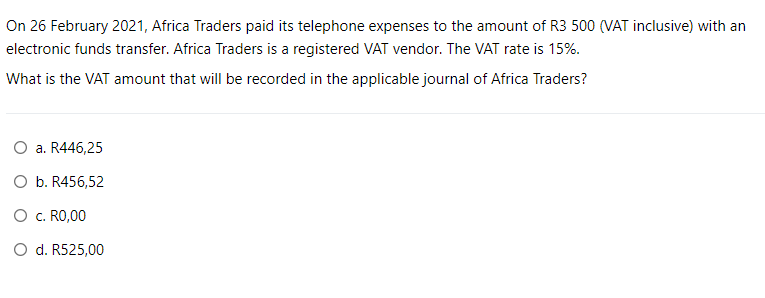

What is the VAT amount that will be recorded in the applicable journal of Africa Traders?

Q: Class Exercise – Crafting of Financial statements Develop the Statements of P&L and Financial…

A: The question is related to Profit and Loss Account and Financial Position as on September 30th,…

Q: are (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the…

A: The establishment of a petty cash fund is making cash available for small expenses that occur for…

Q: The uneamed rent account has a balance of P36,000. If P4,000 of the P36,000 is unearned at the end…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Problem 8-6 (ACP) machinery On January 1, 2021, North Company acquired a with cash price of P750,000…

A: Accounts Payable: Accounts payable is recognized in the accounting books of a company to indicate…

Q: Pharoah Company manufactured 6,720 units of a component part that is used in its product and…

A: given Pharoah Company manufactured 6,720 units of a component part that is used in its product and…

Q: What is the consolidated depreciation expense of equipment for the year ended December 31, 2010

A: The Consolidated Depreciation expense of equipment for the year ended 31 December 2011 is P5,25,000…

Q: emand for Southern Spicy Cheesy Pizza for mont average method. Note: Round up all the forecas emand…

A: Forecasting helps to know the sales of the product in advance so that appropriate stock levels are…

Q: АВС, C. Condensed Income Statement For the Years Ended December 31 (In millions) 2014 2015 8,853.3…

A:

Q: On March 1, 2020, Quinto Mining Inc. issued a $690,000, 8%, three-year bond. Interest is payable…

A: When a bond is issued at a rate higher than the market interest rate then it’s the bond is issued at…

Q: A retailer has a beginning monthly inventory valued at $60,000 at retail and $25,000 at cost. Net…

A: Total merchandise available for sales - at cost Beginning inventory + Net purchases + transportation…

Q: For each situation below identify and explain the threat and one fundamental principle that is…

A: Solution Fundamental principles is the principle from which other truth can be derived.

Q: Consider the following independent scenarios: On 9/1, company accepts a P10,000, 5%, 8-month note…

A: Notes receivable are asset accounts linked to an underlying promissory note, which specifies the…

Q: Cash flow from Investing activities iIs considered the most important category on the cash flow…

A: * As per Bartle by policy, in case multiple questions are asked then answer first only. Cash flow…

Q: The comparative statements of Waterway Company are presented here. Waterway Company Income…

A: given Waterway CompanyIncome StatementsFor the Years Ended December 3120222021Net sales$1,813,300…

Q: 11a.Harry and Sally formed the Evergreen partnership by contributing the following assets in…

A: Solution:- Calculation of Harry’s tax basis in his partnership interest as follows under:-

Q: [The following information applies to the questions displayed below.] Nancy operates a business that…

A: Accrual accounting seems to be a technique of accounting in which income and costs are recorded at…

Q: Business Income-Philippines 1,000,000.00 Business Income-Abroad 500,000.00 Rent Income on property…

A: The taxability of income in Philippines is based on the following rules:- Source of Income…

Q: question 8. Determined that the Capital Projects Fund should be reimbursed $3,000 for wages that…

A: In this question, we just post one transaction with amount, related to the capital Project Funds.

Q: 1. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue 2.…

A: Journal entries refers to the official book of a company which is used to record the day to day…

Q: a.Harry and Sally formed the Evergreen partnership by contributing the following assets in exchange…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance…

A: Elimination of Division: You may have gotten the impression by now that the elimination procedure is…

Q: Machine Operator, manufacturer of shelving keeps stock of a wide range of components. The…

A: Solution Formulas 1- minimum stock level = Reorder level -(Average rate of consumption * Average…

Q: Skip to question [The following information applies to the questions displayed below.] The…

A: The bank reconciliation statement is prepared to adjust the balance of cash book and passbook with…

Q: On January 1, 2019, the Business Info Company had capitalized costs of P6,000,000 for a new computer…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Rip Tide Company manufactures surfboards. Its standard cost information follows: Standard Standard…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Problem 8-13 (AICPA Adapted) At the beginning of current year, Pares Company borrowed P3,600,000…

A: If non-bearing notes are issued, the value of that right (interest) is treated as imputed interest.…

Q: The following information pertains to York Rafting Company: 2 Issued common stock to investors for P…

A: Common stock is the amount invested by the owners and in return they get dividend. This represents…

Q: Solomon, Inc. sponsors a defined benefit pension plan for its employees. On January 2020, the…

A: Pension plans are established to provide payments to the employee when they retire and the main…

Q: An asphalt road requires no upkeep until the end of 2 years when P60,000 will be needed for repairs.…

A: Equivalent Annual cost: Equivalent Annual cost (EAC) is the yearly expense of buying, working, and…

Q: 1) Late in the day at an auction house there are only two bidders left, April and Bart. Th last…

A: Given that :- Sound system to April = $1150 1) April thinks that Bart will bid exactly the worth of…

Q: to service a minimum

A: Khaki Pants have a higher contribution margin per minute on the cutting machines. As the cutting…

Q: Accounts payable $37,500 Accounts receivable $27,500 Accumulated depreciation-Video equipment…

A: Formula: Net income = Total revenues - Total Expenses

Q: Y and Z have capital balances of $80, 000, $180,000 and $60,000 respectively. Immediately prior to…

A: Partnership refers to the act of agreement between two or more people who decided to run the…

Q: Young Corporation is considering purchasing equipment that costs $50,000 and is expected to provide…

A: Period Cash Flow showing calculation of cumulative cash flow Cumulative Cash Flow 0 ($50,000)…

Q: What is the interest income for the year 2023? How much is the total proceeds of Squirtle for the…

A: Answer:

Q: Part2: On March 1, 2020, Quinto Mining Inc. issued a $690,000, 8%, three-year bond. Interest is…

A: Bonds are the securities which are issued to generate funds by the company and these are the…

Q: Division A makes a part with the following characteristics: **SEE IMAGE TO SEE DETAILS** a}…

A: Transfer price is the internal price assigned to the purchase of one unit of product produced by…

Q: P10.6 (LO 2) (Borrowing Costs) Cho Landscaping began construction of a new plant on December 1, 2022…

A: Interest expense to be capitalized includes the amount which is yet to be paid but is added to the…

Q: A company makes a single product and incurs fixed costs of £30,000 per annum. Variable cost per unit…

A: Fixed cost = £30,000 Selling price per unit = £15 Variable cost per unit = £5

Q: On January 2, Todd Company acquired 40% of the outstanding stock of McGuire Company for $205,000.…

A: The journal entries are the basic method for recording transactions. The portion of shares acquired…

Q: Swifty produces 5-foot USB cables. During the past year, the company purchased 180,000 feet of…

A: The direct material quantity variance (DMQV) is based on the difference of standard quantity and…

Q: 13. Sam and Devon agree to go into business together selling college-licensed clothing. According…

A: Tax Basis: Under U.S. government charge regulation, the tax basis of a resource is by and large, its…

Q: Differentiate between Government audit and Commercial audit.

A: Auditing is the process in which a qualified person (known as auditor) conducts an independent…

Q: The variable overhead spending variance has to do with the efficient use of The overhead items. All…

A: Solution Variable overhead spending variance is a difference between actual cost manufacturing a…

Q: Ralston Dairy gathered this data about the two products that it produces: Products Current Sales…

A: Since there is additional cost involved in further sales procedure, the same will be considered…

Q: 5a.Harry and Sally formed the Evergreen partnership by contributing the following assets in exchange…

A: In partner each partner's tax basis is the net value of the partner's contribution.

Q: Eastport Incorporated was organized on June 5, Year 1. It was authorized to issue 420,000 shares of…

A: When shares ( common or preferred ) are issued at more than par value, it results in additional paid…

Q: Seacrest Company uses a process costing system. The company manufactures a product that is processed…

A: In the given question, we have information about Seacrest Company. The physical cash flow schedule…

Q: On January 1, 2022, Frank Co. and Richard, Inc. combined. As of this date, the fair values of the…

A: Net Assets: Net assets is the adjusted value determined by deducting the total liabilities from the…

Q: Lucent Technologies, Inc., was formed from AT&T's Bell Laboratories research organization after the…

A: In this question, we will explain about the quality of Lucent Earnings of 1997,1998 and 1999 from…

Step by step

Solved in 2 steps with 1 images

- On 13 November 2020, Africa Traders received an electronic funds transfer payment of R7 000 from SA Investors, for commission income. Africa Traders is not a registered VAT vendor. Which account will be debited, and which account will be credited in the general ledger of Africa Traders?On 20 December 2021, Africa Traders did an electronic funds transfer payment of R300 000 for the monthly salaries. Africa Traders is not a registered VAT vendor. Which account will be debited, and which account will be credited in the general ledger of Africa Traders? Select one: a. Dr Salaries Cr 2021 R 2021 R Dec Dec 20 Bank 300 000 Dr Bank Cr 2021 2021 R Dec 20 Salaries 300 000 Dec b. Dr Salaries Cr 2021 R 2021 R Dec 20 Bank 300 000 Dec Dr Bank Cr 2021 2021 R Dec Dec 20 Salaries 300 000 c. Dr Salaries Cr 2021 R 2021 R Dec Dec 20 Trade payables 300 000 Dr Trade payables Cr 2021…Africa Traders is a registered VAT vendor and the current VAT rate is 15%. No. 0001 Date: 5 January 2021 Received from: Mr S Zulu R c Amount: Rand Ten thousand rand only Cent: None 10 000 00 For: Settlement of account (electronic funds transfer) Africa Traders Signature: S Africa Which account will be debited and which account will be credited in the accounting records of Africa Traders when recording the above source document? Select one: a. Debit the VAT output account with R1 304,35 and the trade receivables control account with R8 695,65, and credit the Bank account with R10 000. b. Debit the Bank account with R10 000, and credit the trade receivables control account with R10 000. c. Debit the Bank account with R10 000, and credit the VAT output account with R1 304,35 and the trade receivables control account with R8 695,65. d. Debit the trade receivables…

- The Department of Foreign Affairs (DFA) collected P10,000,000 revenue from passport and visa applications for March 20X2. The said amount was then deposited in an authorized servicing bank. Moreover, in the same month, the DFA received a P5,000,000 cash disbursement ceiling (CDC) and paid its rental of P600,000.Required: Give the necessary entries to be made by DFA from the above scenario.In 2021, TUC Inc. guaranteed a bank loan of ATT Corp. ATT Corp has made all the required loan payments and the bank loan has a balance of 4,000,000 as of December 31, 2021. What provision should TUC Inc. recognize on December 31, 2021?The pre-closing trial balance of DENR-CAR shows the following balances of accounts: Subsidy from National Government P500, 000, Unutilized NCA for the month ending December 31, 2020, amounted to P200,000, Refund of excess cash advance P5,000. Salaries and Wages-Regular P150,000, PERA P50,000 Government Share: Retirement and Life Insurance Premiums P18,000, Pag-IBIG Premiums P2,500, PhilHealth premiums P4,500, Travelling expense - local P13,000, Electricity expense P12,000, Telephone Expense P10,000, Rent/Lease Expenses P25,000, Office supplies expense P20,000, Depreciation Expense-Machinery P15,000. How much is the Excess of Income Over Expenses for the year ended December 31, 2020? *

- Persever Company is a dealer in equipment. On December 21, 2021, the enitity sold an equipment in exchange for a noninterest bearing note requiring five annual payments of P500,000. The first payment was made on December 31, 2022. The market interest rate for similar notes was 8%. PV of 1 at 8% for 5 periods 0.68 PV of an ordinary annuity of 1 at 8% for periods 3.99 What amount of interests income should be reported for 2022?On May 1, 2021, the company ACG pignoro assigned 5,500,000 of their Account by Cabrar paid a pre-love granted by a financial institution of $ 400,000. The financial institution charged a charge of 2 of pledged accounts and an interest rate of 10% on the loan. How much electricity received by ACG on May 1?Aunt May, Inc. had the following receivable financing transactions for the fiscal year ended August 31, 2021:a) On June 30, 2021, Aunt May, Inc. had an outstanding accounts receivable balance amounting to P4,000,000. The receivables were pledged to Philippine Savings Bank (PS Bank) in consideration of a 12% loan. The loan amount is 80% of the outstanding receivables. PS Bank charged the company 5% on the outstanding accounts receivable as service charge.By the end of July, Aunt May collected P1,200,000 cash from the accounts receivable net of a P120,000 sales discount. Also, by the end of July, Aunt May accepted from customers merchandise originally invoiced at P80,000 as returns.By the end of August, Aunt May collected another P900,000 after a P50,000 sales discount. The company wrote-off P200,000 of the accounts receivable as worthless.It was agreed-upon with PS Bank that remittances from collections will be made to the bank on a monthly basis and that the collections from customer…

- On September 1, 2020, Pot Co. issued a note payable to National Bank in the amount of P1,800,000, bearing interest at12%, and payable in three equal annual principal payments of P600,000. On this date, the bank's prime rate was 11%. Thefirst payment for interest and principal was made on September 1, 2021. At December 31, 2021, Pot should record accruedinterest payable ofa. P72,000 c. P48,000b. P66,000 d. P44,000On June 30, 2021, BTS Company factored P2,500,000 of accounts receivable for P2,250,000.The allowance for uncollectible accounts for these factored receivables was P50,000. On December 1, 2021, BTS Company assigned accounts receivable of P3,500,000 as collateralof a P2,000,000, 12% annual interest rate loan from a commercial bank. BTS received the P2,000,000 less 2% finance charge based on the loan. How much is the total loss/expenses related to factoring and assignment of receivablesfor the year 2021? *Anama Company is a dealer of equipment. On January 1, 2021, the entity sold equipment in exchange for a noninterest-bearing note requiring 5 annual payments of P850,000. The first payment was made on December 31, 2021. The market rate for a similar note was 9%. The entity used 2 decimal places for the PV factor. How much is the carrying amount of the note receivable on December 31, 2021?