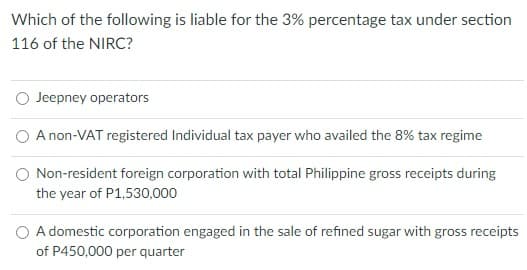

Which of the following is liable for the 3% percentage tax under section 116 of the NIRC?

Which of the following is liable for the 3% percentage tax under section 116 of the NIRC?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 15P

Related questions

Question

100%

Which of the following is liable for the 3% percentage tax under section 116 of the NIRC?

Transcribed Image Text:Which of the following is liable for the 3% percentage tax under section

116 of the NIRC?

O Jeepney operators

A non-VAT registered Individual tax payer who availed the 8% tax regime

O Non-resident foreign corporation with total Philippine gross receipts during

the year of P1,530,000

O A domestic corporation engaged in the sale of refined sugar with gross receipts

of P450,000 per quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you