Which of the following appears to be a safe assumption when there is no difference between the forward and spot exchange rate between two currencies? 8. A. The countries have equal nominal interest rates. B. The spot exchange rate is expected to change. C. Expected inflation is less than the nominal interest rate. D. Both currencies are selling at a premium relative to the other. E. None of the above.

Which of the following appears to be a safe assumption when there is no difference between the forward and spot exchange rate between two currencies? 8. A. The countries have equal nominal interest rates. B. The spot exchange rate is expected to change. C. Expected inflation is less than the nominal interest rate. D. Both currencies are selling at a premium relative to the other. E. None of the above.

Related questions

Question

Please answer all three questions with the

solutions (how you got the answer for all three)

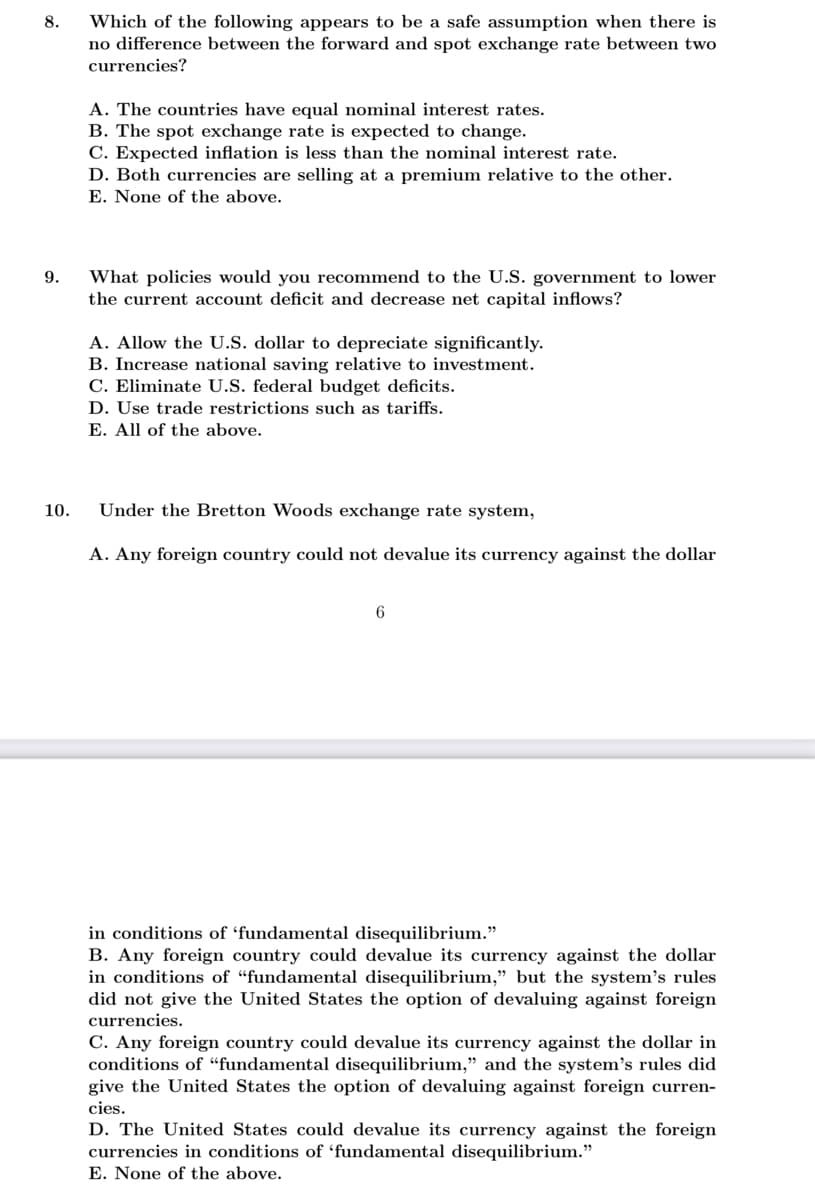

Transcribed Image Text:8.

Which of the following appears to be a safe assumption when there is

no difference between the forward and spot exchange rate between two

currencies?

A. The countries have equal nominal interest rates.

B. The spot exchange rate is expected to change.

C. Expected inflation is less than the nominal interest rate.

D. Both currencies are selling at a premium relative to the other.

E. None of the above.

What policies would you recommend to the U.S. government to lower

the current account deficit and decrease net capital inflows?

9.

A. Allow the U.S. dollar to depreciate significantly.

B. Increase national saving relative to investment.

C. Eliminate U.S. federal budget deficits.

D. Use trade restrictions such as tariffs.

E. All of the above.

10.

Under the Bretton Woods exchange rate system,

A. Any foreign country could not devalue its currency against the dollar

6

in conditions of 'fundamental disequilibrium."

B. Any foreign country could devalue its currency against the dollar

in conditions of “fundamental disequilibrium," but the system's rules

did not give the United States the option of devaluing against foreign

currencies.

C. Any foreign country could devalue its currency against the dollar in

conditions of “fundamental disequilibrium," and the system's rules did

give the United States the option of devaluing against foreign curren-

cies.

D. The United States could devalue its currency against the foreign

currencies in conditions of 'fundamental disequilibrium."

E. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.