What would be the entries for the purchase, evaluation, impairment and sale of the asset

What would be the entries for the purchase, evaluation, impairment and sale of the asset

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 2RP

Related questions

Question

Give me answer within an hour I will give you positive rating immediately its very urgent ........thankyou...

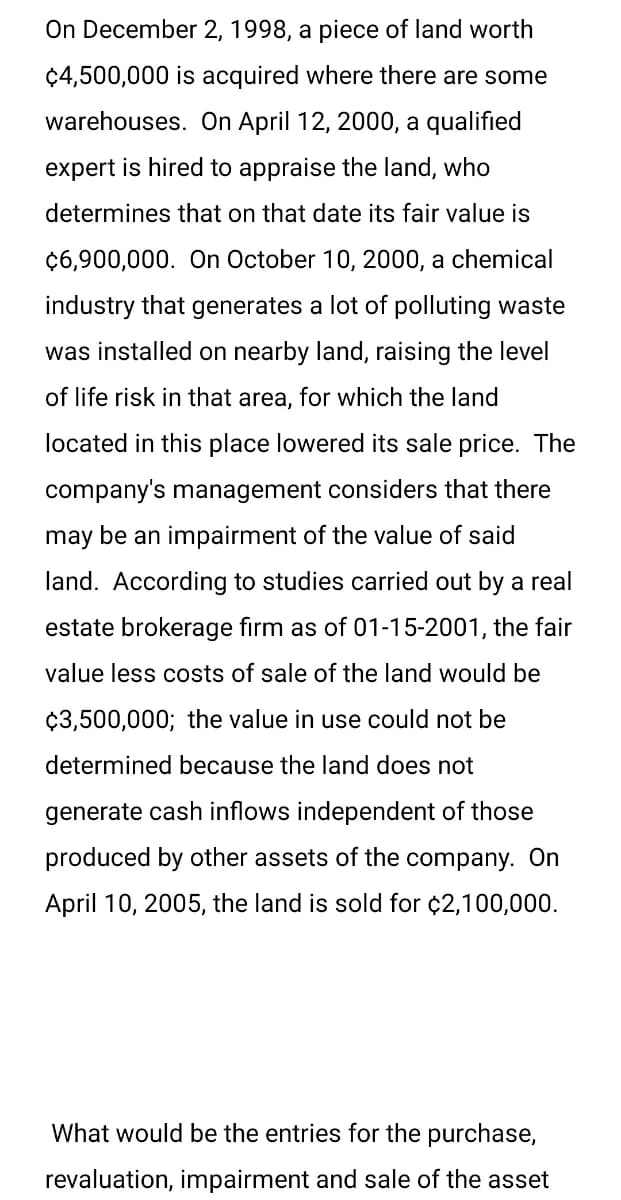

Transcribed Image Text:On December 2, 1998, a piece of land worth

$4,500,000 is acquired where there are some

warehouses. On April 12, 2000, a qualified

expert is hired to appraise the land, who

determines that on that date its fair value is

$6,900,000. On October 10, 2000, a chemical

industry that generates a lot of polluting waste

was installed on nearby land, raising the level

of life risk in that area, for which the land

located in this place lowered its sale price. The

company's management considers that there

may be an impairment of the value of said

land. According to studies carried out by a real

estate brokerage firm as of 01-15-2001, the fair

value less costs of sale of the land would be

$3,500,000; the value in use could not be

determined because the land does not

generate cash inflows independent of those

produced by other assets of the company. On

April 10, 2005, the land is sold for $2,100,000.

What would be the entries for the purchase,

revaluation, impairment and sale of the asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College