: Assume you won the state lottery and you are entitled to $5,000,000. If you choose not to take the…

A: Present value of the amount = $5,000,000Amount to be received weekly over next 10 years1 year = 52…

Q: A buyer wants to purchase a home for $150,000 with a 30% down payment. The lender charges 1.75…

A:

Q: A stock has an expected return of 13.4 percent and a beta of 1.15, and the expected return on the…

A: The Capital Asset Pricing Model (CAPM) is a financial model that establishes a relationship between…

Q: (Present value of complex cash flows) How much do you have to deposit today so that beginning 11…

A: Present value is the current value of the future sum of money, at a specified rate of return.The…

Q: Interpreting Bond Footnote Disclosures and Computing Effective Interest Rate In 2019, French grocery…

A: Issue dateMay 7, 2019Issue Amount (Euro Million) $ 500.00Annual Coupon…

Q: 1. (7 marks) A stock XYZ is quoted 1015. Two counterparties agree to enter into a forward contract…

A: The objective of the question is to calculate the possible values of the payoff for the buyer and…

Q: Weston Clothing Company is considering manufacturing a new style of shirt, whose data are shown…

A: Net Present Value, serves as a crucial tool in evaluating project feasibility. It aids in decision…

Q: Plz complete solution without excel

A: The objective of the question is to calculate the accrued interest on a loan with variable interest…

Q: On April 1, $25,000.00 364-day treasury bills were auctioned off to yield 3.29%. (a) What is the…

A: As per the guidelines, the solution for the first three subparts will be provided. If you want the…

Q: Alp Bilgin deposits $33.000 in asaving account that pays 9%interest compounded monthly.Four years…

A: Alp Bilgin invests money in a savings account with monthly compounding interest. Here's a breakdown…

Q: With the growing popularity of casual surf print clothing, two recent MBA graduates decided to…

A: The NPV of a project is used to measure the profitability of the project. It is done by discounting…

Q: Stock R has a beta of 1.5, Stock S has a beta of 0.85, the required return on an average stock is…

A: The objective of the question is to find out the difference in the required returns of two stocks…

Q: Madetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a…

A: The objective of the question is to calculate various financial metrics related to a new project…

Q: HR Industries (HRI) has a beta of 1.2; LR Industries's (LRI) beta is 0.4. The risk-free rate is 6%,…

A: The objective of the question is to calculate the difference in the required returns for HR…

Q: George and Yujia currently insure their cars with separate companies, paying $1,500 and $1,300 a…

A: The future value of an annuity is the total value of a series of equal payments made at regular…

Q: a. What is the price of the coupon bond? Note: Do not round intermediate calculations. Round your…

A: Bond valuation is the process of calculating a bond's fair value, which is the current value of its…

Q: Three years ago, JKL Co. issued bonds with a 13-year maturity then and at a coupon rate of 7.4…

A: Bond price can be calculated by adding the present value of the bond's future cash flows (Coupon…

Q: Use bootstrapping to obtain a zero rate curve given the prices of the following semiannual coupon…

A: Maturity: 1 year, 18 months, 3 yearsCoupon Rate: 3, 2, 5 respectivelyPrice: 101.25, 99.95, 110.30…

Q: The city planning committee is allocating funds for a sustainable urban development project. e total…

A: The city planning committee has a total budget of $3,000,000 (without GST) that needs to be divided…

Q: Carnes Cosmetics Co.'s stock price is $46, and it recently paid a $1.25 dividend. This dividend is…

A: Current Price of Stock = p0 = $46Current Dividend = d0 = $1.25Growth rate for first 3 years = G =…

Q: The following information relates to Samson Engineering as at 30 June 2023: RProfit for the year180…

A: The objective of the question is to calculate the total non-current assets, total current assets,…

Q: 4. Using Excel or your favorite software: (a) A 5-year Treasury newly issued on February 15, 2021…

A: Bond valuation is the process of determining the fair or intrinsic value of a bond, which represents…

Q: Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental…

A: Capital budgeting is a financial process used by businesses to evaluate and select investment…

Q: Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying…

A: Cost of machinery: $429,000Pretax cost savings: $161,000Salvage value: $62,000Inventory intial…

Q: Assuming markets are operating efficiently, use the current Information to answer the question.…

A: Below is an expression.Explanation:To calculate the realized return on your Treasury bond investment…

Q: Stock 1 has an expected return of 4% and a standard deviation of 38 %. Stock 2 has an expected…

A: The variance of a portfolio is a measure of how the returns of the individual assets in the…

Q: You are trying to decide how much to save for retirement. Assume you plan to save $5,000 per year…

A: Time value of money is a financial concept which is used to analyze various investments and…

Step by step

Solved in 1 steps

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?Washington-Pacific (W-P) invested $4 million to buy a tract of land and plant some young pine trees. The trees can be harvested in 10 years, at which time W-P plans to sell the forest at an expected price of $8 million. What is W-P’s expected rate of return?

- If you invest $15,000 today, how much will you have in (for further instructions on future value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%How much would you invest today in order to receive $30,000 in each of the following (for further Instructions on present value In Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at 15% D. 19 years at 18%Jullo Company is considering the purchase of a new bubble packaging machine. If the machine will provide $20,000 annual savings for 10 years and can be sold for $50,000 at the end of the period, what is the present value of the machine investment at a 9% interest rate with savings realized at year end?

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?Project B cost $5,000 and will generate after-tax net cash inflows of $500 in year one, $1,200 in year two, $2,000 in year three. $2,500 in year four, and $2,000 in year five. What is the NPV using 8% as the discount rate? For further instructions on net present value in Excel, see Appendix C.

- Project A costs $5,000 and will generate annual after-tax net cash inflows of $1,800 for five years. What is the NPV using 8% as the discount rate?How much would you invest today in order to receive $30,000 in each of the following (for further instructions on present value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%If you invest $12,000 today, how much will you have in (for further Instructions on future value in Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at l5% D. 19 years at 18%