whats the answer in question 1?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 47E

Related questions

Question

whats the answer in question 1?

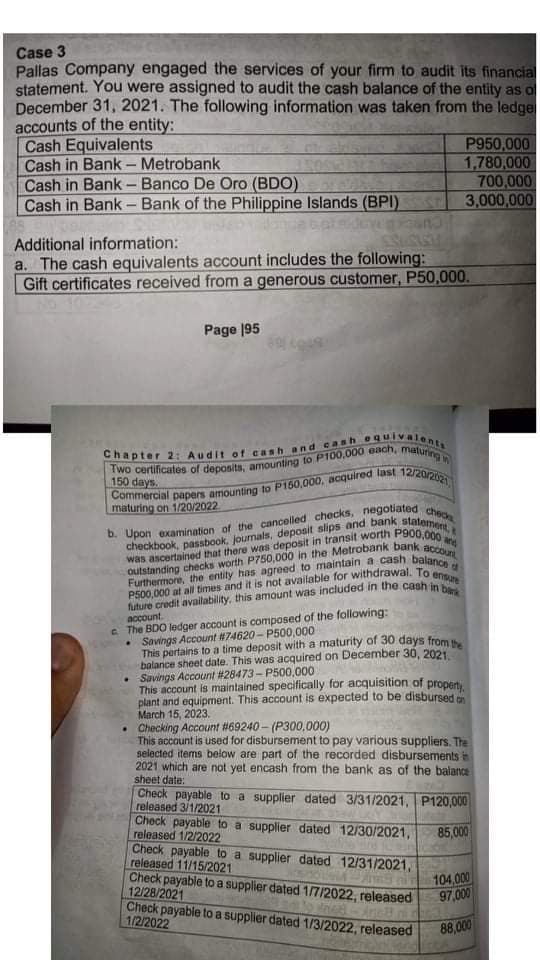

Transcribed Image Text:Case 3

Pallas Company engaged the services of your firm to audit its financial

statement. You were assigned to audit the cash balance of the entity as o

December 31, 2021. The following information was taken from the ledge

accounts of the entity:

Cash Equivalents

Cash in Bank– Metrobank

Cash in Bank- Banco De Oro (BDO)

Cash in Bank- Bank of the Philippine Islands (BPI)

P950,000

1,780,000

700,000

3,000,000

Additional information:

a. The cash equivalents account includes the following:

Gift certificates received from a generous customer, P50,000.

ASASTISS

Page 195

oquivalents

150 days.

maturing on 1/20/2022

future credit availability, this amount was included in the cash in

account.

e The BDO ledger account is composed of the following:

Savings Account #74620 - P500,000

This pertains to a time deposit with a maturity of 30 days from

balance sheet date. This was acquired on December 30, 2021

Savings Account #28473 - P500,000

This account is maintained specifically for acquisition of propen

plant and equipment. This account is expected to be disbursed on

March 15, 2023.

• Checking Account #69240- (P300,000)

This account is used for disbursement to pay various suppliers. The

selected items below are part of the recorded disbursements in

2021 which are not yet encash from the bank as of the baiance

sheet date:

Check payable to a supplier dated 3/31/2021, P120,000

released 3/1/2021

Check payable to a supplier dated 12/30/2021,

released 1/2/2022

Check payable to a supplier dated 12/31/2021,

released 11/15/2021

Check payable to a supplier dated 1/7/2022, released

12/28/2021

Check payable to a supplier dated 1/3/2022, released

1/2/2022

85,000

104,000

97,000

88,000

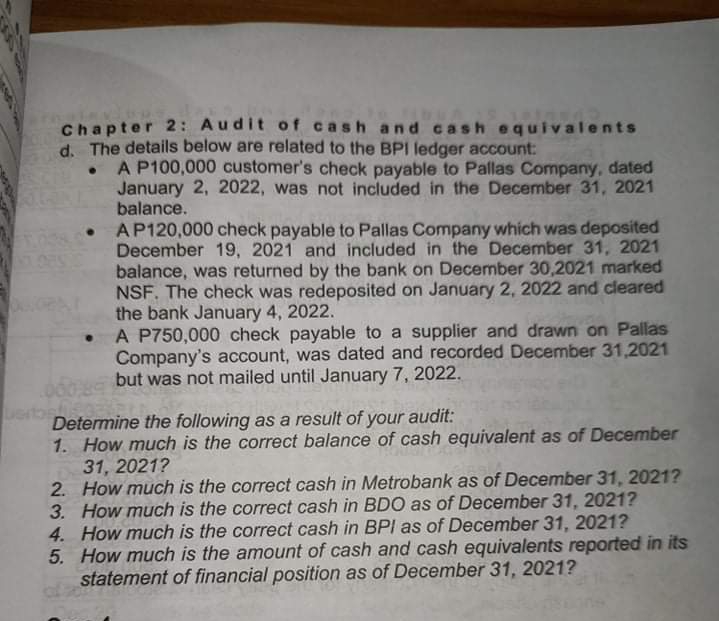

Transcribed Image Text:Chapter 2: Audit of cash and c ash equivalents

d. The details below are related to the BPI ledger account:

A P100,000 customer's check payable to Pallas Company, dated

January 2, 2022, was not included in the December 31, 2021

balance.

AP120,000 check payable to Pallas Company which was deposited

December 19, 2021 and included in the December 31, 2021

balance, was returned by the bank on December 30,2021 marked

NSF. The check was redeposited on January 2, 2022 and cleared

the bank January 4, 2022.

A P750,000 check payable to a supplier and drawn on Pallas

Company's account, was dated and recorded December 31,2021

but was not mailed until January 7, 2022.

Determine the following as a result of your audit:

1. How much is the correct balance of cash equivalent as of December

31, 2021?

2. How much is the correct cash in Metrobank as of December 31, 2021?

3. How much is the correct cash in BD0 as of December 31, 2021?

4. How much is the correct cash in BPI as of December 31, 2021?

5. How much is the amount of cash and cash equivalents reported in its

statement of financial position as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning