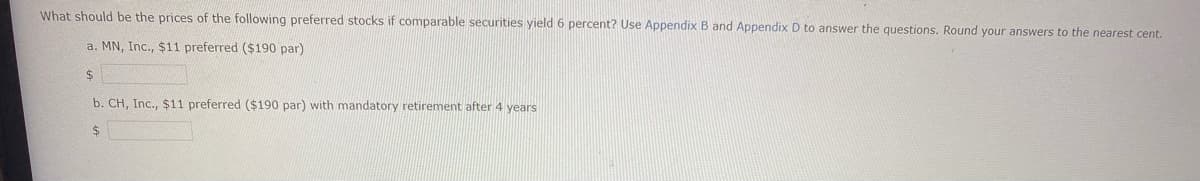

What should be the prices of the following preferred stocks if comparable securities yield 6 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. a. MN, Inc., $11 preferred ($190 par) $ b. CH, Inc., $11 preferred ($190 par) with mandatory retirement after 4 years $

Q: b. What effect would a $10.2 million capital expense have on this year's earnings if the capital is…

A: Information Provided: Tax rate = 25% Capital expenses = $10.2 million Depreciation for five years =…

Q: Could you please provide the solution without using the excel?

A: concept. Formula. 1. F = S * ert where , F= future price. S= spot price r= interest rate t= time…

Q: Lydia purchased a $100,000 150-day T-bill when the prevailing yield on T-bills was 4.5%. She sold…

A: T-Bill: A Treasury Bill (T-Bill) is a short-term obligation of the United States government backed…

Q: the character T followed by the number of minutes until the order expires - why would you have it as…

A: It is limit order. B = Buy 10000 = No. of…

Q: At a certain ratr of compound interest i an investment of 10,000 will grow to 15,000 at the end of…

A: Future Value = Present Value (1 + r)n where r = interest rate n = time period 15,000 = 10,000 * (1 +…

Q: Question 27 Jumbo Airline, a hypothetical company, will purchase 2.5 million gallons of jet fuel…

A: As per the given information: Jet fuel purchased in one month = 2.5 millionSigma subscript F =…

Q: What return do you expect on a portfolio next year that is currently invested 20% in your stock…

A: Expected Portfolio or the overall rate of return of Portfolio is the total return which is generated…

Q: Which of the following is incorrect about the Pecking Order Theory? A.Firms with high ratios of…

A: Several statements have been provided related to the Pecking Order Theory. We have to find the one…

Q: The Boston Globe on New Year's Day 2009 reported that a New Hampshire law will cap the interest rate…

A: a) Payday loans are short term duration loans which are given at high interest rate. These loans are…

Q: Calculate the payback period, the discounted payback period and the NPV for the following project…

A: NPV is the net present value and is the difference between the present value of cash flow and…

Q: Find the commission # Sales Amount 11 12 13 14 $4,000 $8,000 $18,000 $27,500 5% of first $5,000 8%…

A:

Q: Explain how a shareholder can, without knowing the future, diversify away the unsystematic risk of…

A: Unsystematic risk It is the risk that is specific to a company or industry. Unsystematic risk is not…

Q: Proctor and Gamble's total amount of debt increased from 31.9% in March 2011 to 34.2% in December…

A: Bond Issues: A company issues bonds for various purposes. The tenure of the bond, its face value,…

Q: he risk-free rate of return is 1 percent, and the expected return on the market is 8.7 percent.…

A: Shares are valued using a method called the dividend discount model. This model is based on the…

Q: Calculate the monthly payment for a 30 year mortgage of $100,000 at 6% interest. Solve for PMT

A: Mortgages A mortgage is a property that a borrower grants a lender to take in the event of a failure…

Q: use binomial option pricing model for this question. suppose the current spot rate for USD/CHF is…

A: The call option provides the holder the choice to purchase the underlying asset at the given price…

Q: A sports nutrition company is examining whether a new high-performance sports drink should be added…

A: The NPV analysis is conducted to find the profitability of a project. It discounts the future cash…

Q: Consider an amount 25,000 in a fund today, October 25, 2022. Determine its value on the specified…

A: Ordinary interest rate is the method of calculating the interest charged on the loan, based on a 360…

Q: f the following is a loan, identify a) the principal amount, b) the monthly interest rate, and c)…

A: Loans are paid by the equal monthly installments that carry the payment for interest and payment for…

Q: Afamily has a $110,662, 15-year mortgage at 6% compounded monthly (A) Find the monthly payment and…

A: A mortgage is a type of covered loan provided for the purchase or maintenance of the real estate.…

Q: MAT 143 5.5 LAB THE COST OF LIVING IN DIFFERENT PARTS OF THE UNITED STATES The cost of living can…

A: You have specifically asked help in Q 4, 5 and 6. Hence, these questions have been answered. We have…

Q: 2. In the fall of 2022, the Chase Corporation was involved in issuing new common stock at a market…

A: Cost of equity The cost incurred in obtaining equity finance is termed as the cost of equity. The…

Q: A stock that currently sells for $150 has a required return of 11.45% and dividend yield of 3%. What…

A: Select financials about a stock are available. We have to find the expected dividend from the stock.

Q: Cirice Corporation is considering opening a branch in another state. The operating cash flow will be…

A: Given, Operating cash flow is $150400 Tax rate is 21%

Q: Consider an amount of 25,000 in a fund today. October 25, 2022. DETERMINE ITS value on the specified…

A: Future Value = Present Value (1 + r)n where r = periodic interest rate = 3.42% n =time period =…

Q: Mrs. Peacock invests $4757 in a bank account that has an interest rate of 4% for the first 4 months,…

A:

Q: What is the future value in 11 years of $1,000 invested in an account with an APR of 8.9 percent:…

A:

Q: You bout a 5 year bond for a nominal yield of 5% compounded seniannually.The face value of the bond…

A: Face Value of Bond is $10,000 Time PEriod is 5 years Nominal yield of 5% Compounded semi-annually…

Q: Using the formula for the time value of money, if a sum $15,000 is invested for one year at 10%…

A: Future Value refers to the compounded value of a single cash flow received today or multiple cash…

Q: The article highlights an important relationship between the corporate bond yields and the U.S.…

A: Points for consideration: i) Bond's coupon rate is fixed ii) Price of bond fluctuate in secondary…

Q: A firm obtained a floating rate loan at 7% when prime rate is at 6%. Calculate the interest rate the…

A: Prime rate is the rate of interest which is charged by the commercial banks from most trusted…

Q: Robinson's has 45,000 shares of stock outstanding with a par value of $1 per share and a market…

A: The stock split means the company splits its existing number of shares into more shares. The…

Q: Assuming that the bond with the coupon you computed in b.1 were issued today, show to what the…

A: Coupon rate is 4.86% Time to maturity is 10 years Yield to maturity increased by 1% shortly after…

Q: q1- Bunning Warehouse wants to balance the prices for selling 500 trees. Data is in the screenshot.…

A: Total profits refer to the amount remaining with a company after it has paid all its liabilities. It…

Q: Suppose your company needs $15 million to build a new assembly line. Your target debt-equity ratio…

A:

Q: FCOJ, Inc., a prominent consumer products firm, is debating whether or not to convert its all-equity…

A: Given, Number of shares outstanding is 14000 shares EBIT is $77000 Interest is 7%

Q: Define the functions of the Over-The-Counter’s financial market that treasury staff must be aware of…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: Sid's Skins makes a variety of covers for electronic organizers and portable music players. The…

A: Solution:- Profit means the amount of difference between sales revenue and cost. Now, we know, Costs…

Q: According to the liquidity preference hypothesis, which of the following statements is correct? a.…

A: According to liquidity preference theory, investors demand higher return for longer investments as…

Q: When visualising the distribution of a variable using a histogram, if only the right tail has…

A: A distribution's skewness is a measurement of its asymmetry. When a distribution's left and right…

Q: Please answer and explain without using excel. Consider the Mark-to-Market Settlements for 1 gold…

A: concept. 1. F= S * e rt where , F = future price S= spot price r= interest rate t = time period. 2.…

Q: Consider the following information for stocks A, B, and C. The returns on the three stocks are…

A: Capital Asset Pricing Model (CAPM) is used to determine the minimum required rate of return on any…

Q: 1. A stock has a beta of 1.15 and an expected return of 14 percent. A risk-free asset Currently…

A: a. Expected return of a portfolio with 2 assets can be determined with the formula below:Expected…

Q: Suppose a 4-year, 3% annual coupon payment bond has the following sequence of spot rates: Time to…

A: Here, To Find: Price of the bond =?

Q: 15 Mary Robertson sells tires at a large car service center. She earns 10% commission on the first…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve…

Q: Beale Manufacturing Company has a beta of 1, and Foley Industries has a beta of 0.65. The required…

A: Beale Manufacturing Company Beta is 1 Foley Industries beta is 0.65 Market return is 10.5% Risk free…

Q: (2) (B) If A(4) = 1,000 and in = 0.01n, find A(10).

A:

Q: USE THE FORMULA TO CALCULATE THE MONTHLY PAYMENT FOR THE FOLLOWING: ONLY LAST ONE NEEDS TO BE…

A: Solved only 4th question as asked above Monthly Payment = P * r * [(1+ r)n/({1 + r}n -1)] Where, P…

Q: Stephanie Carter has been gifted a sum of $50,000 by her grandparents on completing her graduation…

A: Intrinsic value of each share with constant growth in dividend With Current dividend (D), Constant…

Q: Consider a 10 year, 1000 par value bond with 5% annual coupons. Find the value of the bond, if yield…

A: Given, The Par value is 1000 Annual coupon rate is 5% Yield rate is 7.2%

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. a. MN, Inc., $7 preferred ($200 par) b. CH, Inc., $7 preferred ($200 par) with mandatory retirement after 20 yearsWhat should be the prices of the following preferred stocks if comparable securities yield 4 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. MN, Inc., $8 preferred ($120 par) $ CH, Inc., $8 preferred ($120 par) with mandatory retirement after 7 years $ What should be the prices of the following preferred stocks if comparable securities yield 8 percent? Round your answers to the nearest cent. MN, Inc., $8 preferred ($120 par) $ CH, Inc., $8 preferred ($120 par) with mandatory retirement after 7 years $ In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to -Select-fallriseItem 5 . In which case was the price more volatile? While the prices of both preferred stocks -Select-declinedincreasedItem 6 , the price of the -Select-perpetual preferred stockstock with mandatory retirementItem 7 was more volatile.What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? MN, Inc., $8 preferred ($100 par) Ch, Inc., $8 preferred ($100 par) with mandatory retirement after 20 years.

- What should be the prices of the following preferred stocks if comparable securities yield 10 percent? Use Appendix B and Appendix D to answer the questions. Round your answers to the nearest cent. MN, Inc., $5 preferred ($110 par) $ CH, Inc., $5 preferred ($110 par) with mandatory retirement after 4 years $ What should be the prices of the following preferred stocks if comparable securities yield 12 percent? Round your answers to the nearest cent. MN, Inc., $5 preferred ($110 par) $ CH, Inc., $5 preferred ($110 par) with mandatory retirement after 4 years $ In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to (fall or rise)? In which case was the price more volatile? While the prices of both preferred stocks (declinedor increased) , the price of the (perpetual or preferred stock ) stock with mandatory retirementItem 7 was more volatile.what should be the prices of the following prefered stocks if comparable securities yield 7 percent? why are the valuation different. a.mn, inc., $8 preferred ($100par). b. CH, Inc., $8 preferred with madatory retirement after 20 years.What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? MN, Inc., $8 preferred ($100 par) Ch, Inc., $8 preferred ($100 par) with mandatory retirement after 20 years.(Please no answers in excel, i dont understand that yet)

- What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? MN, Inc., $8 preferred ($100 par) Ch, Inc., $8 preferred ($100 par) with mandatory retirement after 20 years. (BOLD IS PREVIOUS PROBLEM) Repeat the previous problem but assume that the comparable yields are 10 percent. In which case did the price of the stock change? In which case was the price more volatile?{What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? MN, Inc., $8 preferred ($100 par) Ch, Inc., $8 preferred ($100 par) with mandatory retirement after 20 years.} Question i need help with follows Repeat the previous problem but assume that the comparable yields are 10 percent. In which case did the price of the stock change? In which case was the price more volatile?please dont answer in excel, i dont understand that yet, equations or worded answers please, thanks) What should be the prices of the following preferred stocks if comparable securities yield 7 percent? Why are the valuations different? MN, Inc., $8 preferred ($100 par) Ch, Inc., $8 preferred ($100 par) with mandatory retirement after 20 years.

- Two shares X and Y are currently trading for $100 and $50. They are expected to pay dividends of $1 and $0.5 respectively for the next year. The expectations about the price of those two securities for three possible scenarios are summarized below. The market’s standard deviation is 0.10 and correlation between market and share X is 0.5 and correlation between market and share Y is 0.10. Scenarios Prices of share X Prices of share Y Probability Pessimistic $79 $45.5 0.2 Most likely $104 $54.5 0.5 Optimistic $124 $59.5 0.3 Find the expected return and standard deviation of a portfolio consisting of 30% invested in share X and 70% invested in share Y. Find the beta coefficient of the portfolioThe following common stocks are available for investment: COMMON STOCK (Ticker Symbol) BETA Nanyang Business Systems (NBS) 1.40 Yunnan Garden Supply, Inc. (YUWHO) 0.80 Bird Nest Soups Company (SLURP) 0.60 Wacho.com! (WACHO) 1.80 Park City Cola Company (BURP) 1.05 Oldies Records, Ltd. (SHABOOM) 0.90 A; If you invest 20 percent of your funds in each of the first three securities, and 15 percent in each of the last two, what is the beta of your portfolio? B; If the risk-free rate is 8 percent and the expected return on the market portfolio is 14 percent, what will be the portfolio’s expected return?You own a stock portíolio invested 19 percent in Stock Q, 21 percent in Stock R, 39 percent in Stock S, and 21 percent in Stock T. The betas for these four stocks are .91, .97, 1.37, and 1.82, respectively. What is the portfolio beta? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16 .)