What is the vat payable? P43,830 P44,280 P46,680 P59,248

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 2PB

Related questions

Question

What is the vat payable?

P43,830

P44,280

P46,680

P59,248

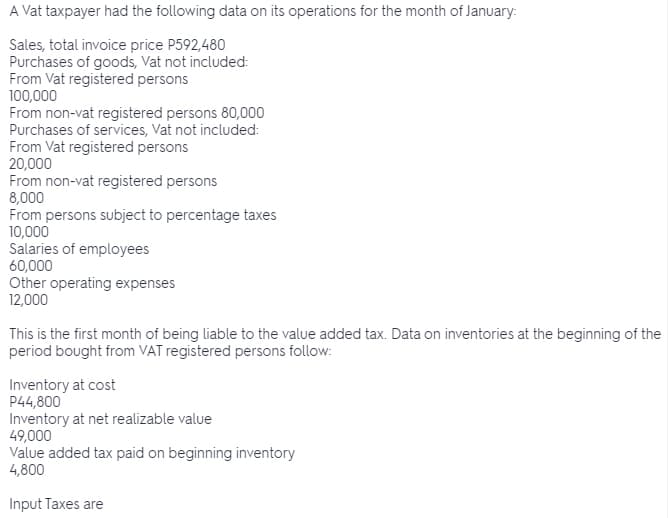

Transcribed Image Text:A Vat taxpayer had the following data on its operations for the month of January:

Sales, total invoice price P592,480

Purchases of goods, Vat not included:

From Vat registered persons

100,000

From non-vat registered persons 80,000

Purchases of services, Vat not included:

From Vat registered persons

20,000

From non-vat registered persons

8,000

From persons subject to percentage taxes

10,000

Salaries of employees

60,000

Other operating expenses

12,000

This is the first month of being liable to the value added tax. Data on inventories at the beginning of the

period bought from VAT registered persons follow:

Inventory at cost

P44,800

Inventory at net realizable value

49,000

Value added tax paid on beginning inventory

4,800

Input Taxes are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College