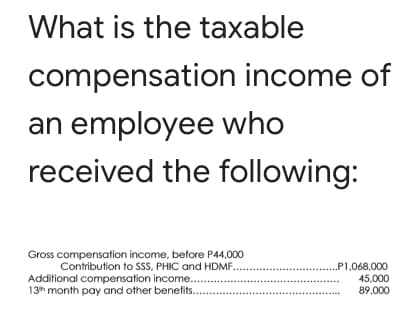

What is the taxable compensation income of an employee who received the following: Gross compensation income, before P44,000 Contribution to SSS, PHIC and HDMF. Additional compensation income... 13h month pay and other benefits... ..P1,068,000 45,000 89,000 ....

Q: QUESTION 3 Jaime Ltd manufactures and sells a small electric product to order for the computer…

A: Absorption Costing - In this costing method cost associated with the manufacturing of a product is…

Q: Explain and what is the calculation of the following. Tax rates (formula) HELP repayment amount…

A:

Q: 2- An analyst has compiled the following information about Steller Corp. (in million) Income…

A: TAT- Total assets turnover ratio ROA - Return on Assets ROE = Return on equity NPM - Net profit…

Q: value is established on the bases of accepted accounting procedures. value is the amount that could…

A: Solution Concept Book value is the value that appears on the books of accounts . it is as per the…

Q: On January 1, 2023, Legis Company issued 10-year, P200,000 face value, 6% bonds at par (payable…

A: Basic EPS is a tool used to measure the profit of a company in per share basis. Again, Diluted EPS…

Q: C Corporation sold $55,000,000, 8%, 10-year bonds on January 1, 2022. The bonds apply interest on…

A: The bonds are the financial instruments for the business. These instruments are useful to raise…

Q: A liability in 2021 is reported for financial reporting purposes but not for tax purposes. When this…

A: As per IAS 12 Income taxes, When carrying amount of liability as per books(financial reporting…

Q: On March 2, 2022, Gumamela Corporation issued 4,000 shares of 6% cumulative P100 par value…

A: One non- detachable share warrant for one share total mumber of shares warrant =4000 shares x 1…

Q: Every summer Marianna offers a special convertible roof on the Sport Coupe model. The demand for the…

A: Suppose She Ordered the 2200 roof Every Year and as Per Question no Inventory left out as she sold…

Q: For the year ended 2012 Wendy's Retail Store's Net income is PI50,000 (10% of Net Sales). Operating…

A: Formulas: beginning merchandise inventory = Cost of sales x 20% where, Cost of sales = Net sales -…

Q: 6. Find the amount at the end of 15 years if P 55 000 is invested at an interest rate of 5%…

A: 5% compounded semi anually: Given data, P= 55,000 t=10 m =2 Therefore, n=tm =10*2 =20 i=5%/2 =0.025…

Q: Matubig Corporation is VAT registered and a holder of franchise from the government engaged in the…

A: ANSWER Here in this question Matubig corporation is a holder of franchise from government in the…

Q: Pension benefits contributed by the employer affects both the projected benefit obligation and…

A: A projected benefit obligation (PBO) is an actuarial measurement of what a company will need at…

Q: Accounting A lender whose mortgagor has defaulted may be offered a deed in lieu of foreclosure. If…

A: the correct option with proper explanation are as follows

Q: A temporary difference that would not result in a deferred tax asset but not a permanent difference?…

A: Solution: A temporary difference that would not result in a deferred tax asset but not a permanent…

Q: 4. When her granddaughter was born, Melay invested P 20 000 at 12% compounded quarterly. How much…

A: In the given question, P 20,000 is invested today at 12% compounded quarterly for 18 years. Since…

Q: 6. Gain realized on a like-kind exchange is excluded from income in all of the following…

A: correct answer with explanation are as follows

Q: Red Co. has a patent on a communication process. The company has amortized the patent on a…

A:

Q: A lease agreement whereby the lessee recognized rent expense which is always equal to the rent…

A: Lease is an agreement between two parties whereby one party gives its asset for use to other party…

Q: 3. Maricel borrows P 10 000 with interest at 15% compounded monthly. How much should she pay at the…

A: Given information P=P 10 000 t = 2 years and 6 months m = 12 Therefore, n =tm =12 * 2.5…

Q: Blossom Company reported the followinginformation for November and December 2022. November December…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Ronwar Company has prepared a unit sales budget for the upcoming months of 2022 as follows: Months…

A: Budget means the expected value of future. Budget is not affected by the actual value as it is…

Q: Which method of depreciation is suitable when expenditure on repairs and maintenance, increases as…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: it has six students. Only three students sign up for the class. The VP states the professor can…

A: Principles of Management and Cost Accounting The basic principles which are evolved in the…

Q: Loren Company uses many kinds of machines in operations. The entity acquires some machines from…

A: Expenditure incurred by the organisation may be capital expenditure or revenue expenditure. It…

Q: 0. A taxpayer engaged in the practice of his profession bought a brand-new motor vehicle in the…

A: Solution Concept Provisions When a asset is used in the business depreciation can be claimed in such…

Q: What is the amount of ending retained earnings in the following case? Beginning retained earnings =…

A: Retained earnings is the amount of earning retained by the company out of its profits.

Q: On January 1, 2021, Robin Cormpany received a grant of P1,500,000 from the government to subsidize…

A: Government Grant: Instead than acting as an incentive to carry out specified expenditures, a…

Q: 3- Implementation of planned decisions and evaluating performance is classified as: a. Evaluation…

A: Planning is very important and initial step of business process. This shows what needs to be done,…

Q: ABC Corporation will be converted into a publicly listed corporation. The original shareholders…

A: A crown jewels sale is a last-ditch approach used by a firm to avoid a hostile takeover or relieve…

Q: On January 1, 2021, Raffy Company took out a loan of P24,000,000 in order to finance specifically…

A: The borrowing costs are the interest cost for the loans obtained. The borrowing costs are normally…

Q: The interest expense of the lessee during the year when payment is made in advanced shall be: Group…

A: Lease liability is shown in the statement as the present value of future lease liabilities that are…

Q: For Questions 36-38 refer to problem below: On August 1, 2020, Tempest Company bought a property…

A: Prepaid insurance are current assets disclosed in the Balance Sheet.

Q: b. Income statement using the "cost of goods sold" method a: Statement of cost of goods manufactured…

A: Based on the information provided, cost of goods manufactured needs to be prepared. Cost of goods…

Q: C Co. reported a retained earnings balance of $200,000 at December 31, 2020. In September 2021, the…

A: Prepaid Insurance is an advance payment made towards Insurance of goods and assets used in the…

Q: On January 1, 2014, Mr. Albuera invested P2,000,000 in the six-year time deposit of Sulu Unibank…

A: Answer:- Time deposit meaning:- A time deposit, is a fixed-term interest-bearing bank account. It…

Q: Case 2: Consider the following data for the Assembly Department of Sink Manufacturing Company:…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Boxwood Company sells blankets for $31 each. The following was taken from the inventory records…

A: LIFO is the inventory valuation method as per which the goods that are bought at last are to be sold…

Q: Determine the account and amount to be debited and the account and amount to be credited for the…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: The following is the Balance Sheet of Lila Ltd. as on .31.12.2814. Liabilities Amount ($) Assets…

A: Calculation of Average Profit: Year Profit 2010 34,000 2011 38,000 2012…

Q: T-registered taxpayer with gross sales of Php 1 Million is qualified to avail 8% taxation. S2:…

A: VAT refers to the value-added tax implied by the government over the consumption of products or…

Q: Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $20 per unit.…

A: Existing data: Selling price per unit 20 Less: Variable expenses per unit…

Q: In 1998 a council-owned factory began selling replacement windows to outside customers for the first…

A: Total Labour hours required for order= 300 hr Average cost per labour hour = £5 Overtime labour hour…

Q: Paulis Kennel uses tenant-days as its measure of activity: an animal housed in the kennel for one…

A: A spending variance is the difference between the actual amount of a particular expense and the…

Q: The Conceptual Framework for Financial Reporting addresses fundamental issues including Group of…

A: Solution Concept Conceptual framework is the accounting framework that provides the basis for the…

Q: What is Farewell's diluted earnings per share for 2021, rounded to the nearest cent? O $3.14. O…

A: Earning per shares is the measure used by the company to analyze the profitability of the business.…

Q: Closing entries The ledger of the General Fund of the City of New Lanier shows the following…

A: The appropriation amount is divided into Estimated revenue and Budgetary fund balance.

Q: Compute the taxable income. A. Zero B. P4,000,000 C. P5,000,000 D. P29,000,000

A: The taxability of income of the nonstock nonprofit educational institutions depends upon whether the…

Q: Alex launched a company with $500K initial investments and 100K shares. Angel X invested $200K…

A: The number of shares at the time of conversion is computed by dividing the market value of the…

Q: TD ILK U 1. On a bank reconciliation, the amount of an unrecorded bank service charge should be: A.…

A: Hi student Since there are multiple questions, we will answer only first question.

Step by step

Solved in 2 steps

- CHOOSE THE LETTER OF THE CORRECT ANSWER What is the employee benefit expense for the current year? a. 1,180,000b. 2,100,000c. 1,850,000d. 1,050,000 What is the remeasurement gain or loss on plan assets on Dec. 31? a. 670,000 gainb. 670,000 lossc. 650,000 gaind. 650,000 lossMr. A, a minimum wage earner sales agent, received the following from his employer for the year 2021: Compensation Income P150,000; Overtime pay P10,000; 13th month pay P12,000; Commission from sales P300,000. What is the amount of taxable Income? Answer please!For each circumstances, calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a taxable earnings threshold of $8,500. A-1 Framing employs three workers who, as of the beginning of the current pay period, have earned $8,550, $8,200, and $7,400. Calculate SUTA tax for the current pay period if these employees earn taxable pay of $1,100, $1,420, and $2,140, respectively. SUTA tax = $ What is the SUTA tax?

- he following relate to the compensation income of a private rank andfile employee during the year: Annual compensation income P 540,000 13th month pay 45,000 14thmonth pay 45,000 Total of monthly rice allowances during the year 26,000 Commission from employer 12,000 Christmas gift 8,000 SSS, Philhealth and HDMF contributions 21,000 Compute the total non-taxable compensation incomeThe following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) of Nicanor, a purely compensation income earner: Gross compensation income Php 400,000.00 13th month pay and other benefits 40,000.00 Amount of taxes withheld (by the employer) 30,000.00 Commission 50,000.00 Pagibig contributions 10,000.00 Philhealth contributions 10,000.00 SSS 10,000.00 Union dues…Mr. Raya earns purely compensation income for the year 2021 with an annual basic salary of Php480,000.00 and other compensation received as follows:Holiday, OT and Night Differential Pay – Php56,091.95Sick leave conversion (3 leave credits) – Php5,517.24Government Mandatory Contributions – Php21,900.00 a. How much is the total non-taxable income for the year 2021? b. How much is the total taxable income for the year 2021? c. How much is the income tax due for the year 2021?

- A business entity's taxable income before the cost of certain fringe benefits paid to owners and other employees is $41,600. The amounts paid for these fringe benefits are reported as follows. Note the following: (1) Assume the fringe benefit plans are not discriminatory and (2) The business entity is equally owned by three owners. Owners Other Employees Group term life insurance $4,400 $7,270 Lodging incurred for the convenience of the employer 2,930 4,680 Qualified retirement plan 2,500 5,620 a. Calculate the taxable income of the business entity if the entity is a partnership, a C corporation, and an S corporation. The taxable income of the business entity, if it is a partnership, is $____________. If the entity is a C corporation, it is $_______________, and if the entity is an S corporation, it is $_____________.Julie's gross salary is 950,000; mandatory contributions is 50,000. Compute for the following: a. gross compensation? b. exclusions from gross income c.taxable compensationThe following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) of Angelou, a purely compensation income earner: Gross compensation income - Php 400,000.00 13th month pay and other benefits 40,000.00 Amount of taxes withheld (by the employer) 30,000.00 Commission 50,000.00 Pagibig contributions 10,000.00 Philhealth contributions 10,000.00 SSS 10,000.00 Union dues…

- Mr. Carlo had the following income during the year:Gross compensation income (including 13th month pay of P25,000), P325,0000;Less: Tardiness or absences, (P10,0000)Net compensation income, P315,000Deduction: SSS deductions, P12,000Philhealth deductions, P9,000Pag-ibig deductions, P10,000Union dues, P5,000Withholding tax, P40,000Net pay, P239,000Compute the total exclusion from gross income.Question text Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $128,400; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable. PROBLEM: During 2019, Amanda Hines, president of Dunne, Inc., was paid a semimonthly salary of $7,100. Determine the following amounts. OASDI HI (a) The amount of FICA taxes to withhold from her 9th pay is ______ ______ (b) The amount of FICA taxes to withhold from her 19th pay is ______ ______ (c) The amount of FICA taxes to withhold from her 24th pay is ______ ______ Mr. Ramos earns purely compensation income for the year 2021 with an annual basic salary of Php480,000.00 and other compensation received as follows:Holiday, OT and Night Differential Pay – Php56,091.95Sick leave conversion (3 leave credits) – Php5,517.24Government Mandatory Contributions – Php21,900.00 a. How much is the total non-taxable income for the year 2021? b. How much is the total taxable income for the year 2021? c. How much is the income tax due for the year 2021?