Which of the following is false? I. A lower interest rate would increase the present value of an investment. II. With compound interest method, interest is earned every period only on the orginal starting amount. III. "PMT" in the FVA formula tells us the periodic mortage payments for a fixed-rate fully amortized loan. O A. I, II, and III B. C. OD. Ill only II and III only I only

Which of the following is false? I. A lower interest rate would increase the present value of an investment. II. With compound interest method, interest is earned every period only on the orginal starting amount. III. "PMT" in the FVA formula tells us the periodic mortage payments for a fixed-rate fully amortized loan. O A. I, II, and III B. C. OD. Ill only II and III only I only

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 12MC: (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest...

Related questions

Question

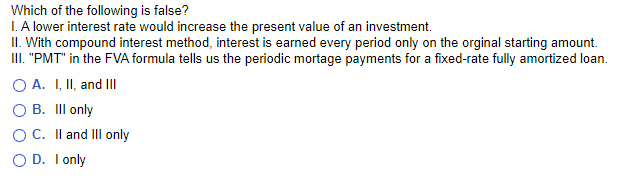

Transcribed Image Text:Which of the following is false?

I. A lower interest rate would increase the present value of an investment.

II. With compound interest method, interest is earned every period only on the orginal starting amount.

III. "PMT" in the FVA formula tells us the periodic mortage payments for a fixed-rate fully amortized loan.

O A. I, II, and III

O B. III only

O C. II and III only

D. I only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT