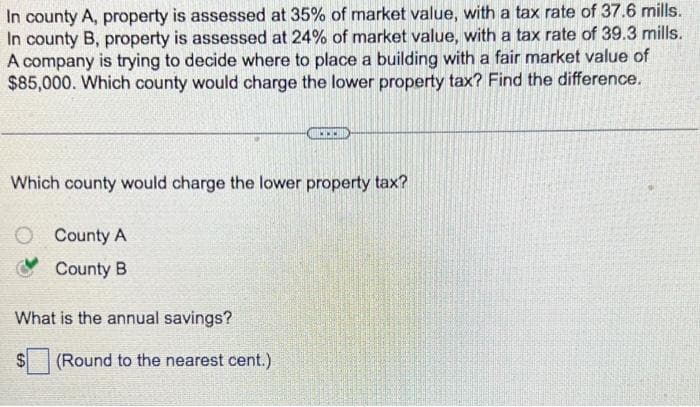

Which county would charge the lower property tax? O County A O County B What is the annual savings? (Round to the nearest cent.) %24

Q: lease read and answer journal entry questions using table.

A: Recording the Monthly transaction of DS unlimited

Q: b. Ir all direct materials are placed in process at the beginning of production, determine the direc...

A: The equiavlent units are the units completed during the period.

Q: E16.25 (LO 1, 5) (EPS with Convertible Bonds and Preference Shares) The Ottey Corporation issued 10-...

A: Solution:- Given, The Ottey Corporation issued 10-year, $4,000,000 par, 7% callable convertible subo...

Q: Information about Orion Industrial's utility cost for the last 6 months of year 2010 follows. The hi...

A: Lets understand the basics. High low method is utilized to separate fixed cost and variable cost fro...

Q: Healthy Foods Inc. sells 50-pound bags of grapes to the military for $10 a bag. The Fixed costs of t...

A: Answer A) Calculation of Degree of operating Leverage if 20,000 bags are sold Amount Sa...

Q: A layoff is considered to be temporary when: Multiple Choice The employee is encouraged to retrain s...

A: A layoff is considered to be temporary when the employee is expected to be recalled to the regular j...

Q: If an employee has the chance of receiving cash in lieu of lodging when traveling for legitamate bus...

A: The employee may exclude the value of the meals and lodging from the gross income for purpose of fed...

Q: Jeremiah Sugar Company has the policy of valuing inventory at lower of cost and net realizable value...

A: Lets understand the basics. As per IAS 2 "Inventories", inventories should be valued at cost or net ...

Q: Depreciation and Rate of Return Burrell Company purchased a machine for $43,000 on January 2, 2019....

A: Machine cost $43,000 Less: Residual value $- Depreciable cost $43,000 Divided by: Estimated ...

Q: On January 2, 2021, Tripod Company receives a government loan of P2,000,000 paying a coupon interest...

A:

Q: A firm has a lower quick (or acid test) ratio than the industry average, which implies Select one: a...

A: The acid-test, also known as the quick ratio, compares a firm's most short-term assets to its most s...

Q: A Swiss Interior Company produces and sells lamps that are sold usually all year round. The company ...

A: The new selling price can be calculated by dividing the desired sales level by the decreased units o...

Q: ROPERTY AND EQUIPMENT. Expenditures for major additions, improvements and flight equipment modificat...

A: calculation of above requirement are as follows

Q: E16.16 (LO 4) (Weighted-Average Ordinary Shares) Portillo SA uses a calendar year for financial repo...

A:

Q: The Lessor Company leases equipment to the Lessee Company on January 1, 2020. The lease is appropria...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: total cash received

A: Cash Inflow on, 1. Pledge with Yupy bank = P500000 2. Factoring with Yalong finance = P1300000 - P13...

Q: Bell expects to produce 1,900 finished goods units in January and 2,200 finished goods units in Febr...

A: A planned cost is a projected future expense that the organization expects to incur. In other words,...

Q: At what amount should the biological assets be recognized on December 31, 2022?

A: Biological assets are those assets which are having the feature of living like the cows and the plan...

Q: Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the co...

A: Adjusted tax basis is cost of asset after adjusting various tax related items.

Q: Steve’s Outdoor Company purchased a new delivery van on January 1 for $58,000 plus $4,900 in sales t...

A: In this question, There are 4 requirements : 1.Indicate the effects of each transaction on the accou...

Q: Lucia Company reported cost of goods sold for Year 1 and Year 2 as follows: Year 1 Year 2 Beginning ...

A: Calculation of Correct Cost of Goods Sold Amount Beginning Inventory $ 145,000 A...

Q: Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $20,800 $19,900 Inventory 72,000 72,700 Accounts pay...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements. ...

Q: You are given the following information relating to Exodus Trading: Gross profit rate based on cost...

A: Cost of Goods Sold = Cost of Goods Available for Sale in 2022 - Merchandise Inventory as on Dec 31, ...

Q: 6 Landis Co. purchased P500,000 of 8%, 5-year bonds (DI@FVTOCI) from Ritter, Inc. on January 1, 202...

A: Solution:- Given, Landis Co. Purchased = P500,000 of 8%, 5 year bonds. Bonds sold = P520,790 Interes...

Q: Transferred cash from a personal bank account in exchange for stock, $50,000 Purchased $8000 of merc...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Steve’s Outdoor Company purchased a new delivery van on January 1 for $58,000 plus $4,900 in sales t...

A: In this question, we compute: 1. Indicate the effects of each transaction on the accounting equation...

Q: The stockholders’ equity accounts of Whispering Winds Corp. on January 1, 2017, were as follows. P...

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since th...

Q: Carla incorporated her sole proprietorship by transferring inventory, a building, and land to the co...

A: A sole proprietorship is an ego business with a sole proprietor who is taxed on earnings on a person...

Q: Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers...

A: The question is related to Provisions and Contingent Liabilities.

Q: The entity shall measure a non-current asset that ceases to be classified as held for sale at the lo...

A: Non-Current Asset: Noncurrent assets are long-term investments made by a corporation that cannot be ...

Q: Ali Mamat Enterprise Trial Balance as at 31 December 2019 Debit (RM) Credit (RM) 190,576 Particulars...

A: Formula: Net income = Revenues - Expenses

Q: Please see below. The information is needed to answer the items that are in the pictures. Note: I ON...

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued i...

Q: The stockholders’ equity accounts of Whispering Winds Corp. on January 1, 2017, were as follows. P...

A: Stockholders' equity refers to the assets remaining in a business once all liabilities have been set...

Q: In the lecture video I used Lay's Potato Chips and an imaginary company (Smith Co.) as examples to e...

A: Process costing is an accounting technique under which all the products produced by a company have t...

Q: ullumber Markets imports and sells small bear-shaped piñatas. In planning for the coming year, the c...

A: preparation of contribution margin income statement are as follows

Q: Long-term solvency ratios Total debt ratio Debt-equity ratio Equity multiplier Times interest earned...

A: Long-term solvency ratio:- It is calculated to check the firm's long-term ability to meet its financ...

Q: Date Activities Units Acquired at Cost 10 units @ $10 August 1 Beginning inventory = $100 August 3 P...

A: In this question, we have to compute the cost of goods sold under FIFO Perpetual inventory method

Q: On October 1, 2021, Neon Company purchased a P2,000,000 face value 10% debt instrument paying a tota...

A: A profit and loss financial statement that illustrates a company's revenue and spending over a perio...

Q: Sam and Devon agree to go into business together selling college-licensed clothing. According to the...

A: It has been assumed that Devon has received 25 percent of the stock in the corporation in return for...

Q: Malachi Department Store starts its business on May 1, 2022 and completes the following transactions...

A: Credit Card Sales are the sales when the customer pays through credit cards and the money transfer f...

Q: What would be the payback period for the machine? What would be the net present value?

A: Cost of the Machine 360000 Life 6 years Salvage Value Zero SLM For Depreciation Ann...

Q: BJ Company produces "JUICE". To produce JUICE, BJ will require 15 units of Material X at P8 per unit...

A: Absorption costing: Absorption costing is also called traditional costing. This method of costing di...

Q: The following information relates to Wilson, Inc.'s equipment lease with an inception date of Januar...

A: Answer:- Correct Option is d. $ 20,278.

Q: A parent sold a land to an 80% owned subsidiary at a loss. The subsidiary continue to use the land a...

A: Parent company: Parent company is an entity who takes the holding stake in the subordinate company. ...

Q: Account Debit Credit

A: Income statement reflects profit or loss from business operations. Here we will ...

Q: company had the following purchases and sales during its first month of operations: Date Activities ...

A: Tje average cost per unit is calculated as total cost of goods available for sale divided by number ...

Q: Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa- tion,...

A: Product profitability analysis is the practice of connecting a company's total profit to the profit ...

Q: Riverbend Incorporated received a $200,000 dividend from stock it held in Hobble Corporation. Riverb...

A: DRD is 70% for dividends from less than 20% owned domestic corporation. If a corporation is entitled...

Q: For which type of investments would unrealized holding gain or loss be recorded directly in an owner...

A: Solution Accounting for investment in associates is done using the equity method . In the equity met...

Q: The following transactions happened for a retailer in January: Date Transaction # of Units Co...

A: LIFO is also written as last in first out. It is the method of inventory valuation in which it it is...

Step by step

Solved in 2 steps

- . The municipal assessor was taxing an idle agricultural land consisting of 2 hectares valued at P 200 per square meter. If the idle land tax imposed is 5% by the ordinance, how much will the owner pay for the idle land tax?a. P 80,000.00 b. P 100,000.00 c. P 200,000 d. P 40,000.0011. The following data are shown on the tax declarations of a piece of land and thA typical home in Waukesha County had an assessed value of $218,700. The tax rate is $2.21 per $1,000. What is the amount of property taxes for county services?In San Francisco, the tax on a property assessed at $770,000 is $10,780. If tax rates are proportional in this city, how much would the tax be on a property assessed at $930,000?

- Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when collected. In the prior year, income recognized for financial reporting purposes for lots sold this way was $20 million, which would be collected equally over the next two years. The enacted tax rate was 40%. This year, a new tax law was enacted, revising the tax rate from 40% to 35% beginning next year. Calculate the amount by which Superior should reduce its deferred tax liability this year.As the tax assessor for Indian Creek County, you have been informed that due to budgetary demands, a tax increase will be necessary next year. The total market value of the property in the county is $700,000,000. Currently, the assessment rate is 35% and the tax rate is 40 mills. The county commission increases the assessment rate to 55% and the tax rate to 45 mills. (a) How much property tax (in $) was collected under the old rates? $ (b) How much more tax (in $) revenue will be collected under the new rates? $Choose the correct. Niceville Company pays property taxes of $100,000 in the second quarter of the year. Which of the following statements is true with respect to the recognition of property tax expense in interim financial statements?a. Under U.S. GAAP, the company would report property tax expense of $100,000 in the second quarter of the year.b. Under IFRS, the company would report property tax expense of $100,000 in the second quarter of the year.c. Under U.S. GAAP, the company would report property tax expense of $33,333 in each of the second, third, and fourth quarters of the year.d. Under IFRS, the company would report property tax expense of $25,000 in the first quarter of the year.

- As the tax assessor for Indian Creek County, you have been informed that due to budgetary demands, a tax increase will be necessary next year. The total market value of the property in the county is $300,000,000. Currently, the assessment rate is 35% and the tax rate is 40 mills. The county commission increases the assessment rate to 55% and the tax rate to 45 mills. (a)How much property tax (in $) was collected under the old rates? (b)How much more tax (in $) revenue will be collected under the new rates?The market value(P) of a property is $833,333.33 in a jurisdiction in which the assessment ratio is 60%. The property owner has just been granted a homestead exemption of $50,000. The property is in a jurisdiction in which the current budget is $9 billion of which 80% derives from property taxes. The gross assessed value of all taxable properties is $684,000,000,000. Calculate the owner’s property tax for the yearA residence has a market value of $250,000. The municipality's tax policy is set at 80%. Real estate owners must pay two separate taxes: the municipality tax and an education tax. The tax rates for each are set at 1.25% and 0.75% respectively. 1. Calculate the total property tax bill

- Niceville Company pays property taxes of $100,000 in the second quarter of the year. Which of the following statements is true with respect to the recognition of property tax expense in interim financial statements?a. Under U.S. GAAP, the company would report property tax expense of $100,000 in the second quarter of the year.b. Under IFRS, the company would report property tax expense of $100,000 in the second quarter of the year.c. Under U.S. GAAP, the company would report property tax expense of $33,333 in each of the second, third, and fourth quarters of the year.d. Under IFRS, the company would report property tax expense of $25,000 in the first quarter of the year.Leo's townhouse has a market value of $310,000. The property in Leo's area is assessed at 40% of the market value. The tax rate is $145.10 per $1,000 of assessed valuation. The tax for Leo is A. $7,999.40. B. $16,992.40. C. $7,999.30. D. $17,992.40.Which of the following are subjected to Value Added Tax (VAT)? A Sale by a real estate dealer of residential lot with a selling price or P800,000. B Sale by a real estate dealer of residential lot with a selling price of P3,500,000. C Sale by a real estate dealer of commercial lot with a selling price of P2,800,000. D Sale of residential lot classified as capital asset. E Sale by a real estate dealer of residential house and lot with a selling price of P3,000,000 F Sale by a real estate dealer of condominium unit with a selling price of P3,250,000 G Sale by a real estate dealer of parking lot in a condominium unit with a selling price of P850,000. H Sale of residential house and lot classified as capital asset with a selling price of P8,000,000.