Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1cM

Related questions

Question

Please answer both part

a) When would you would use a Personal Loan? Why would you choose a Personal Loan over other methods of Credit?

b) When would you would use a Mortgage? Why would you choose a Mortgage over other methods of Credit

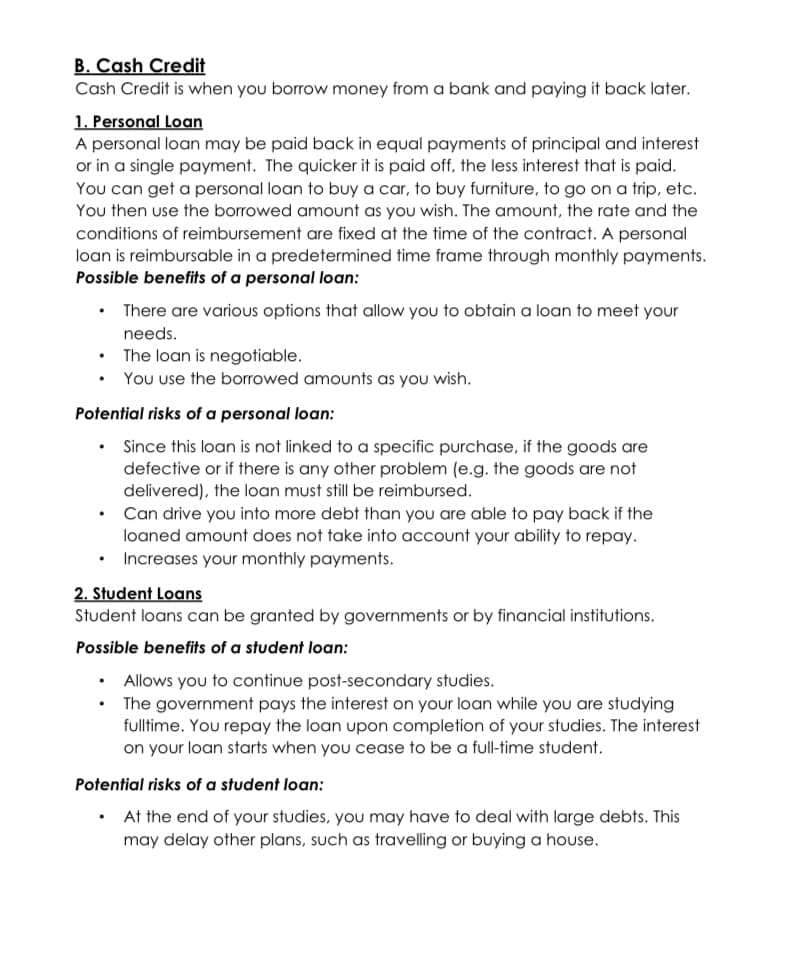

Transcribed Image Text:B. Cash Credit

Cash Credit is when you borrow money from a bank and paying it back later.

1. Personal Loan

A personal loan may be paid back in equal payments of principal and interest

or in a single payment. The quicker it is paid off, the less interest that is paid.

You can get a personal loan to buy a car, to buy furniture, to go on a trip, etc.

You then use the borrowed amount as you wish. The amount, the rate and the

conditions of reimbursement are fixed at the time of the contract. A personal

loan is reimbursable in a predetermined time frame through monthly payments.

Possible benefits of a personal loan:

There are various options that allow you to obtain a loan to meet your

needs.

The loan is negotiable.

You use the borrowed amounts as you wish.

Potential risks of a personal loan:

Since this loan is not linked to a specific purchase, if the goods are

defective or if there is any other problem (e.g. the goods are not

delivered), the loan must still be reimbursed.

Can drive you into more debt than you are able to pay back if the

loaned amount does not take into account your ability to repay.

Increases your monthly payments.

2. Student Loans

Student loans can be granted by governments or by financial institutions.

Possible benefits of a student loan:

Allows you to continue post-secondary studies.

The government pays the interest on your loan while you are studying

fulltime. You repay the loan upon completion of your studies. The interest

on your loan starts when you cease to be a full-time student.

Potential risks of a student loan:

At the end of your studies, you may have

may delay other plans, such as travelling or buying a house.

deal with large debts. This

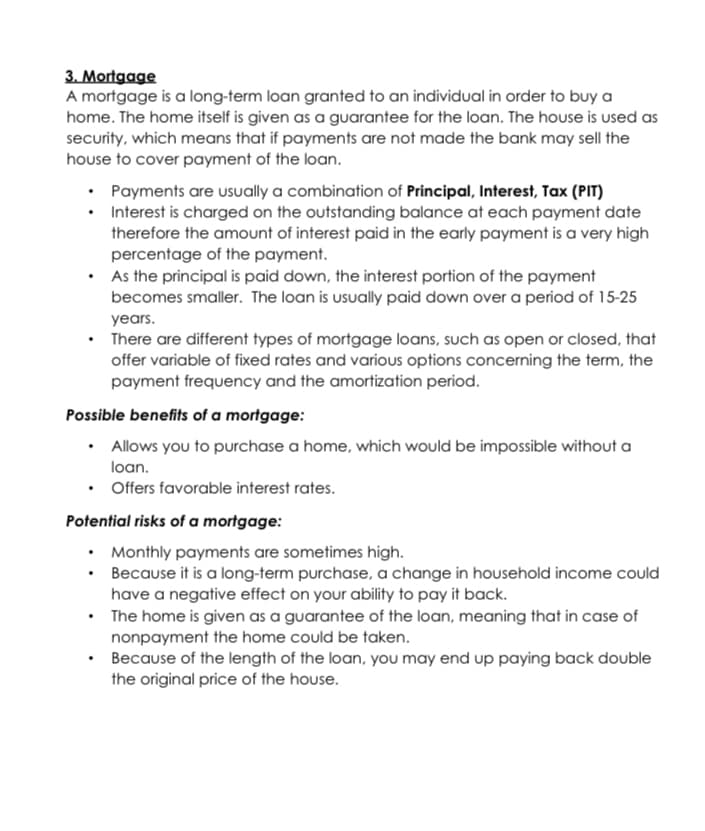

Transcribed Image Text:3. Mortgage

A mortgage is a long-term loan granted to an individual in order to buy a

home. The home itself is given as a guarantee for the loan. The house is used as

security, which means that if payments are not made the bank may sell the

house to cover payment of the loan.

• Payments are Usually a combination of Principal, Interest, Tax (PIT)

• Interest is charged on the outstanding balance at each payment date

therefore the amount of interest paid in the early payment is a very high

percentage of the payment.

• As the principal is paid down, the interest portion of the payment

becomes smaller. The loan is usually paid down over a period of 15-25

years.

• There are different types of mortgage loans, such as open or closed, that

offer variable of fixed rates and various options concerning the term, the

payment frequency and the amortization period.

Possible benefits of a mortgage:

• Allows you to purchase a home, which would be impossible without a

loan.

• Offers favorable interest rates.

Potential risks of a mortgage:

• Monthly payments are sometimes high.

Because it is a long-term purchase, a change in household income could

have a negative effect on your ability to pay it back.

• The home is given as a guarantee of the loan, meaning that in case of

nonpayment the home could be taken.

Because of the length of the loan, you may end up paying back double

the original price of the house.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning