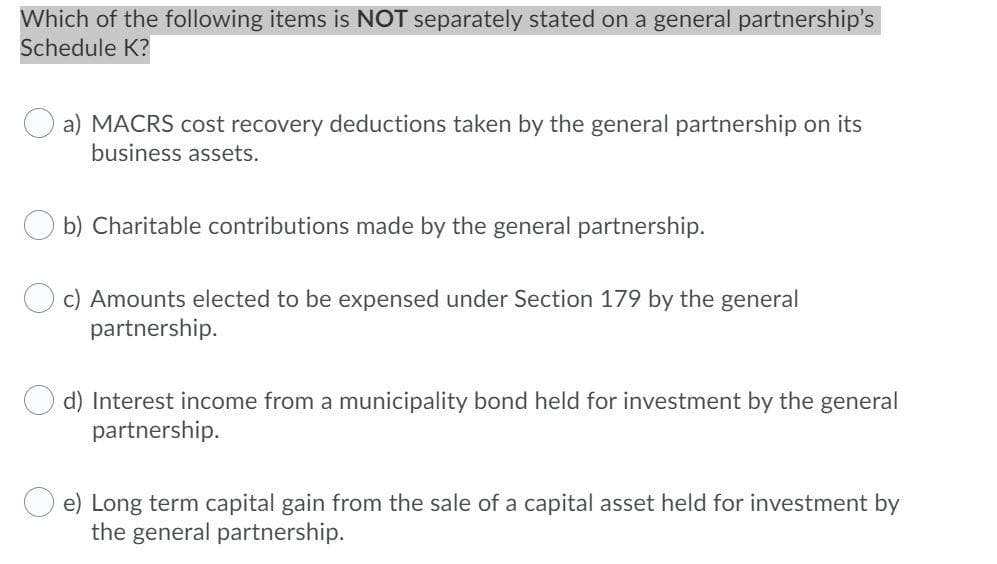

Which of the following items is NOT separately stated on a general partnership's Schedule K? a) MACRS cost recovery deductions taken by the general partnership on its business assets. b) Charitable contributions made by the general partnership. c) Amounts elected to be expensed under Section 179 by the general partnership. d) Interest income from a municipality bond held for investment by the general partnership. e) Long term capital gain from the sale of a capital asset held for investment by the general partnership.

Which of the following items is NOT separately stated on a general partnership's Schedule K? a) MACRS cost recovery deductions taken by the general partnership on its business assets. b) Charitable contributions made by the general partnership. c) Amounts elected to be expensed under Section 179 by the general partnership. d) Interest income from a municipality bond held for investment by the general partnership. e) Long term capital gain from the sale of a capital asset held for investment by the general partnership.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 9DQ

Related questions

Question

Transcribed Image Text:Which of the following items is NOT separately stated on a general partnership's

Schedule K?

a) MACRS cost recovery deductions taken by the general partnership on its

business assets.

b) Charitable contributions made by the general partnership.

c) Amounts elected to be expensed under Section 179 by the general

partnership.

d) Interest income from a municipality bond held for investment by the general

partnership.

e) Long term capital gain from the sale of a capital asset held for investment by

the general partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College