What will be the Total income a. 206200 b. All the options are wrong c. 233300 d.

Q: The following figure illustrates the FW of two alternatives A and B with respect to different…

A: IRR is discount rate at which present value of cash flow equal to initial investment that means net…

Q: 1._____________ is the rate at which the net present value becomes zero. a. None of the options b.…

A: EXPLANATION:- Internal rate of return (IRR) is a way of measuring the value of return on the…

Q: Which of the following is correct? Assets, Liabilities, Capital, a. P7,850, P1,250, P6,600 b.…

A: Assets = Liabilities + Capital

Q: What is Project A’s modified internal rate of return (MIRR)? Use 5 decimal places for the factors…

A: Modified internal rate of return is the rate at which the value of latest cash inflow is equal to…

Q: Use the compound interest formula A = P(1 + r)' and the given information to solve for t. 201 A=…

A: To calculate the value of T we will use the below formula A = P*(1+r)T Where A - Accumulated…

Q: Suppose that we can describe the world using two states and that two assets are available, asset K…

A: Arbitrage: The arbitrage process reduces risk by purchasing and selling different securities in a…

Q: ii) Equity A has a higher standard deviation than equity B, but a lower CAPM-beta. Explain, in no…

A: Risk: Risk is the possibility that the actual return will be different from the expected return. The…

Q: Compute each investment’s Internal Rate of Return (IRR). v. Which investment should Mr. Dates…

A: Here, To Find: Part 1. Internal Rate of Return (IRR) =?Part 2. Decision to accept and why =? Part…

Q: Cost of the capital is the minimum required rate of earnings or the cut-off rate of capital…

A: According to Ezra Solomon, 'the cost of capital is the minimum required rate of earnings or the…

Q: What is EE Taxable Wages FUTA in quater 3? Emloyee Q1 Q2 Q3 Q4 EE 3500 3500 3200 3200

A: FUTA is an abbreviation for Federal Unemployment Tax Act. FUTA Tax is a United States federal tax…

Q: O a. 49000 O b. All the options wrong O c. 60700 O d. 31000 O e. 48000 What will be the cost of…

A: The cost of goods sold is a very important calculation in the area of cost accounting. It includes…

Q: : (b) Write a detailed note on Minimum Attractive Rate of Return.

A: The minimum attractive rate of return (MARR) is the affordable rate of return utilized in the choice…

Q: Which of the following investments does a rational investor prefer? a. Investment A: E(R) = 12%, σ…

A: Introduction: Usually, the expected return is the average return that is measured arithmetically…

Q: ling price is $3 per unit. O a. 59,895 O b. None of the given answers Oc. 176,650 o d. 116,755 O e.…

A: Option A is the Correct Answer.

Q: Please fill out the table below. Use your estimates from the table to answer the multiple-choice…

A: Calculations are done using excel. Note, answer closest to the calculation are chosen from the…

Q: Determining Missing Items in Return Computation One item is omitted from each of the following…

A: Return on investment indicates the profit earned by the business entity on its investment.

Q: Exhibit 6.2 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset (A) Asset (B) E(RA)…

A: CAPM stands for Capital Asset Pricing Model which indicates the relation between the expected…

Q: Q3. Explain the following A) Measure of historical returns (Single Asset) B) Measure of historical…

A: Return= Total gain/loss on an asset over a given period of time.

Q: Which of the following is not an investment grade rating? Question 10 options: BBB+/Baa3…

A: Credit Rating refers act of providing symbolic figures to different financial assets after analysis…

Q: believes the IRR is the best selection criterion, while the CFO advocates the MI with the higher…

A: Compute the IRR in the following manner:- The result will be as follows:- The IRR of Project is…

Q: Use the compound interest formula A=P(1+r)^t and the given information to solve for r.…

A: We need to use compound interest formula to sove this problem A=P(1+r)t Where P=principal r=rate of…

Q: A firm has three investment alternatives. Payoffs are in thousands of dollars. a. Using the expected…

A: The decision based on the expected value approach is based on the sum of cash flows for a particular…

Q: Alternative K the preferred alternative? [A] 0%<=MARR<=8.144169% [B] 4.2775% <=MARR<=8.144169% [C]…

A: The MARR is minimum attractive rate of return that project must earn to satisfy the investors and to…

Q: On what information return is the employment income of an individual reported? Question 10…

A: Answer: Employment income and other income are to be reported in the return.

Q: The time value of money indicates that Select one: O a. the money obtained today is worth less than…

A: An individual prefers to receive money as early as possible in order to earn a return by investing…

Q: 3. Which of the following alternatives represents the correct return on equity ratio for year 2021?…

A: A measure of a company's profitability is return on equity (ROE), sometimes known as return on…

Q: How do you solve the Annual Worth (AW) of A & B manually? without using excel

A: To solve the annual worth of the investment by the manually requires very much calculations and the…

Q: which one is correct please confirm? Q19: "An increase in the exercise price, all other things…

A: Option premium of Call = Market Price - Excercise Price

Q: Determine the best Alternative, if data are PROFIT Decertaine the course in diagram. Alucrative 4/₂…

A: We are provided here with a decision tree. In finance we often make use of decision trees to find…

Q: a. Do the evaluation based on Future worth (FW) method b. Do the evaluation based on Annual worth…

A: “Since you have posted a question with multiple subparts, we will solve first three subparts for…

Q: What will be the Net purchases ? O a. 220000 O b. 324000 O c. All the options are wrong O d. 205000…

A: Net purchases = Purchases - Purchase returns

Q: A net present worth equation is used to solve for a ROR by setting the net present worth equation…

A: ROR or rate of return of project also known as internal rate of return of project is the interest…

Q: What is a box spread in terms of the necessary option position, cost, payoff, maximum profit, and…

A: A box spread is basically an options arbitrage system that includes the purchase of a bull call…

Q: The future value interest factor is calculated as: Select one: O a. None of the other options are…

A: Future value: Dollar earned today is greater than dollar earned tomorrow. So, money in hand today…

Q: What will be the total office expense? O a. 48500 O b. 47800 O. All the options are wrong O d. 26700

A: Total office expenses are the indirect expenses that helps to produce product Calculations are…

Q: In the following situation, assume there are only two possible states in future and the prices of…

A: The question is based on the concept of business transactions analysis.

Q: ) Finance Which one is a financial risk? Select one: a. Uncertainty about demand b. uncertainty…

A: Meaning of Financial risk is diffrent for different category of person. In case of individual who is…

Q: What is net income ? 251+113 =364 or only 251 ?????

A: Net income (NI), also called net earnings

Q: a. The present worth of this alternative has a negative value at MARR = 15% O b. The IRR of this…

A: The present worth of investment is inversely related to MARR and if more is value of MARR less is…

Q: use attachment to answer questions This question relates to Diagram 1 from the 9.4 diagrams, which…

A: Explanation : From the diagram 9.1, we can see that that market return will be 15%. The beta of the…

Q: Estimating the SML Equation 13.2 ;=17 = Yo + Y1 * b; i = 1,... 100 CAPM is valid, then yo and y,…

A: This question is based on the CAPM Regression equation which shows the relationship between the…

Q: purc nvestment, which am ptions is best to tak purchase of Php1,00C Which is the worst? E

A: Best option would be that option which is having less cost of finance and worst will be having more…

Q: se the compound interest formula A = P(1 + r)" and the given information to solve for r. A = $2200,…

A: We need to use compound interest formula given below A = P(1 + r)" where A=Amount or Final payment…

Q: 3.15) The table below shows the rate of return on plans (A, B, C, D) and he rate of return on…

A: Project selection is an important concept of capital budgeting. The project selection depends on…

Q: The 4 mutually exclusive alternatives shown below are compared by the incremental B/C method. What…

A: Incremental B/C ratio refers to the Incremental Benefit-Cost Ratio.

Q: 48) Find out the monetary asset from the following. a. Fixed Liabilities b. Current Liabilities c.…

A: Monetary assets are those assets which can be easily converted into cash.

Q: Find the requested value (to the nearest dollar)

A: Annuity is the investment of fixed sum over a fixed interval of time, for a specified period. Future…

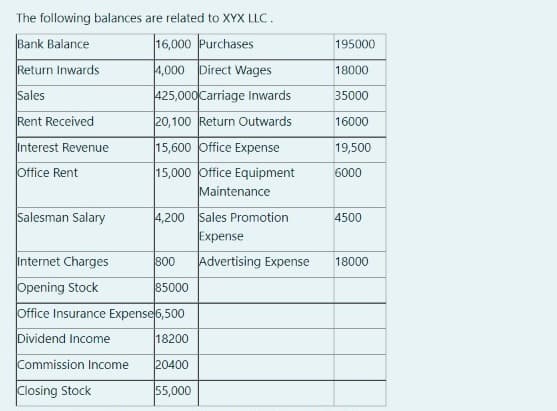

What will be the Total income

206200

All the options are wrong

233300

215200

223200

Step by step

Solved in 2 steps with 1 images

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Assume that an organization asserts that it has $35 million in net accounts receivable. Describe specifically what management is asserting with respect to net accounts receivable.To demonstrate the difference between cash account activity and accrual basis profits (net income), note the amount each transaction affects cash and the amount each transaction affects net income. A. paid balance due for accounts payable $6,900 B. charged clients for legal services provided $5,200 C. purchased supplies on account $1,750 D. collected legal service fees from clients for current month $3,700 E. issued stock in exchange for a note payable $10,000

- Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?What accounting method (cash or accrual) would you recommend for the following businesses? a. A gift shop with average annual gross receipts of 900,000. b. An accounting partnership with average annual gross receipts of 12 million. c. A drywall subcontractor who works on residences and has annual gross receipts of 3 million. d. An incorporated insurance agency with average annual gross receipts of 28 million. e. A sole proprietor operating a retail clothing store with average annual gross receipts of 12 million. f. A sole proprietor operating a widget manufacturing plant with average annual gross receipts of 27 million.Provide journal entries to record each of the following transactions. For each, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). A. Paid $22,000 cash on bonds payable. B. Collected $12,600 cash for a note receivable. C. Declared a dividend to shareholders for $16,000, to be paid in the future. D. Paid $26,500 to suppliers for purchases on account. E. Purchased treasury stock for $18,000 cash.

- The following balances are related to XYX LLC . Bank Balance 16,000 Purchases 195000 Return Inwards 4,000 Direct Wages 18000 Sales 425,000 Carriage Inwards 35000 Rent Received 20,100 Return Outwards 16000 Interest Revenue 15,600 Office Expense 19,500 Office Rent 15,000 Office Equipment Maintenance 6000 Salesman Salary 4,200 Sales Promotion Expense 4500 Internet Charges 800 Advertising Expense 18000 Opening Stock 85000 Office Insurance Expense 6,500 Dividend Income 18200 Commission Income 20400 Closing Stock 55,000 1- What will be the total Selling and distribution expense? 2- What will be the Total income 3- What will be the total office expense?Uptodate Projects Ltd has approached you to analyse and interpret their financial statements. The following amounts were extracted from the records of the company: 2019 2020 2021 R R R Turnover 200 000 220 000 250 000 Cost of sales 140 000 150 000 165 000 Profit before interest and tax 12 000 11 000 10 500 Accounts receivable 16 500 25 000 29 600 Accounts payable 13 000 14 700 17 000 Inventory 18 750 26 000 30 400 Bank/ (Overdraft) Required: 4 000 (1000) (2 000) Explain the purpose of financial statement Calculate each of the following ratios for each of the three (3) years: Accounts receivable collection period Inventory holding period Accounts payable payment period Current ratio Acid test ratio Comment on the company’s working capital management in light of the analysis undertaken in aboveWayne Rogers Corp. maintains its financial records on the cash basis of accounting. Interested in securing a long-term loan from its regular bank, Wayne Rogers Corp. requests you as its independent CPA to convert its cash-basis income statement data to the accrual basis. You are provided with the following summarized data covering 2019, 2020, and 2021. 2019 2020 2021 Cash receipts from sales: On 2019 sales $295,000 $160,000 $ 30,000 On 2020 sales –0– 355,000 90,000 On 2021 sales 408,000 Cash payments for expenses: On 2019 expenses 185,000 67,000 25,000 On 2020 expenses 40,000a 160,000 55,000 On 2021 expenses 45,000b 218,000 a Prepayments of 2020 expenses. b Prepayments of 2021 expenses. Instructions a. Using the data above, prepare abbreviated income statements for the years 2019 and 2020 on the cash basis. b. Using the data above, prepare abbreviated income statements for the years 2019…

- PROBLEM 1BABY Corporation provided the following information:Balance per book, August 31 P2,000,000Receipts per book for August 4,400,000Disbursements per book for August 3,600,000Balance per bank, August 31 1,860,000Bank receipts for August 5,000,000Bank disbursements for August 3,940,000August collection of P200,000 recorded by the entity as 20,000August check in payment of account payable for P600,000 recorded by the entity as 60,000Deposit of BABE Corporation erroneously credited by bank to BABY Corporation 200,000August check of BABE Corporation erroneously charged by bank to BABY Corporation 400,000NSF Check: July 100,000August 50,000Note collected by bank for BABY Corporation: July 200,000August 300,000Deposit in transit: July 31 600,000August 31 480,000Outstanding checks July 31 100,000August 31 650,000 Requirement:Prepare a proof of cash for the month of August.Which of these items belong on the statement of financial position (SOFP)? Debit Credit Buildibgs at cost 740 Buildings,accumulated depreciation 60 Plant at cost 220 Plant,accumulated depreciation 110 Bank balance 70 Revenue 1,800 Purchases…The data below are from the records of Almanor, Inc. on December 31, 2021: Accounts payable net of supplier’s accounts with debit balances P 680,000 Cash balance in ABC Bank 1,240,000 Cash overdraft with XYZ Bank 80,000 Customers’ accounts with credit balances 25,000 Supplier’s accounts with debit balances 65,000 Dividends in arrears on preference shares 400,000 Employees’ income tax payable 100,000 Estimated warranty payable 50,000 Estimated premium claims outstanding 90,000 Income tax payable 320,000 Notes payable issued in 2020 maturing in 20 quarterly installments beginning April 1, 2021 8,000,000 Salaries payable 140,000 Deferred tax liability 80,000 9. The amount to be shown as total current liabilities on Almanor’s statement of financial position at December 31, 2021 is: