Which of the following situation/s do you think are considered to be part of property, plant and equipment as per IAS 16? I An entity owns a motor vehicle for the exclusive business and private use of its chief accounts officer II. An entity acquired a license to import a specific chemical into the country. III. The entity owns a Pickup truck and trailer used to transport feed to the animals in a cattle farm. IV. An entity owns a fleet of motor vehicles. The vehicles are used by the sales staff in the performance of their duties. I, II, III and IV only I and IV only I, III and IV only IV only

Which of the following situation/s do you think are considered to be part of property, plant and equipment as per IAS 16? I An entity owns a motor vehicle for the exclusive business and private use of its chief accounts officer II. An entity acquired a license to import a specific chemical into the country. III. The entity owns a Pickup truck and trailer used to transport feed to the animals in a cattle farm. IV. An entity owns a fleet of motor vehicles. The vehicles are used by the sales staff in the performance of their duties. I, II, III and IV only I and IV only I, III and IV only IV only

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 27P

Related questions

Question

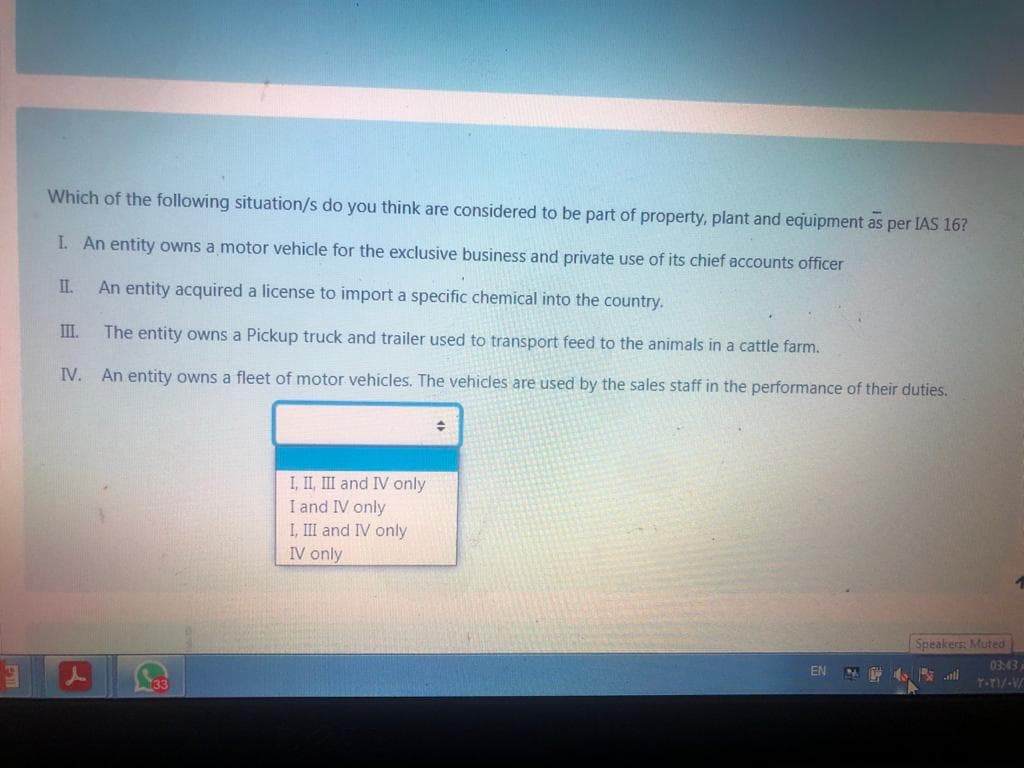

Transcribed Image Text:Which of the following situation/s do you think are considered to be part of property, plant and equipment as per IAS 16?

I An entity owns a motor vehicle for the exclusive business and private use of its chief accounts officer

II.

An entity acquired a license to import a specific chemical into the country.

II.

The entity owns a Pickup truck and trailer used to transport feed to the animals in a cattle farm.

IV. An entity owns a fleet of motor vehicles. The vehicles are used by the sales staff in the performance of their duties.

I, II, III and IV only

I and IV only

I, III and IV only

IV only

Speakers: Muted

03:43

EN A E s all

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage