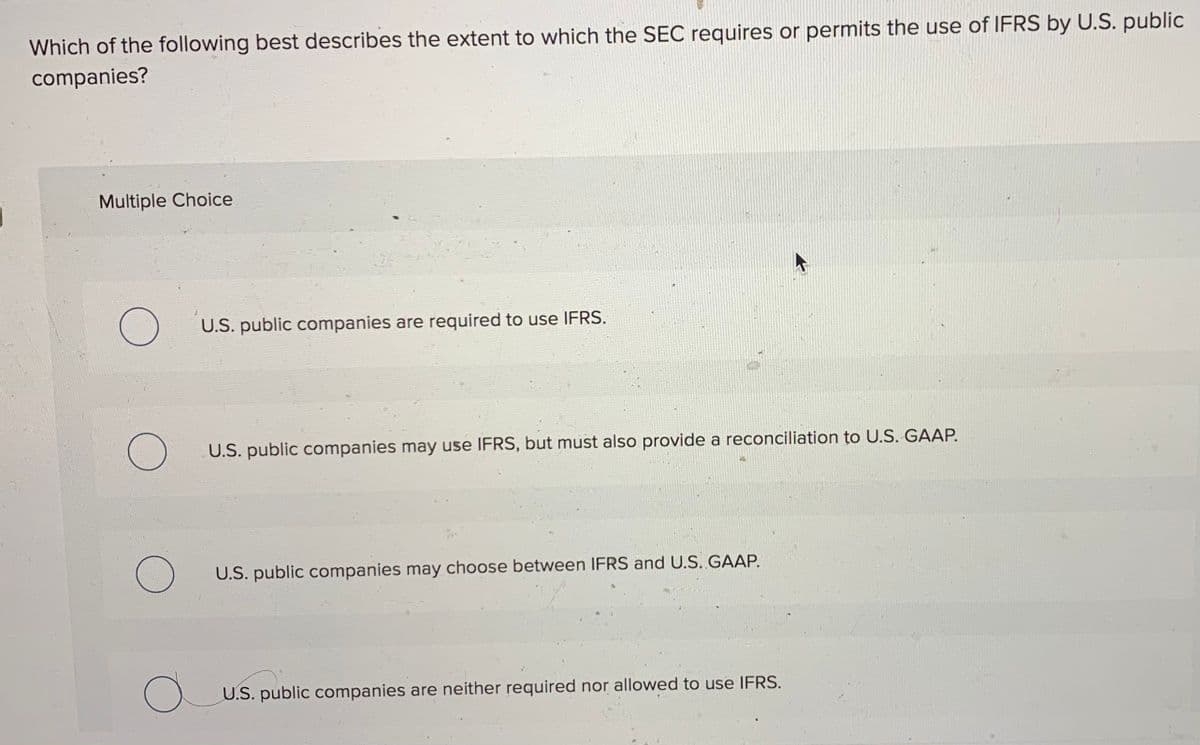

Which of the following best describes the extent to which the SEC requires or permits the use of IFRS by U.S. publi companies? Multiple Choice U.S. public companies are required to use IFRS. U.S. public companies may use IFRS, but must also provide a reconciliation to U.S. GAAP. U.S. public companies may choose between IFRS and U.S. GAAP. U.S. public companies are neither required nor allowed to use IFRS.

Which of the following best describes the extent to which the SEC requires or permits the use of IFRS by U.S. publi companies? Multiple Choice U.S. public companies are required to use IFRS. U.S. public companies may use IFRS, but must also provide a reconciliation to U.S. GAAP. U.S. public companies may choose between IFRS and U.S. GAAP. U.S. public companies are neither required nor allowed to use IFRS.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11MC: Which of the following is true about the Sarbanes-Oxley Act? A. It was passed to ensure that...

Related questions

Question

Transcribed Image Text:Which of the following best describes the extent to which the SEC requires or permits the use of IFRS by U.S. public

companies?

Multiple Choice

U.S. public companies are required to use IFRS.

U.S. public companies may use IFRS, but must also provide a reconciliation to U.S. GAAP.

U.S. public companies may choose between IFRS and U.S. GAAP.

U.S. public companies are neither required nor allowed to use IFRS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage