If in 5.8% per semiannual, compounded manthly, What is the nominal quarter rate. CABET, SO1)

If in 5.8% per semiannual, compounded manthly, What is the nominal quarter rate. CABET, SO1)

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 15PROB

Related questions

Question

Transcribed Image Text:If i 5.8% per semiannual, compounded monthly, What is the nominal quarter rate.

(ABET, SO1)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Calculate the equivalent FW at i= 10% per year for the

following net cash flow:

Year

Cash flow, $

-2,000

-2,000

3

-2,000

4.

4,600

5

4,600

4,600

Select one:

O a. 6415

O b. 5091

O c. 4429

O d. 5753

O e. 7077

Solution

Follow-up Question

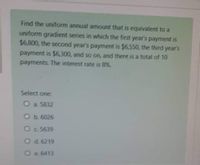

Transcribed Image Text:Find the uniform annual amount that is equivalent to a

uniform gradient series in which the first year's payment is

$6,800, the second year's payment is $6,550, the third year's

payment is $6,300, and so on, and there is a total of 10

payments. The interest rate is 8%.

Select one:

O a. 5832

O b. 6026

O c 5639

O d. 6219

O e 6413

Solution

Follow-up Question

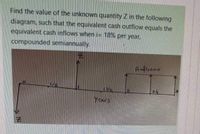

Transcribed Image Text:Find the value of the unknown quantity Z in the following

diagram, such that the equivalent cash outflow equals the

equivalent cash inflows when i= 18% per year,

compounded semiannually.

Ycars

Solution

Follow-up Question

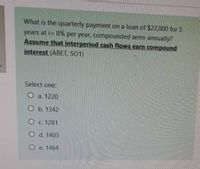

Transcribed Image Text:What is the quarterly payment on a loan of $22,000 for 5

years at i= 8% per year, compounded semi-annually?

Assume that interperiod cash flows earn compound

interest (ABET, SO1)

Select one:

O a. 1220

O b. 1342

O c. 1281

O d. 1403

O e. 1464

Solution

Follow-up Question

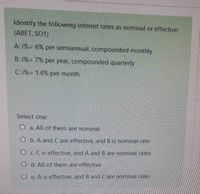

Transcribed Image Text:Identify the following interest rates as nominal or effective:

(ABET, SO1)

A: 1%= 6% per semiannual, compounded monthly

B: 1%= 7% per year, compounded quarterly

C: 1%= 1.4% per month

Select one:

O a. All of them are nominal

O b. A and C are effective, and B is nominal rate

O c. C is effective, and A and B are nominal rates

O d. All of them are effective

O e. A is effective, and B and Care nominal rates

Solution

Follow-up Question

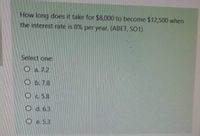

Transcribed Image Text:How long does it take for $8,000 to become $12,500 when

the interest rate is 8% per year. (ABET, SO1)

Select one:

O a 72

Ob.7.8

Oc.58

O d.6.3

O e. 5.3

Solution

Follow-up Question

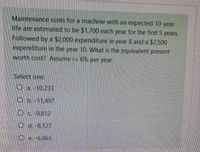

Transcribed Image Text:Maintenance costs for a machine with an expected 10-year

life are estimated to be $1,700 each year for the first 5 years

Followed by a $2,000 expenditure in year 8 and a $2,500

expenditure in the year 10. What is the equivalent present

worth cost? Assume i= 6% per year.

Select one:

O a.-10,233

O b.-11.497

Oc-9,812

O d.-8,127

O e.-6863

Solution

Follow-up Question

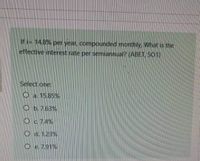

Transcribed Image Text:If i= 14.8% per year, compounded monthly What is the

effective interest rate per semiannual? (ABET, SO1)

Select one:

O a. 15.85%

O b. 7.63%

O c 74%

O d. 1.23%

O e. 7.91%

Solution

Follow-up Question

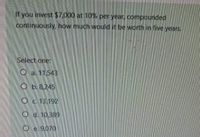

Transcribed Image Text:If you invest $7,000 at 10% per year, compounded

continuously, how much would it be worth in five years.

Select one:

O a. 11,543

O b.8,245

Oc.13,192

O d. 10,389

O e. 9,070

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you