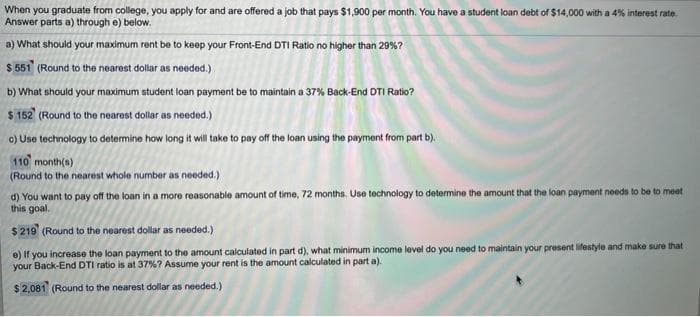

When you graduate from college, you apply for and are offered a job that pays $1,900 per month. You have a student loan debt of $14,000 with a 4% interest rate. Answer parts a) through e) below. a) What should your maximum rent be to keep your Front-End DTI Ratio no higher than 29%? $ 551 (Round to the nearest dollar as needed.) b) What should your maximum student loan payment be to maintain a 37% Back-End DTI Ratio? $ 152 (Round to the nearest dollar as needed.) c) Use technology to determine how long it will take to pay off the loan using the payment from part b). 110 month(s) (Round to the nearest whole number as needed.) d) You want to pay off the loan in a more reasonable amount of time, 72 months. Use technology to determine the amount that the loan payment needs to be to meet this goal. $ 219 (Round to the nearest dollar as needed.) e) If you increase the loan payment to the amount calculated in part d), what minimum income level do you need to maintain your present lifestyle and make sure that your Back-End DTI ratio is at 37%? Assume your rent is the amount calculated in part a). $2,081 (Round to the nearest dollar as needed.)

When you graduate from college, you apply for and are offered a job that pays $1,900 per month. You have a student loan debt of $14,000 with a 4% interest rate. Answer parts a) through e) below. a) What should your maximum rent be to keep your Front-End DTI Ratio no higher than 29%? $ 551 (Round to the nearest dollar as needed.) b) What should your maximum student loan payment be to maintain a 37% Back-End DTI Ratio? $ 152 (Round to the nearest dollar as needed.) c) Use technology to determine how long it will take to pay off the loan using the payment from part b). 110 month(s) (Round to the nearest whole number as needed.) d) You want to pay off the loan in a more reasonable amount of time, 72 months. Use technology to determine the amount that the loan payment needs to be to meet this goal. $ 219 (Round to the nearest dollar as needed.) e) If you increase the loan payment to the amount calculated in part d), what minimum income level do you need to maintain your present lifestyle and make sure that your Back-End DTI ratio is at 37%? Assume your rent is the amount calculated in part a). $2,081 (Round to the nearest dollar as needed.)

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

Transcribed Image Text:When you graduate from college, you apply for and are offered a job that pays $1,900 per month. You have a student loan debt of $14,000 with a 4% interest rate.

Answer parts a) through e) below.

a) What should your maximum rent be to keep your Front-End DTI Ratio no higher than 29%?

$ 551 (Round to the nearest dollar as needed.)

b) What should your maximum student loan payment be to maintain a 37% Back-End DTI Ratio?

$ 152 (Round to the nearest dollar as needed.)

c) Use technology to determine how long it will take to pay off the loan using the payment from part b).

110 month(s)

(Round to the nearest whole number as needed.)

d) You want to pay off the loan in a more reasonable amount of time, 72 months. Use technology to determine the amount that the loan payment needs to be to meet

this goal.

$ 219 (Round to the nearest dollar as needed.)

e) If you increase the loan payment to the amount calculated in part d), what minimum income level do you need to maintain your present lifestyle and make sure that

your Back-End DTI ratio is at 37%? Assume your rent is the amount calculated in part a).

$ 2,081 (Round to the nearest dollar as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,