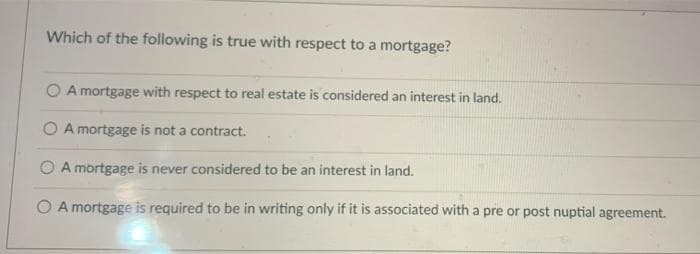

Which of the following is true with respect to a mortgage? O A mortgage with respect to real estate is considered an interest in land. O A mortgage is not a contract. O A mortgage is never considered to be an interest in land. O A mortgage is required to be in writing only if it is associated with a pre or post nuptial agreement.

Which of the following is true with respect to a mortgage? O A mortgage with respect to real estate is considered an interest in land. O A mortgage is not a contract. O A mortgage is never considered to be an interest in land. O A mortgage is required to be in writing only if it is associated with a pre or post nuptial agreement.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter9: Individuals As Taxpayers

Section: Chapter Questions

Problem 14P

Related questions

Question

Please answer both sir will rate your answer

Transcribed Image Text:Which of the following is true with respect to a mortgage?

O A mortgage with respect to real estate is considered an interest in land.

O A mortgage is not a contract.

O A mortgage is never considered to be an interest in land.

O A mortgage is required to be in writing only if it is associated with a pre or post nuptial agreement.

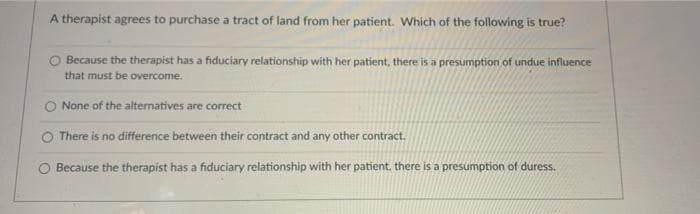

Transcribed Image Text:A therapist agrees to purchase a tract of land from her patient. Which of the following is true?

O Because the therapist has a fiduciary relationship with her patient, there is a presumption of undue influence

that must be overcome.

None of the alternatives are correct

There is no difference between their contract and any other contract.

Because the therapist has a fiduciary relationship with her patient. there is a presumption of duress.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage