Which company stock is better to invest and why

Q: Harvest Inc. produces and sells a single product. The selling price of the product is $200.00 per…

A: Formula: Break even units = Fixed cost / Unit contribution margin.

Q: Lynch Company manufactures and sells a single product. The following costs were incurred during the…

A: Income statement is the financial statement prepared for knowing the profitability position of a…

Q: On January 1, 2008, Warren Co. purchased a 600,000 machine, with a five-year useful life and no…

A: The cumulative effect of change in the depreciation method is the difference between retained…

Q: 21. Boussard Company, which uses normal job costing, incurred the following costs last period di (A…

A: Job costing is a method of costing. In this type of costing we keep track of the revenue and…

Q: Required information [The following information applies to the questions displayed below.] On June…

A: Answer:- Stock split definition:- When a corporation splits its stock, it raises the number of…

Q: The following dists from the just completed year are taken from the accounting records of Mason…

A: Cost of goods manufactured - Total Manufacturing Cost = Direct Material + Direct Labour + Factory…

Q: 7. If cash dividend of P20,000 is declared, how much will be paid to preferred stockholders if…

A: Given in the question: Cash Dividend Declared = P20,000 Number of preference shares issued = 2,000…

Q: bts being written off on the individual customer account but not included in the nominal ledger. You…

A: Ethics:

Q: The following information relates to Marshall Manufacturing's current accounting period: $ 16,400…

A: Introduction: Net income is the total profit earned by the organization during the period. At the…

Q: Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventories Other Total…

A: Formula: Average Total Assets = ( 20x1 assets value + 20x2 assets value ) / 2

Q: Following is the chart of accounts of the C. Gervais Clinic: Assets Revenue 111 Cash 411…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Moyment Condition An employee taking annual Does it meet the award or National Employment Standard's…

A: National Employment Standard Minimum requirements: This is the system of employment standard minimum…

Q: Alliance Manufacturing Ltd manufactures three products; A, B and C. The following information is…

A: The marginal costs of producing one additional unit of output. The idea is used to determine a…

Q: Liabilities and Stockholder's Equity Accounts payable $30,000 Bonds payable 42,500 Common stock…

A: Cash flow statement shows the amount of cash inflows and outflows during the period.

Q: 9. En Vogue Boutique sells blouses for $26.21. If the cost per blouse is $11.21, what is the amount…

A:

Q: On Jan 1 Glamazon issues 10,000 common shares for $75 and 3,000 preferred shares for $85 with…

A: Contribution surplus refers to the amount of capital that is above the par value of shares,…

Q: Salt Corporation's contribution margin ratio is 75% and its fixed monthly expenses are $55,000.…

A: Introduction: Fixed cost: fixed costs are fixed in nature. It does not varies according to the…

Q: Use the Corporate Income Tax information above to answer this question. A corporation has a taxable…

A: Introduction: Cities, counties, school districts, and other municipalities may levy a local income…

Q: The following data were gathered to use in reconciling the bank account of Conway Company: Balance…

A: The back reconciliation is a statement that outlines the reason for the difference in bank balance…

Q: Crane Company i

A: Bonds are priced by discounting future cash flows. Future cash flows include coupons and par value…

Q: Question; Use a calculator to determine the exact sale price of the speakers in #1 The speakers cost…

A: Given cost of speakers is $59.89 Given that speakers are on sale for 15% off

Q: Harvest Inc. produces and sells a single product. The selling price of the product is $200.00 per…

A: Formula used: Break even in units = Fixed cost / Unit contribution margin

Q: Given that the current ratio is 2:1 and the assets and liabilities are $20,000 and $10,000…

A: The ratio analysis helps to analyse the financial statements of the business. The current ratio is…

Q: In 2010, Stephan formed a calendar-year C-corporation. In 2017, Stephan realized that his interests…

A: Capital Gain- Capital gains are the increases in the value of an asset or investment over time.

Q: Using the direct write-off method of accounting for uncollectible receivables. Transactions: April 1…

A: Journal entries is the very basic step which reports the events that occur during the course of…

Q: T

A: Branch Reciprocal Accounts: When the transactions of business are recorded by both head office and…

Q: Last year, Toby's Hats had net sales of $45,000,000 and cost of goods sold of $29,000,000. Toby's…

A: Introduction: Accounts receivable turnover ratio : Division of Average Accounts receivable with Net…

Q: The Trial Balance of WTF Company as follows. UNADJUSTED ADJUSTED Account Receivable 2,200 3,200…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Required 1 Required 2 Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the…

A: The direct costs incurred are debited to work in process and indirect costs are debited to…

Q: 4. a) Explain why Customs (Amendment) Act 2018 and Free Zones (Amendment) Act 2018 was introduced by…

A: a. The Act was amended to reflect modifications to a number of aspects of the Act, including, among…

Q: Employment Condition

A: 1.ANNUL LEAVE: the national employment standards provide 4 weeks paid annual leave for each year of…

Q: Accounts Payable Dr. i 8000 12000 Mi Supplies Dr. i 160 120 i Inventory Cr. 245 1200 Cash Cr. 7840…

A: Here asked for multi sub part question we will solve first sub part question for you. If you need…

Q: What is the amount of total credits for this trial balance?

A: TRIAL BALANCE IS A REPORT THAT LIST THE BALANCES OF ALL GENERAL LEDGER ACCCOUNTS OF AN ENTITY AT A…

Q: A company reports the following: Net income Preferred dividends Shares of common stock outstanding…

A: Formula used: Earnings per share = ( Net income - Preferred dividends ) / Total common stock…

Q: (a) Direct material cost=90,000 (b) Direct labour is =50,000 (c) Factory overhead=85,000 (d)…

A: Cost of goods sold: =Cost of the production + opening stock - closing stock

Q: Time Remaining 02:28 55 □ Close All P Blag for Review Pillar Co has developed a new product called…

A: For the bluebell candle product following information I provided: The company spends $20000 on an…

Q: The following items appear on the balance sheet of a company with a one-year operating cycle.…

A: Current liabilities are those liabilities which are likely to pay with the operating cycle of the…

Q: As during eighth year, Clark Company spent $2,400,000 on equipment for its own use. The project took…

A: Introduction: GAAP is a collection of standardized processes and principles released by the…

Q: These are selected account balances on December 31, 2021 Land (location of the corporation's office…

A: Property , Plant and Equipment means tangible assets , which are held for use in production of goods…

Q: For its most recent year a company had Sales (all on credit) of P830,000 and Cost of Goods Sold of…

A: Average inventory = (Beginning value + ending value) / 2 Accounts Receivable Turnover = Net credit…

Q: ACME Corp’s balance sheet reported that it had $650,000 in liabilities and $275,000 in equity. On…

A: Return on Assets: Return on assets (ROA), also known as return on total assets, is a measurement of…

Q: Calculating the Return on Sales The income statement, statement of retained earnings, and balance…

A: Return on sales = (Earning before interest and taxes / net sales) *100 Earning before internet and…

Q: a) Danny had a taxable income of $126,500. How much federal income tax should he report? (assuming…

A: The federal tax means the amount of tax paid by the taxpayer on his taxable income. The tax on…

Q: Price per unit: $10 Variable cost per unit: $7 . Fixed costs: $1,500 Given these data, compute the…

A: Introduction: Break even units: Division of Unit contribution margin with Fixed cost derives the…

Q: Market value per share is: Multiple Choice The right of common stockholders to protect their…

A: The right of common stockholders to protect their proportionate interests in a corporation by…

Q: a. Depreciation on the company's equipment for the year is computed to be $16,000. b. The Prepaid…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: View Policies Current Attempt in Progress On July 1, 2022, Blossom Co. pays $12.000 to Nash's…

A: A record is typically kept in the general ledger, but it can also be kept in a separate account,…

Q: Aram's taxable income before considering capital gains and losses is $82,000 Determine Aram's…

A: +/- Particulars Amount (in $) + Taxable income before capital gains and losses 82000 + Capital…

Q: Anthoney Inc's trial balance contains the following balances: Cash $535 Accounts Receivable $278…

A: We are given the trial balance of Anthony Inc. Let us group the items of the trial balance according…

Q: What is the tax rate expressed as a percent, per $100, per $1,000, and in mills?

A: Tax amount is required by every government so that the government can run the states smoothly as it…

Step by step

Solved in 2 steps

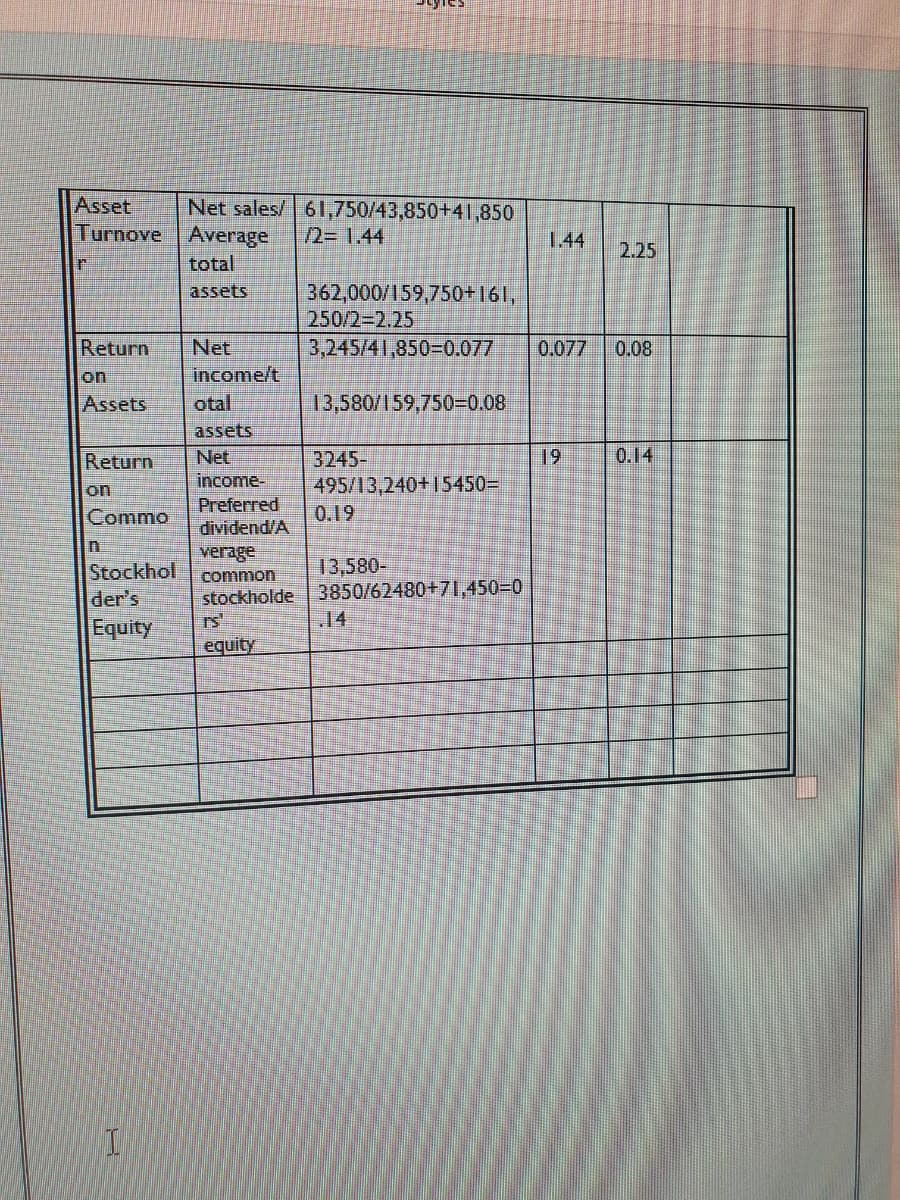

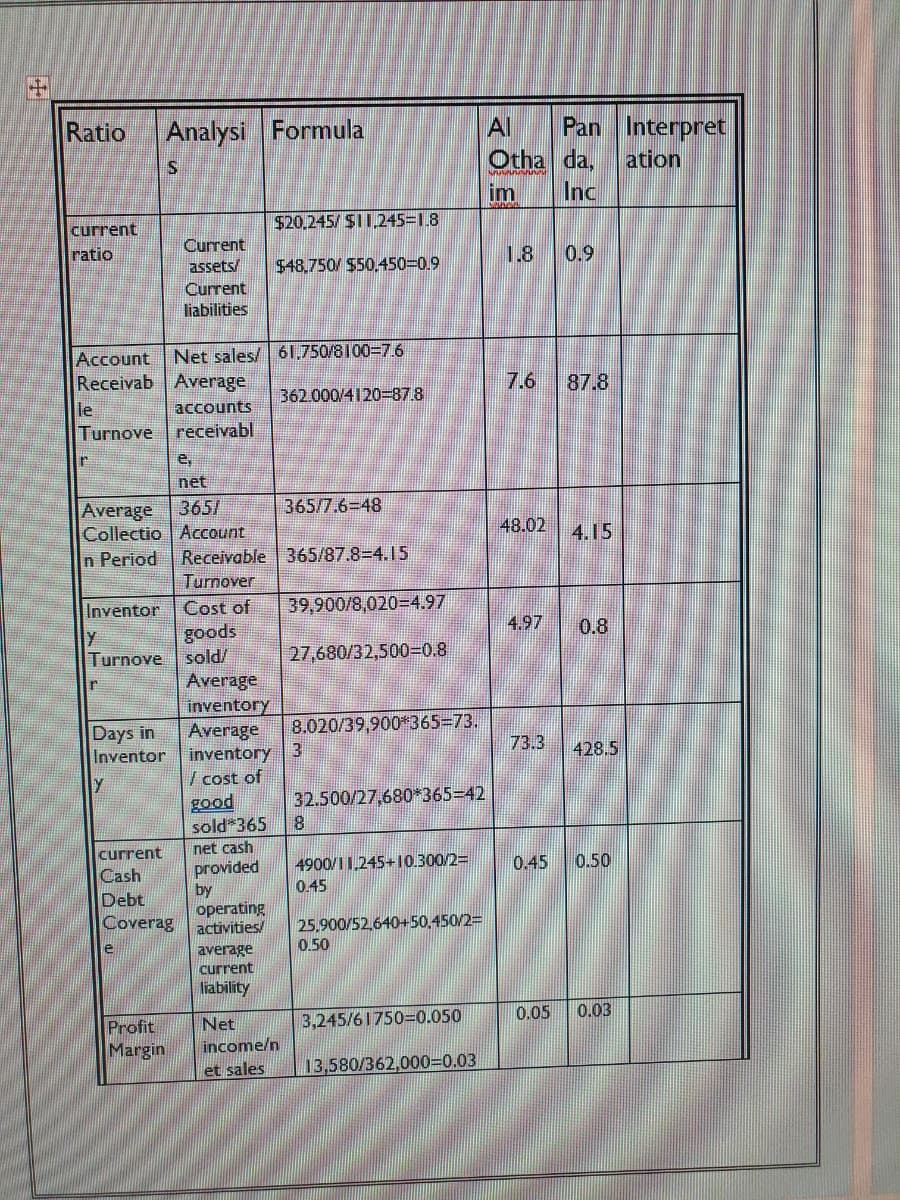

- Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).)How do you calculate the TTM? Particulars 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 TTM Sales ₱ 32,067.00 ₱ 35,422.00 ₱ 70,881.00 ₱ 95,519.00 ₱ 122,128.00 ₱ 165,654.00 ₱ 188,793.00 ₱ 232,834.00 ₱ 263,159.00 ₱ 273,046.00 ₱ 269,693.00 ₱ 294,619.00Computing and analyzing trend percents LO P1 2021 2020 2019 2018 2017 Sales $ 446,122 $ 293,501 $ 242,563 $ 173,880 $ 128,800 Cost of goods sold 221,100 145,365 122,206 87,101 63,112 Accounts receivable 21,592 17,140 16,664 10,137 8,784 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable.

- Selected comparative statement data for Oriole Company are presented below. All balance sheet data are as of December 31. 20222021Net sales$1,165,000 $1,125,000Cost of goods sold705,000 645,000Interest expense20,000 15,000Net income154,945 145,000Accounts receivable145,000 125,000Inventory105,000 100,000Total assets785,000 700,000Preferred stock (6%)205,000 200,000Total stockholders’ equity635,000 525,000 Compute the following ratios for 2022. (Round answers to 1 decimal place, e.g. 1.8 or 2.5%) (a)Profit marginenter the profit margin in percentages %(b)Asset turnoverenter the asset turnover in times times(c)Return on assetsenter the return on assets in percentages %(d)Return on common stockholders’ equityenter the return on common stockholders' equity in percentages %Compute trend percent for the following accounts using 2018 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percent appears to be favorable or unfavorable. 2022 2021 2020 2019 2018 Sales $282,880 $270,800 $252,600 $234,560 $150,000 Cost of goods sold 128,200 122,080 115,280 106,440 67,000 Accounts receivable 18,100 17,300 16,400 15,200 9,000Determine the missing amounts. Unit SellingPrice Unit VariableCosts Unit ContributionMargin Contribution MarginRatio 1. $750 $375 $ (a) % (b) 2. $450 $ (c) $153 % (d) 3. $ (e) $ (f) $760 40 %

- Calculate acid test ratio? Current assets = 212,300 Inventory = 14,300 Current liabilities = 103,000where did the fixed sellind and admin $110,000 come fromThe comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is:Dec. 31, 20Y9 Dec. 31, 20Y8AssetsCash $70,720 $47,940Accounts receivable (net) 207,230 188,190Inventories 298,520 289,850Investments 0 102,000Land 295,800 0Equipment 438,600 358,020Accumulated depreciation—equipment (99,110) (84,320)Total assets $1,211,760 $901,680Liabilities and Stockholders' EquityAccounts payable (merchandise creditors) $205,700 $194,140Accrued expenses payable (operating expenses) 30,600 26,860Dividends payable 25,500 20,400Common stock, $1 par 202,000 102,000Paid-in capital: Excess of issue price over par—common stock 354,000 204,000Retained earnings 393,960 354,280Total liabilities and stockholders' equity $1,211,760 $901,680The income statement for the year ended December 31, 20Y9, is as follows:Sales $2,023,898Cost of goods sold 1,245,476Gross profit $778,422Operating expenses:Depreciation expense $14,790Other operating expenses 517,299Total operating expenses 532,089Operating…

- Using the following selected items from the comparative balance sheet of Oriole Products.Determine the horizontal analysis. (Round percentages to 2 decimal places, e.g. 12.21%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Horizontal analysis Amount Percentage Amount Percentage Current assets $110,880 enter percentages % $128,216 enter percentages % Long-term assets 174,240 enter percentages % 117,304 enter percentages % Total assets 3,168,000 enter percentages % 2,728,000 enter percentages % Determine the vertical analysis. (Round percentages to 1 decimal place, e.g. 12.2%.) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Vertical analysis Amount Percentage Amount Percentage Current assets $110,880…Randall Corporation reported the following revenue data:Year Net revenues (in millions)$$$$6,8007,0046,7327,2762016201720182019Use 2016 as the base year. The trend percentage in 2019 is closest toa. 93%.b. 104%.c. 107%.d. 112%Solvency and Profitability Trend Analysis (Graph Picture from A-D is on the buttom for references) Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders’ equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate…