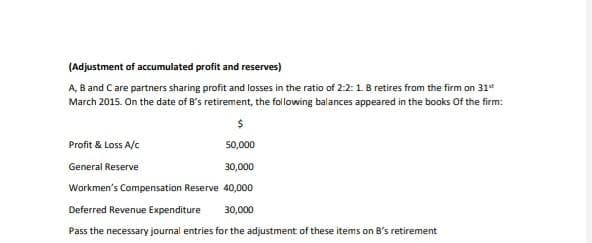

(Adjustment of accumulated profit and reserves) A, B and Care partners sharing profit and losses in the ratio of 2:2: 1B retires from the firm on 31" March 2015. On the date of B's retirement, the following balances appeared in the books Of the firm: Profit & Loss A/c 50,000 General Reserve 30,000 Workmen's Compensation Reserve 40,000 Deferred Revenue Expenditure 30,000 Pass the necessary journal entries for the adjustment of these items on B's retirement

Q: Philippine Bank of Communication has the following records of its trading transactions. January P…

A: The percentage tax are applicable for Banking and Non Banking institutes @7% on the following: Net…

Q: Your broker Luke works for a major bank that is working on the merger between ABC Inc. and XYZ Corp.…

A: Correct answer is (d) Unethical and illegal

Q: QUESTION 5 Cosi Ltd. manufactures a variety of engines for use in heavy equipment. The company has…

A: In decision-making, we must use only the relevant costs. Relevant costs are the cost that will…

Q: Devon Corp. is trying to decide whether to lease or purchase a piece of equipment. The total cost…

A: While making the decision between purchasing or leasing the Equipment, net present value between…

Q: Compute the taxable income. A. Zero B. P4,000,000 C. P5,000,000 D. P29,000,000

A: The taxability of income of the nonstock nonprofit educational institutions depends upon whether the…

Q: Explain the data provided

A: Introduction:- Fundamental accounting equation denotes relationship between the assets,…

Q: Whispering Winds Company has developed the following standard costs for its product for 2022:…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Calculate the following variances (i)Direct material total variances (ii)Direct labor total…

A: Variance analysis is used by the company to answer the various questions regarding about the actual…

Q: TRUE OR FALSE? Advertising and bonuses are reported in the interim period when incurred.

A: Financial statements are those statements which are prepared at the end of accounting period in…

Q: A resident foreign corporation received 900,000 dividends from a domestic corporation. How much…

A: Resident foreign corporations (i.e. foreign corporations engaged in trade or business in the…

Q: . A cash remittance from the branch to the home office is recorded by the home office as a. Debit…

A: Cash Remittance from branch to home Office is recorded by the Home office as Journal Entry will be…

Q: Happy Inc. provided the following information: Beginning balance of Accounts receivable P5,000,000…

A: The accrual basis accounting records the revenue and expenses of the current period when they are…

Q: Accounting A lender whose mortgagor has defaulted may be offered a deed in lieu of foreclosure. If…

A: the correct option with proper explanation are as follows

Q: 1.2.Choose TRUE or FALSE? Give short explaination? a. In marginal costing method, factory rent is…

A: In Marginal costing method, factory rent is absorbed into cost of production: FALSE Justification:…

Q: Use the following information for the Exercises below. (Algo) [The following information applies to…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: Which is TRUE in 8% preferential tax? S1: Nicanor, a VAT-registered taxpayer with gross sales of…

A: Here discuss about the details of the option to get the 8% preferential taxes which are applicable…

Q: YOU ARE REQUIRED TO: 1. Prepare the entries in the General journal to record the events described…

A: Robert and Donald are partners sharing partnership profits and losses in the ratio of 3:2. They…

Q: On January 1, 2021, Risa signed an agreement to operate as a franchisee of Teddy Company for an…

A: The acquisition cost of the franchise will be the sum of down payment and the present value of the…

Q: Beta Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/20 and…

A: Understatement of expense will increase net income for that year. Overstated expense will decrease…

Q: During 2021, Eaton Co. introduced a new product carrying a two-year warranty against defects. The…

A: The liabilities are the amount due to be paid in near future. The warranty Expenses are estimated…

Q: Net income after tax is: The difference of financial income and total deferred income tax expense.…

A: Net income is the amount of money earned by an entity after deducting its outlays from the revenues.…

Q: Blossom Company reported the following information for November and December 2022. November December…

A: Gross profit rate (%) = [Gross profit/Sales]×100 Gross profit = Sales - cost of goods sold

Q: 7. AHR Company has provided the following data: Inventory and prepaid expenses, P35,000, Current…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: There were no changes during Year 11 in the number of common shares, preferred shares, or…

A:

Q: 3. Maricel borrows P 10 000 with interest at 15% compounded monthly. How much should she pay at the…

A: Given information P=P 10 000 t = 2 years and 6 months m = 12 Therefore, n =tm =12 * 2.5…

Q: In 2009, Bratz, Inc.’s net profit before tax was P35 million while its operating expenses was P31…

A: Profits after subtracting the GP's operational expenses are referred to as net profits. To compute…

Q: The general ledger of JEONGCHEOL INDUSTRIES showed the following balances: Dr Cr Cash Accounts…

A: Cash balance: It implies to the cash including coins, paper notes, cheques, money order, etc, that…

Q: Determine the account and amount to be debited and the account and amount to be credited for the…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door…

A: Flexible budget is the estimation of the variable and fixed costs of an entity.

Q: an economic life of 5 years. Sales for 2021 amounted to P3 its economic life are expected to be…

A: Solution Calculation of software carrying value on 31st Dec, 2021 Software value on 1st Jan, 2021…

Q: X Corporation opted to deduct OSD. The following are the results of its operation: Net sales…

A: An OSD or Optional Standard Deduction is a standard deduction at the rate of 40% which taxpayers…

Q: Calculate the gross profit and the sales figures using the income statement approach.

A: Income statement approach refers to the approach which is used to determine the gross profit and it…

Q: The amortization of prior service costs will affect the pension expense for the period along with…

A: solution of above requirement are as follows

Q: 6. Find the amount at the end of 15 years if P 55 000 is invested at an interest rate of 5%…

A: 5% compounded semi anually: Given data, P= 55,000 t=10 m =2 Therefore, n=tm =10*2 =20 i=5%/2 =0.025…

Q: On January 1, 2023, the city government provided Swerte Company a zero interest, P6,000,000 loan…

A: In this Question, this is a zero-coupon bond having no interest. Therefore in this, we will…

Q: ABC Corporation, an international organization made the following calls: Calls from Manila to…

A: There are various types of taxes imposed by a government on the services rendered in a country. The…

Q: On January 1, 2018, Joel Company purchased a patent for P7,140,000. The patent is being amortized…

A: Amortization of Patent: The practice of allocating the cost of patents, which are considered forms…

Q: Marvel Corporation (a C-corporation) has the following operating profit for 2019 through 2021. Year…

A: Net operating loss is a situation when the deductions exceed the income. For example, deductions…

Q: The primary objective of the statement of cash flows is to provide information about a company's: O…

A: Solution: Statement of cash flows is a financial statement that provides data regarding all cash…

Q: Cooper Inc. took physical inventory count at the end of 2020. On the day of physical count, there…

A: Generally there are two terms of Shipping: FOB SHIPPING FOB DESTINATION Under FOB SHIPPING,…

Q: Dex Corporation, part of banking industry but performing quasi - banking function had the following…

A: Banks and non-bank financial intermediaries performing quasi-banking functions Interest,…

Q: Explain the data provided

A: Gross profit is that profit of a company that is left over after accounting for all costs that the…

Q: The following business transactions of Mrs.Emma Blake, a sole trader.…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Maurice, single, has wages of $215,114 and net investment income of $40,000 in 2021. His AGI (MAGI)…

A: Net investment tax is calculated by applying 3.8% on the net investment income of an individual. It…

Q: 2. S1: The excess of allowable deductions over gross sales is net operating loss. S2: Net…

A: Net operating loss is the loss calculated as per the tax code and as per the tax code the net…

Q: 19. A taxpayer engaged in the practice of his profession bought a brand-new motor vehicle in the…

A: Solution Concept Provisions When a asset is used in the business depreciation can be claimed in such…

Q: On March 2, 2022, Gumamela Corporation issued 4,000 shares of 6% cumulative P100 par value…

A: Share warrant is a acknowledgment or document which issued by the company under its common seal,…

Q: Mark Company quarries limestone, crushes it and sells it to be used in road building. Mark paid…

A: Formula: Depletion rate per ton = (Cost of the Quarry - Residual value) / Estimated total reserves…

Q: This depreciation method was brought about by the Tax Reform Act of 1986 a. Straight-Line O b.…

A: Fixed assets are those assets which are held by the business for longer period of time. For example,…

Step by step

Solved in 2 steps

- Costello & Summers are partners in a merchandising business. During 2014, they withdrew their salary allowances of P 34,000 & P 59,000 respectively. Bonus is given to Summers based on 20% of net income after salaries but before bonus and the remaining profit & loss equally by Costello & Summers. The partners’ capital accounts show the following: COSTELLO SUMMERS Beginning Balance P 85,000 P 67,000 Additional Investments 40,000 43,000 Withdrawal other than salary allowance 35,000 20,000 What is Summer’s capital if Costello’s capital after dividing net income is P 138,800? a. P 201,750 b. P 163,200 c. P 158,320 d. P 155,067On October 01, 2019, Benny and Joey pooled their resources in a partnership with the firm taking over their business assets and assuming their business liabilities. They agreed to make the following adjustments and to make settlement among themselves to conform to the 40:60 capital and profit and loss ratio. ➢ Joey’s inventory be reduced by P3,000. ➢ Allowance for doubtful accounts be recognized in the amount of P1,500 each. ➢ P4,000 of unrecorded accounts payable to supplier be recorded in the books of Benny ➢ Accrued utilities be recognized in the books of Benny, P1,200. ➢ Store equipment in the books of Joey are under depreciated by P5,000. The individual trial balance before adjustments show the following: BennyJoey AssetsP120,000P150,000 Liabilities 25,000 35,000 Capital 95,000 115,000 The capital balances of the partners that conform with their agreement are: Benny: ___________________Joey: _____________________The following were the balance of the partnership between Reynolds and Wynter as at December 31, 2015. DR $ CR $ Capital on January 1, 2015 Reynolds 35,000 Wynter 35,000 Current accounts on January 1, 2015 Reynolds 1,700 Wynter 400 Drawings during the year Reynolds 8000 Wynter 6400 Land and building .........................................160 000 Equipment .......................................................15000 Cash and bank .................................................20000 Bank loan .................................................................. 90,000 Electricity ..........................................................1400 Office salaries .................................................40000…

- Lambert Company had a $15,300 loss for the year ended October 31, 2024. The company is a partnership owned by Lilia and Terry Lambert. Salary allowances for the partners are Lilia $24,900 and Terry $15,000. Interest allowances are Lilia $5,300 and Terry $9,300. The remainder is shared 75% by Lilia and 25% by Terry. (a) Calculate the loss to be allocated to each partner. (b) Prepare a journal entry to close the Income Summary account.Prepare financial statements.On January 1, 2017, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $30,000, $58,000, and $60,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2017 . . . . . . . . . . . . . .. . . . . $70,000 2018 . . . . . . . . . . . . . . . . . . 42,000 2019 . . . . . . . . . . . . . . . . . . (25,000) During this period, each partner withdrew cash of $15,000 per year. Krause invested an additional $5,000 in cash on February 9, 2018.At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows:∙ Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year.∙ Because of prior work experience, Angela is entitled to an annual salary allowance of $12,000 per year and Diaz is entitled to an annual salary allowance of…Partners A,B and C decided to liquidate their business on January 31, 2021 and showed the following financial position: ASSETS LIABILITIES & STOCKHOLDER'S EQUITY Cash 28,000 Accounts Payable 14,400 Non-Cash Assets 36,000 Loan Payable to A 4,000 A, Capital 8,000 B, Capital 16,000 C, Capital 21,600 Totals 64,000 Totals 64,000 It was also agreed that cash distribution be made at the end of each month provided there was sufficient cash for this purpose. Profit and loss ratio was 2:1:2 respectively. The liquidation transactions for the months of February, March and April were as Follows: Cash Proceeds BV of Assets Sold Liabilities paid Liquidation Expense Restricted Cash for future expenses February 8,000 12,000 12,000 2,400 1,600 March 12,800 16,000…

- Partners A,B and C decided to liquidate their business on January 31, 2021 and showed the following financial position: ASSETS LIABILITIES & STOCKHOLDER'S EQUITY Cash 28,000 Accounts Payable 14,400 Non-Cash Assets 36,000 Loan Payable to A 4,000 A, Capital 8,000 B, Capital 16,000 C, Capital 21,600 Totals 64,000 Totals 64,000 It was also agreed that cash distribution be made at the end of each month provided there was sufficient cash for this purpose. Profit and loss ratio was 2:1:2 respectively. The liquidation transactions for the months of February, March and April were as Follows: Cash Proceeds BV of Assets Sold Liabilities paid Liquidation Expense Restricted Cash for future expenses February 8,000 12,000 12,000 2,400 1,600 March 12,800 16,000…Tom and Julie formed a management consulting partnership on January 1, 2016. The fair value of the net assets invested by each partner follows: Tom Julie Cash $12,600 $11,200 Accounts receivable 7,400 5,700 Office supplies 2,100 900 Office equipment 32,600 — Land — 32,200 Accounts payable 2,200 5,500 Mortgage payable — 19,100 During the year, Tom withdrew $16,000 and Julie withdrew $12,800 in anticipation of operating profits. Net profit for 2016 was $46,200, which is to be allocated based on the original net capital investment. (a) Your answer is correct. Prepare journal entries to: 1. Record the initial investment in the partnership. 2. Record the withdrawals 3. Close the Income Summary and Drawing accounts. (Round intermediate calculations to 6 decimal places, e.g. 1.576843 answers to 0 decimal places, e.g. 5,125. Credit account titles are…On October 1, 2024, Apollo, Brett, and Clark formed the A, B and C partnership. Apollo contributed $27,300; Brett, $42,900; and Clark, $59,800. Apollo will manage the store; Brett will work in the store three-quarters of the time; and Clark will not work in the business. Read the requirements LOADING... . Requirement 1. Compute the partners' shares of profits and losses under each of the following plans: a. Net loss for the year ended September 30, 2025, is $55,000, and the partnership agreement allocates 70% of profits to Apollo, 15% to Brett, and 15% to Clark. The agreement does not discuss the sharing of losses. (Use parentheses or a minus sign for loss amounts. Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate cell.) A, B and C Allocation of Profits and Losses Apollo Brett Clark Total a. Net income (loss) Capital allocation:…

- Which of the following expenses is deductible for the current year (after 2017)? Group of answer choices Tax return preparation fees of $300. Gambling losses to the extent of gambling winnings. Fees paid to an investment advisor to manage one’s stock portfolio. Employee business expenses of $500 not reimbursed by the employer.The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 61,000 Liabilities $ 55,000 Noncash assets 329,000 Drysdale, loan 42,500 Drysdale, capital (50%) 107,500 Koufax, capital (30%) 97,500 Marichal, capital (20%) 87,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $21,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $99,000 are sold for $72,500. How is the available cash to be divided?Capital balances and profit-and-loss-sharing ratios for the Nix, Man and Per partnership on December 31, 2020, just before the retirement of Nix, are as follows: Nix Capital (30%) 128,000 Man Capital (30%) 140,000 Per Capital (40%) 160,000 Total 428,000 On January 2, 2021, Nix is paid $170,000 cash upon his retirement. Prepare the journal entry(s) to record Nix’s retirement assuming that goodwill, as implied by the payment to Nix, is recorded on the partnership books.