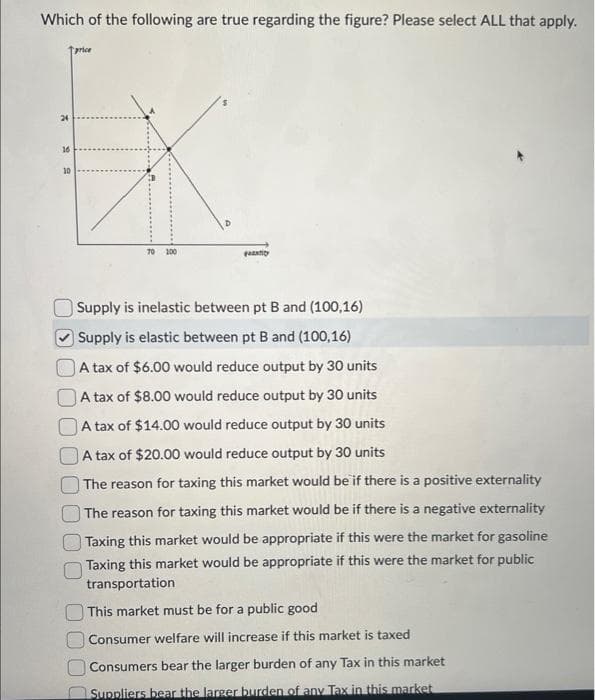

Which of the following are true regarding the figure? Please select ALL that apply. ↑price EX 24 16 10 70 100 quantity Supply is inelastic between pt B and (100,16)

Which of the following are true regarding the figure? Please select ALL that apply. ↑price EX 24 16 10 70 100 quantity Supply is inelastic between pt B and (100,16)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter3: Demand Analysis

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:Which of the following are true regarding the figure? Please select ALL that apply.

2

16

10

price

70 100

ti

Supply is inelastic between pt B and (100,16)

Supply is elastic between pt B and (100,16)

A tax of $6.00 would reduce output by 30 units

A tax of $8.00 would reduce output by 30 units

A tax of $14.00 would reduce output by 30 units

A tax of $20.00 would reduce output by 30 units

The reason for taxing this market would be if there is a positive externality

The reason for taxing this market would be if there is a negative externality

Taxing this market would be appropriate if this were the market for gasoline

Taxing this market would be appropriate if this were the market for public

transportation

This market must be for a public good

Consumer welfare will increase if this market is taxed

Consumers bear the larger burden of any Tax in this market

Suppliers bear the larger burden of any Tax in this market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning