Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2024 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $2.6 million. The fiscal year ends on December 31. Required: 1. Should this contingent liability be reported, disclosed in a note only, or neither? 2. What loss, if any, should Top Sound report in its 2024 income statement? 3. What liability, if any, should Top Sound report in its 2024 balance sheet? 4. What entry, if any, should be recorded? 1. Should this

Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2024 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product recall is probable, estimated to cost the company $2.6 million. The fiscal year ends on December 31.

Required:

1. Should this

2. What loss, if any, should Top Sound report in its 2024 income statement?

3. What liability, if any, should Top Sound report in its 2024

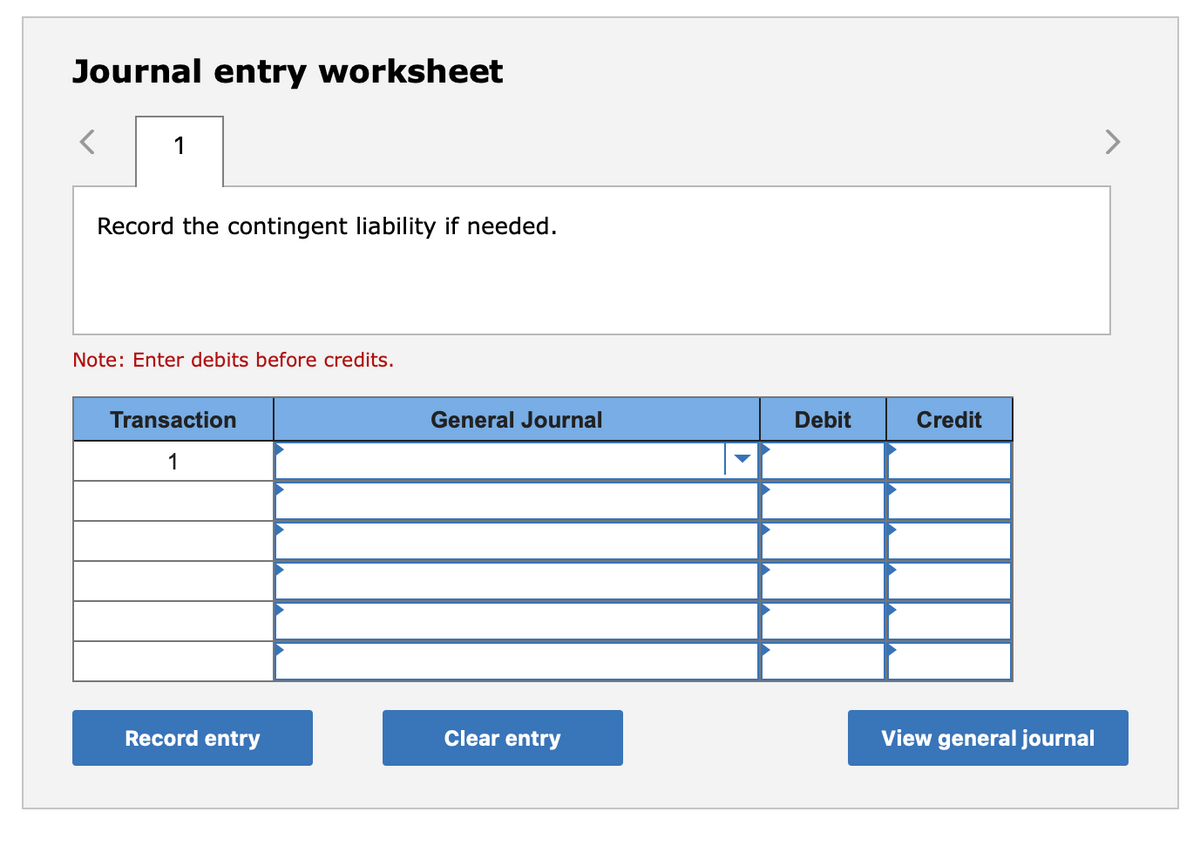

4. What entry, if any, should be recorded?

1. Should this contingent liability be reported, disclosed in a note only, or neither?

This contingent liability should be ??????

Trending now

This is a popular solution!

Step by step

Solved in 2 steps