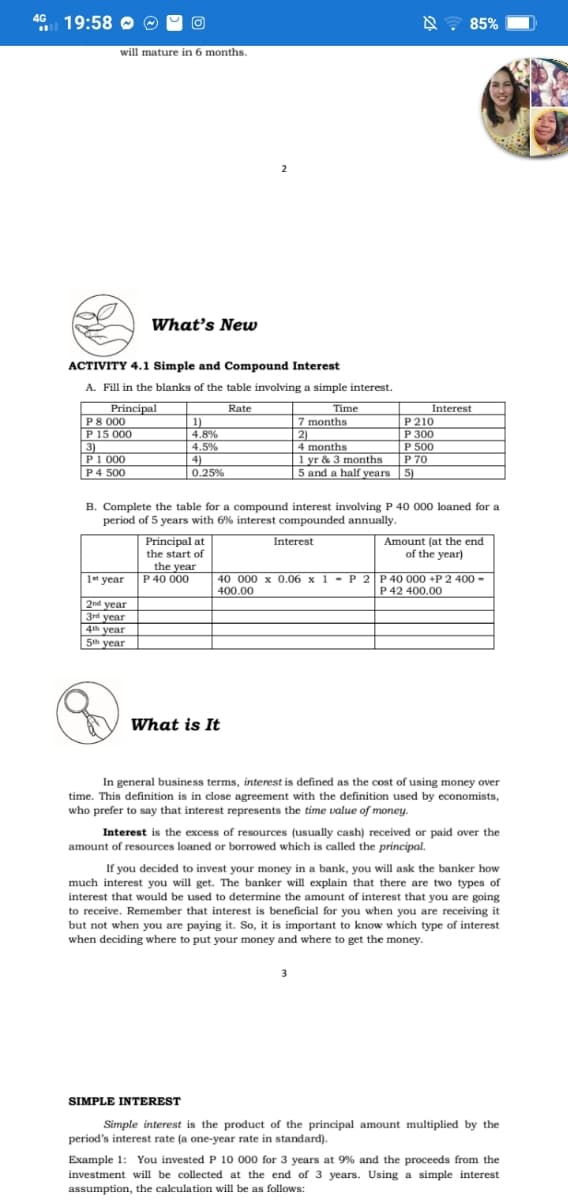

What's New ACTIVITY 4.1 Simple and Compound Interest A. Fill in the blanks of the table involving a simple interest. Principal P8 000 P15 000 3) P1 000 P4 500 Interest Time 7 months 2) 4 months Rate 1) 4.8% P210 P 300 P 500 P 70 5 and a half years 5) 4.5% 1 yr & 3 months 4) 0.25% B. Complete the table for a compound interest involving P 40 000 loaned for a period of 5 years with 6% interest compounded annually. Principal at the start of the year P 40 000 Interest Amount (at the end of the year) 1 year 40 000 x 0.06 x 1 - P 2 P 40 000 +P 2 400 - 400.00 P 42 400.00 2nd year 3d year 4h year 5 year

What's New ACTIVITY 4.1 Simple and Compound Interest A. Fill in the blanks of the table involving a simple interest. Principal P8 000 P15 000 3) P1 000 P4 500 Interest Time 7 months 2) 4 months Rate 1) 4.8% P210 P 300 P 500 P 70 5 and a half years 5) 4.5% 1 yr & 3 months 4) 0.25% B. Complete the table for a compound interest involving P 40 000 loaned for a period of 5 years with 6% interest compounded annually. Principal at the start of the year P 40 000 Interest Amount (at the end of the year) 1 year 40 000 x 0.06 x 1 - P 2 P 40 000 +P 2 400 - 400.00 P 42 400.00 2nd year 3d year 4h year 5 year

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:4G

19:58 O O

A. 85%

will mature in 6 months.

2

What's New

ACTIVITY 4.1 Simple and Compound Interest

A. Fill in the blanks of the table involving a simple interest.

Principal

P8 000

P 15 000

3)

P1 000

Rate

Time

Interest

7 months

2)

4 months

1 yr & 3 months

5 and a half years 5)

1)

4.8%

P210

P 300

P 500

P 70

4.5%

4)

P4 500

0.25%

B. Complete the table for a compound interest involving P 40 000 loaned for a

period of 5 years with 6% interest compounded annually.

Principal at

the start of

the year

P 40 000

Interest

Amount (at the end

of the year)

1t year

40 000 x 0.06 x 1- P 2 P 40 000 +P 2 400 -

400.00

P 42 400.00

2nd year

3rd year

4th year

5h year

What is It

In general business terms, interest is defined as the cost of using money over

time. This definition is in close agreement with the definition used by economists,

who prefer to say that interest represents the time value of money.

Interest is the excess of resources (usually cash) received or paid over the

amount of resources loaned or borrowed which is called the principal.

If you decided to invest your money in a bank, you will ask the banker how

much interest you will get. The banker will explain that there are two types of

interest that would be used to determine the amount of interest that you are going

to receive. Remember that interest is beneficial for you when you are receiving it

but not when you are paying it. So, it is important to know which type of interest

when deciding where to put your money and where to get the money.

3

SIMPLE INTEREST

Simple interest is the product of the principal amount multiplied by the

period's interest rate (a one-year rate in standard).

Example 1: You invested P 10 000 for 3 years at 9% and the proceeds from the

investment will be collected at the end of 3 years. Using a simple interest

assumption, the calculation will be as follows:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education