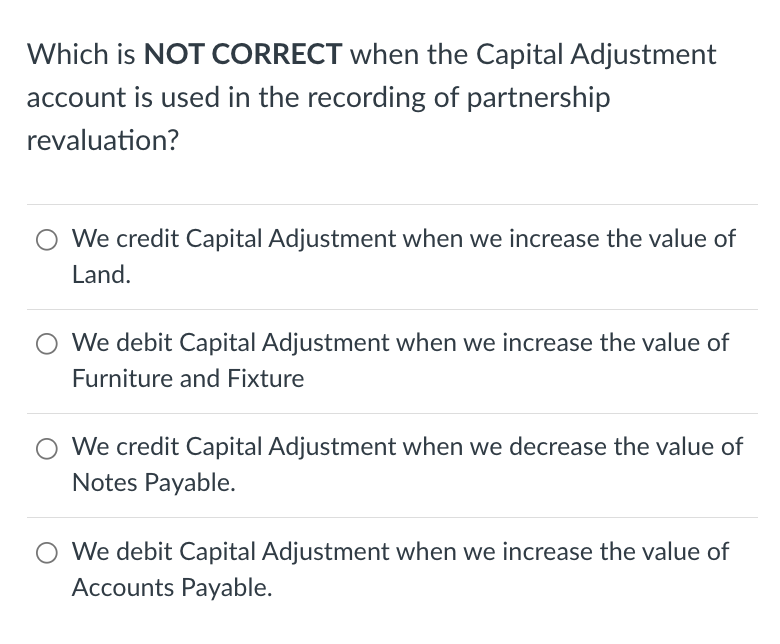

Which is NOT CORRECT when the Capital Adjustment account is used in the recording of partnership revaluation? We credit Capital Adjustment when we increase the value of Land. We debit Capital Adjustment when we increase the value of Furniture and Fixture We credit Capital Adjustment when we decrease the value of Notes Payable. We debit Capital Adjustment when we increase the value of Accounts Payable.

Which is NOT CORRECT when the Capital Adjustment account is used in the recording of partnership revaluation? We credit Capital Adjustment when we increase the value of Land. We debit Capital Adjustment when we increase the value of Furniture and Fixture We credit Capital Adjustment when we decrease the value of Notes Payable. We debit Capital Adjustment when we increase the value of Accounts Payable.

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

Transcribed Image Text:Which is NOT CORRECT when the Capital Adjustment

account is used in the recording of partnership

revaluation?

We credit Capital Adjustment when we increase the value of

Land.

We debit Capital Adjustment when we increase the value of

Furniture and Fixture

We credit Capital Adjustment when we decrease the value of

Notes Payable.

We debit Capital Adjustment when we increase the value of

Accounts Payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you