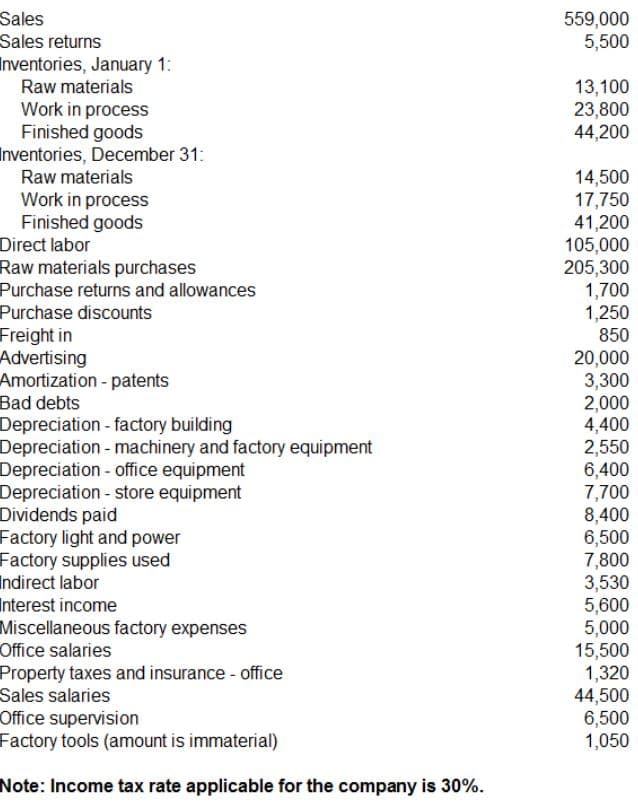

WHAT IS THE TOTAL GENERAL AND ADMINISTRAVE EXPENSES?

Q: Describe the accounting for actuarial gains and losses

A: Actuarial Gains and losses arises due to the difference in the pension payment made by the employer…

Q: Distinguish between Expenditure and Encumbrances

A: Expenditure and Encumbrances are two terms used in Accounting most frequently.

Q: Define Expenses

A: Expenses are the cost that is incurred by the firm or the company to run the business. Basically,…

Q: What is the fees earned and net income of this income statement?

A: Net income is the excess of revenue over expenses. Net income is calculated under income statement…

Q: The difference between revenues and expenses is net income. What is net income?

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: Define the term accrued expense.

A:

Q: What is an accrued expense? Provide an example.

A: Accrued expense: This is the expense incurred but not yet paid. It is treated as liability until the…

Q: Compute the consignment income to be reported by the consignor

A: Consignment is a arrangement of principal and agent where cosignor the principal sends goods the…

Q: what is the difference betwwen classifying an expense by nature or function?

A: The costs that are incurred to earn revenues in the process of operating activities of the business…

Q: hat does the term "miscellaneous expenditure" mean?

A: Miscellaneous Expenditure: These are the expenditure that are allowances for government services,…

Q: How did you calculate the depriciation expense?

A: This method also called diminishing balance method or declining balance method where the…

Q: What are operating expenses?

A: Expenses refers to the money outflow or the assets outflow to another company or to individual…

Q: revenues and expenses

A: The income statement shows the net income or net loss that includes the revenues and expenses of the…

Q: how to compare between prepaid expenses and unearned revenue?

A: The adjustment for deferred items are made at the end of the year.

Q: What is accured expenses with example

A: Definition: Expenses: Expenses are costs incurred for the operations of a business. The costs…

Q: Which are the total interest expense in the income statement?

A: Interest expenses mean costs related to financing. It is also called finance costs. From the above…

Q: How to compute gross estate

A: "Gross estate" could be a term that won’t describe the entire dollar price of a personality's assets…

Q: Distinguish between cash-basis net income and accrual-basis net income.

A:

Q: How to calculate or compute the operating income and the net income

A: Operating Income: Income generated from the business operation is called operating income. In simple…

Q: Define net income and explain its computation.

A: Net income is the amount of income which is left over revenue after all the expenses have been…

Q: Explain the purpose and construction of a statement of functional expenses.

A: Financial Statement: It refers to the financial records of an organization that reports their…

Q: What is a deferral expense?

A: Word "Deferral" means the postponement of something happening.

Q: State the meaning of Income and Expenditure Account.

A: Accounting: It refers to the process of recording the financial transactions of an organization…

Q: What is function of expense method?

A: Organisations can opt for either of the options to prepare and report the income statement. They are…

Q: Expenses, losses, and distributions to owners are alldecreases in net assets. What are the…

A: Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for…

Q: Why should inventories be included in (a) a statement offinancial position and (b) the computation…

A:

Q: What are the differences between assets and expenses

A: Definition of Assets: Properties or things owned by business

Q: What is the difference between the APBO and the EPBO? What are the components of postretirement…

A: Difference between the APBO and the EPBO:Expected pension benefit obligation (EPBO): The amount of…

Q: What is a functional expense statement?

A: The answer is explained as follows:

Q: What is gross income?

A: The concept of gross income can be understood in two contexts 1. for corporates 2. for individuals

Q: What is the difference between assets and expenses?

A: Assets and expenses are two different elements of the financial statements of an entity. Assets…

Q: Define Accretion expense.

A: Accretion expense is incurred due to the effluxion of time which is calculated on the basis of…

Q: Discuss how to report various income items.

A: Introduction Income/Revenue is the money received from business/profession/service. There are many…

Q: Give example of personal assets

A: An asset is a resource owened by individual or business that provides…

Q: What are (a) pass-through expenses, (b) recoverable expenses, and (c) common area expenses? Give…

A: a) Pass through expense: This is an expense which the customer pays directly to a third party or…

Q: What is the difference between gross method and the net method?

A: Gross margin (gross profit): Gross margin is the amount of revenue earned from goods sold over the…

Q: Distinguish between costs that are capitalized and costs that are expensed in the period inwhich…

A: A business cost includes all costs such as capitalized cost, the variable cost, direct or indirect…

Q: Determine the components of postretirement benefit expense

A: Post-retirement benefit expense: This is an expense to the employer-paid as compensation after the…

Q: When to recognize expenses?

A: Under the accrual basis of accounting, revenue is considered to have been earned when goods are sold…

Q: Distinguish among appropriation, expenditures, encounters, encumbrance, and expenses

A: It is the money set aside by the company in order to meet the necessities of the business…

Q: What is expenditure? explain types of expenditure?

A: Payments or liabilities incurred in exchange for goods or services are referred to as expenditures.…

WHAT IS THE TOTAL GENERAL AND ADMINISTRAVE EXPENSES?

Step by step

Solved in 2 steps

- Webster Company uses backflush costing to account for its manufacturing costs. The trigger points for recording inventory transactions are the purchase of materials, the completion of products, and the sale of completed products. Required: 1. Prepare journal entries, if needed, to account for the followingtransactions. a. Purchased raw materials on account, 135,000. b. Requisitioned raw materials to production, 135,000. c. Distributed direct labor costs, 20,000. d. Incurred manufacturing overhead costs, 80,000. (Use Various Credits for the credit part of the entry.) e. Cost of products completed, 235,000. f. Completed products sold for 355,000, on account. 2. Prepare any journal entries that would be different from theabove, if the only trigger points were the purchase of materialsand the sale of finished goods.Bubba Manufacturing Company provided the following information for the fiscal year toJune 30, 2020:Inventories 01/07/2019 30/06/2020Direct MaterialsWork-in-ProcessFinished Goods$72,000107,000149,500$65,000128,000141,700Other information:Office cleaner’s wages 4,500Sales Revenue 1,031,000Raw materials purchased 235,000Factory wages 239,700Indirect materials 23,500Delivery truck driver’s wages 15,400Indirect labor 9,500Depreciation on factory plant & equipment 32,000Insurance 1 60,000Depreciation on delivery truck 7,250Utilities 2 118,750Administrative salaries 41,250Special Design Costs 5,000Selling expenses 9,000Sales Commission 2% of gross profit1 Of the total insurance, 66⅔% relates to the factory facilities & 33⅓% relates to general& administrative costs.2 Of the total utilities, 80% relates to the manufacturing facilities & 20% relates to theoffice area.Requirements:a) What was the amount of direct materials used in production?b) What was the amount of manufacturing…Ethel Company provided the following information asof May 31, 2020SalesP900,000Finished goods inventory, May 31300,000Work in process inventory,May 31 350,000Raw materials inventory, May 31280,000Finished goods inventory, May 1200,000Work in process inventory,May310,000Raw materials inventory, May250,000Direct labor150,000Factory overhead110,000The average historical gross profit is 30% of salesWhat is the total manufacturing cost? How much was the total raw materials used? How much was the total raw materials purchased?

- Consider the following dataWork in process inventory December 317000Work in process inventory January 19000Purchases of raw material63000Raw Material inventory December 313000Raw Material inventory January 19000Direct Labor12000Total manufacturing overhead6000Calculate the cost of goods manufactured4.The following were taken from accounting records of Bella Company in December 2020.Prime cost, P301,000Gross profit rate on sales, 20%Cost of goods available for sale, P460,000Direct materials purchased, P170,000Work in process, December 1, 2020, P34,000Direct Materials, December 1, 2020, P16,000Finished goods, December 1, 2020, P30,000Factory overhead, 40% of conversion cost.Sales, P500,000Direct labor, P180,000Compute for December 31, 2020: (1) Direct materials inventory; (2) Work in process inventory; (3) Finished goodsinventory: A.(1) P6,000 ; (2) P25,400 ; (3) P30,000B. (1) P49,000 ; (2) P25,000 ; (3) P30,000C. (1) P65,000 ; (2) P25,400 ; (3) P60,000D. (1) P65,000 ; (2) P25,000 ; (3) P60,000Account Dollar amount Beginning Materials Inventory $74,323 Purchases ? Materials available for use 151,644 Ending inventory ? Materials used in production 78,413 Work In Process Inventory Beginning inventory 253,210 Materials used in production ? Direct labor 125,900 Overhead applied 94,425 Manufacturing costs incurred ? Ending inventory 242,932 Cost of goods manufactured ? Finished Goods Inventory Beginning inventory 333,149 Cost of goods manufactured ? Goods available for sale ? Ending inventory 354,235 Cost of goods sold ? Prepare the journal entries to record the following events: The purchase of materials The completion of work in process The sale of finished goods (omit the revenue side of the sale)

- Raw Material inventory $657 $277 Work-in-Process inventory $4473 $1444 Finished Goods inventory $5429 $1481 Direct materials: $128 Direct labor: $193 Actual Manufacturing overhead costs: $1039 Applied Manufacturing overhead costs: $1933 Compute the ADJUSTED Cost of Good Sold Please give explanation for answer, thank you!ssume the following information: Milling Department Materials Conversion Total Cost of beginning work in process inventory $ 10,000 $ 15,000 $ 25,000 Costs added during the period 291,600 394,500 686,100 Total cost $ 301,600 $ 409,500 $ 711,100 Assume the equivalent units of production for materials and conversion, when using the weighted-average method, are 5,200 units and 5,000 units, respectively. If the equivalent units in ending work in process inventory for materials and conversion are 400 units and 200 units, respectively, then what is the total cost of ending work in process for the Milling Department?A firm uses backflush costing and values inventory using throughput accounting. All actual amounts are equal to budgeted amounts. Total DM $360,000 Total DL $140,000 Total OH $70,000 Total completed and in process 20,000 units Units sold 19,480 Units in process 100 $500 of raw materials are still in the warehouse at the end of the period. Which journal entry appropriately backflushes costs to inventory accounts? Group of answer choices Debit: Finished Goods $7,560 Debit: WIP $1,800 Debit: RM $500 Credit: COGS $9,860 Debit: COGS $9,860 Credit: Finished Goods $7,560 Credit: RIP $2,300 Debit: COGS $9,860 Credit: Finished Goods $7,560 Credit: WIP $1,800 Credit: RM $500 Debit: Finished Goods $7,560 Debit: RIP $2,300 Credit: COGS $9,860

- Selected information from the Iowa Instruments accounting records for April follows: Materials Inventory Debit Credit BB (4/1) 26,800 210,800 175,800 Work-in-Process Inventory Debit Credit Labor 95,400 EB (4/30) 92,800 Finished Goods Inventory Debit Credit BB (4/1) 88,800 288,200 273,800 Cost of Goods Sold Debit Credit 5,300 Manufacturing Overhead Control Debit Credit 79,300 79,300 Applied Manufacturing Overhead Debit Credit 89,040 83,740 5,300 Additional information for April follows: The labor wage rate was $30 per hour. During the month, sales revenue was $320,900, and selling and administrative costs were $82,000. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor-hours. Customer returns are discarded and not resold. Required: What was…All costs incidental to materials procurement and handling until they are issued are charged tothe materials account by Cruz Mfg. Co. at a rate predetermined for each of the departmentsinvolved.For 19C, the estimated departmental costs are given:Purchasing department P175,000Receiving and Inspection Dept. 124,500Materials department 83,000Accounting department (20% isestimated to be related toprocessing of payments formaterials.295,000Purchases for 19C were estimated to amount to P5, 000,000 for more or less 8,300,000units to be ordered 50 times.Actual purchases for 19C amounted to P5, 600,000 for total of 8,000,000 units in 52orders. Costs incurred by the four given departments were as follows:Purchasing department P180,000Receiving and inspectiondepartment128,000Materials department 78,000Accounting department (20% isestimated to be related toprocessing of payments formaterials.290,000Required:a. Compute for the predetermined departmental overhead rates.b. How much is the applied…An incomplete cost of goods manufactured schedule is presented here.Complete the cost of goods manufactured schedule for Splish Brothers Company. (Assume that all raw materials used were direct materials.) SPLISH BROTHERS COMPANYCost of Goods Manufactured ScheduleFor the Year Ended December 31, 2022 Work in process, January 1 $243,600 Direct materials Raw materials inventory, January 1 $enter a dollar amount Raw materials purchases 184,000 Total raw materials available for use enter a total of the two previous amounts Less: Raw materials inventory, December 31 27,000 Direct materials used $208,800 Direct labor enter a dollar amount Manufacturing overhead Indirect labor 21,600 Factory depreciation 41,400 Factory utilities 79,600 Total manufacturing overhead 142,600 Total…