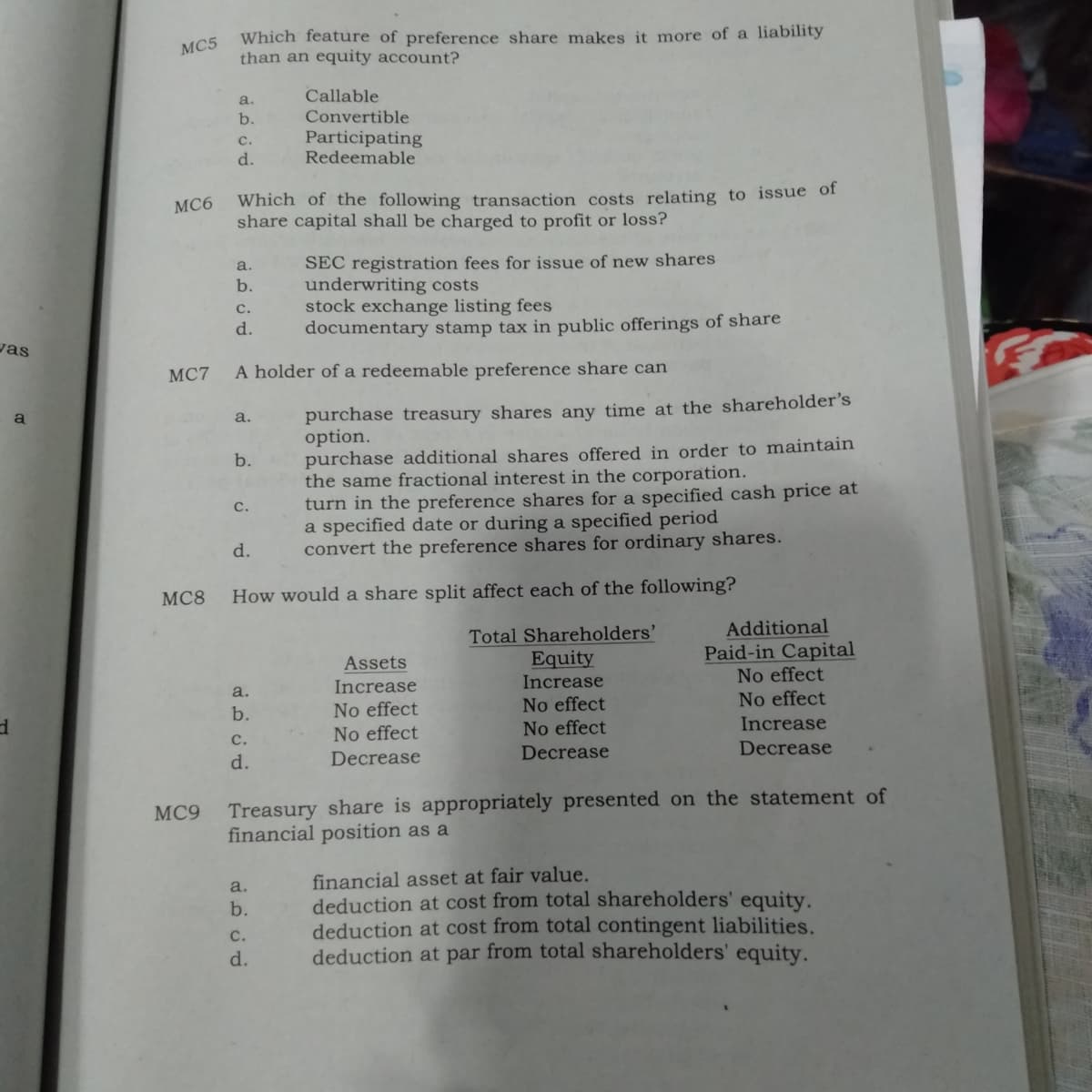

Which feature of preference share makes it more of a liability than an equity account? MC5 Callable Convertible a. b. Participating Redeemable c. d.

Which feature of preference share makes it more of a liability than an equity account? MC5 Callable Convertible a. b. Participating Redeemable c. d.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please help me with numbers 5-9 thank you ?❤️?

Transcribed Image Text:Which feature of preference share makes it more of a liability

than an equity account?

MC5

a.

Callable

b.

Convertible

Participating

Redeemable

C.

d.

Which of the following transaction costs relating to issue of

share capital shall be charged to profit or loss?

MC6

SEC registration fees for issue of new shares

underwriting costs

stock exchange listing fees

documentary stamp tax in public offerings of share

a.

b.

с.

d.

vas

MC7

A holder of a redeemable preference share can

purchase treasury shares any time at the shareholder's

option.

purchase additional shares offered in order to maintain

the same fractional interest in the corporation.

turn in the preference shares for a specified cash price at

a specified date or during a specified period

convert the preference shares for ordinary shares.

a

a.

b.

c.

d.

MC8

How would a share split affect each of the following?

Additional

Paid-in Capital

No effect

No effect

Total Shareholders'

Assets

Equity

a.

Increase

Increase

b.

No effect

No effect

с.

No effect

No effect

Increase

d.

Decrease

Decrease

Decrease

Treasury share is appropriately presented on the statement of

financial position as a

MC9

financial asset at fair value.

deduction at cost from total shareholders' equity.

deduction at cost from total contingent liabilities.

deduction at par from total shareholders' equity.

a.

b.

c.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education