(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $80,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 10 percent.

(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $80,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 10 percent.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 5R

Related questions

Question

Module 5 Question 1 Part A

Transcribed Image Text:(Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two

alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but

alternative A will cost $80,000 to purchase, while alternative B will cost only $55,000. Moreover, the two alternatives will have very different cash

flows and useful lives. The after-tax costs for the two projects are as follows:

a. Calculate each project's EAC, given a discount rate of 10 percent.

a. Alternative A's EA) at a discount rate of 10% is $

(Round to the nearest cent.)

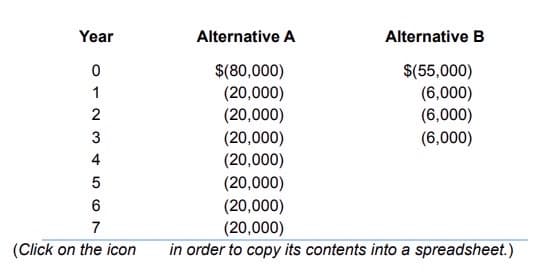

Transcribed Image Text:Year

0

1

2

3

4

5

6

7

(Click on the icon

Alternative A

$(80,000)

(20,000)

(20,000)

(20,000)

(20,000)

(20,000)

(20,000)

(20,000)

in order to copy its contents into a spreadsheet.)

Alternative B

$(55,000)

(6,000)

(6,000)

(6,000)

Expert Solution

Step 1

EAC is the equivalent annual cost.

EAC is used in capital budgeting to compare projects with unequal lives.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Which of the alternatives do you think Barry should select? Why? (Select the best choice below.)

Alternative A should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative B.

Solution

Follow-up Question

b. Which of the alternatives do you think Barry should select? Why?

Solution

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning