Sup has paid a dividend of $3.82 per share per year for the last 16 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 100 shares of Kelsey class A common 10 years ago at a time when the required rate of return for the stock was 9.7%. She wants to sell her shares today. The current required rate of return for the stock is 14.70%. How much total capital gain or loss will Kim have on her shares? The value of the stock when Kim purchased it was S per share. (Round to the nearest cent.) The value of the stock if Kim sells her shares today is $ per share. (Round to the nearest cent.) The total capital gain (or loss) Kim will have on her shares is S (Round to the nearest dollar. Enter a positive number for a capital gain and a negative number for a loss.)

Sup has paid a dividend of $3.82 per share per year for the last 16 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 100 shares of Kelsey class A common 10 years ago at a time when the required rate of return for the stock was 9.7%. She wants to sell her shares today. The current required rate of return for the stock is 14.70%. How much total capital gain or loss will Kim have on her shares? The value of the stock when Kim purchased it was S per share. (Round to the nearest cent.) The value of the stock if Kim sells her shares today is $ per share. (Round to the nearest cent.) The total capital gain (or loss) Kim will have on her shares is S (Round to the nearest dollar. Enter a positive number for a capital gain and a negative number for a loss.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.2P

Related questions

Question

please help me analyze and asnwer the questions with formula so that i can learn and get ready for my exam :<

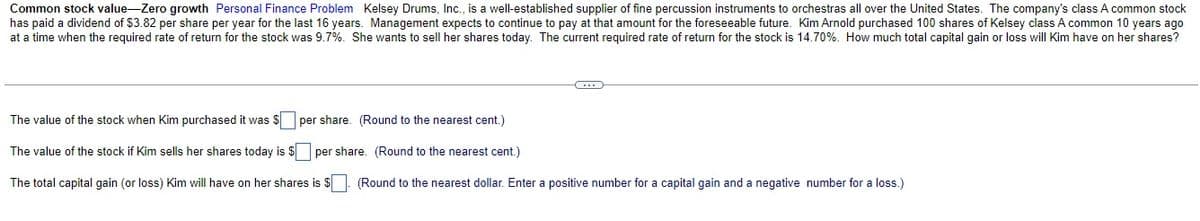

Transcribed Image Text:Common stock value-Zero growth Personal Finance Problem Kelsey Drums, Inc., is a well-established supplier of fine percussion instruments to orchestras all over the United States. The company's class A common stock

has paid a dividend of $3.82 per share per year for the last 16 years. Management expects to continue to pay at that amount for the foreseeable future. Kim Arnold purchased 100 shares of Kelsey class A common 10 years ago

at a time when the required rate of return for the stock was 9.7%. She wants to sell her shares today. The current required rate of return for the stock is 14.70%. How much total capital gain or loss will Kim have on her shares?

The value of the stock when Kim purchased it was $ per share. (Round to the nearest cent.)

The value of the stock if Kim sells her shares today is $ per share. (Round to the nearest cent.)

The total capital gain (or loss) Kim will have on her shares is $ |. (Round to the nearest dollar. Enter a positive number for a capital gain and a negative number for a loss.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT