ugust the following

Cost-Volume-Profit Analysis

Cost Volume Profit (CVP) analysis is a cost accounting method that analyses the effect of fluctuating cost and volume on the operating profit. Also known as break-even analysis, CVP determines the break-even point for varying volumes of sales and cost structures. This information helps the managers make economic decisions on a short-term basis. CVP analysis is based on many assumptions. Sales price, variable costs, and fixed costs per unit are assumed to be constant. The analysis also assumes that all units produced are sold and costs get impacted due to changes in activities. All costs incurred by the company like administrative, manufacturing, and selling costs are identified as either fixed or variable.

Marginal Costing

Marginal cost is defined as the change in the total cost which takes place when one additional unit of a product is manufactured. The marginal cost is influenced only by the variations which generally occur in the variable costs because the fixed costs remain the same irrespective of the output produced. The concept of marginal cost is used for product pricing when the customers want the lowest possible price for a certain number of orders. There is no accounting entry for marginal cost and it is only used by the management for taking effective decisions.

![(The following information applies to the questions displayed below.]

Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follow

categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space

supplies expense, and advertising expense. It categorizes the remaining expenses as general and administra

Adjusted Account Balances

Merchandise inventory (ending)

Other (non-inventory) assets

Total liabilities

Common stock

Retained earnings

Dividends

Sales

Debit

$ 33,500

134,000

Credit

$38,693

67,029

45,095

8,000

229,140

Sales discounts

Sales returns and allowances

Cost of goods sold

Sales salaries expense

Rent expense-Selling space

Store supplies expense

Advertising expense

Office salaries expense

Rent expense-Office space

Office supplies expense

3,506

15,123

89,129

31,392

10,770

2,750

19,477

28,643

2,750

917

es

Totals

$ 379,957

$ 379,957

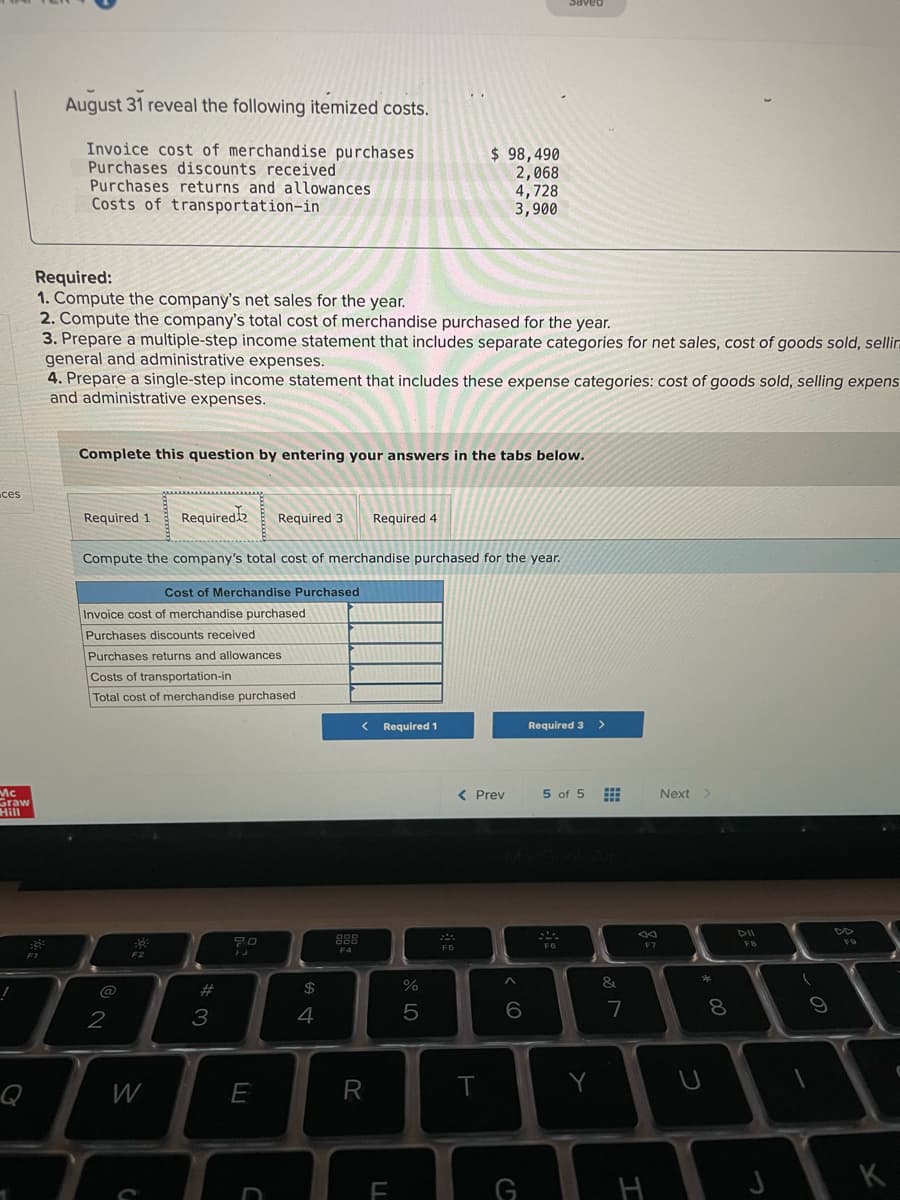

Beginning merchandise inventory was $27,035. Supplementary records of merchandising activities for the year endea

August 31 reveal the following itemized costs.

Invoice cost of merchandise purchases

Purchases discounts received

Purchases returns and allowances

Costs of transportation-in

$ 98,490

2,068

4,728

3,900

Required:

1. Compute the company's net sales for the year.

2. Compute the company's total cost of merchandise purchased for the year.

3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses,

raw

( Prev

5 of 5

Next>

DII

DD

88

F5

F7

F4

@

#

2$

3

4

5

7

8

W

E

T

Y

K

F](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F72072a7e-cb22-4e0a-926e-24ea3c0f3f80%2F50144ebd-b73a-47d0-8400-2910d79811f4%2Fdk3mqul_processed.jpeg&w=3840&q=75)

Net sales are calculated by deducting sales discount, sales returns etc. from gross sales. Similarly net purchases are calculated by decucting purchase discouns and purchase returns from gross purchases. We add transport charges incurred for purchase of material to get total purchase cost .

A multiple income statement is prepared by showing multiple stages of various profits . From sales when we deduct cost of sales we get Gross Profit. From Gross Profit when we deduct operating expenses [expenses incurred to run the main activity of business] we get Operating Profit. Then we deduct financial expenses and add other incomes to get Net Profit before tax. After deducting tax we get Net Profit .

Trending now

This is a popular solution!

Step by step

Solved in 5 steps