Which of the following statements are true? OCalifornia Corp has relied on equitý to finance its assets more than Indiana Corp has OCalifornia Corp has a lower return on equity than Indiana Corp California Corp has a higher return on equity than Indiana Corp California Corp generates more sales for every dollar of assets than does Indiana Corp

Which of the following statements are true? OCalifornia Corp has relied on equitý to finance its assets more than Indiana Corp has OCalifornia Corp has a lower return on equity than Indiana Corp California Corp has a higher return on equity than Indiana Corp California Corp generates more sales for every dollar of assets than does Indiana Corp

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 13P: Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth...

Related questions

Question

100%

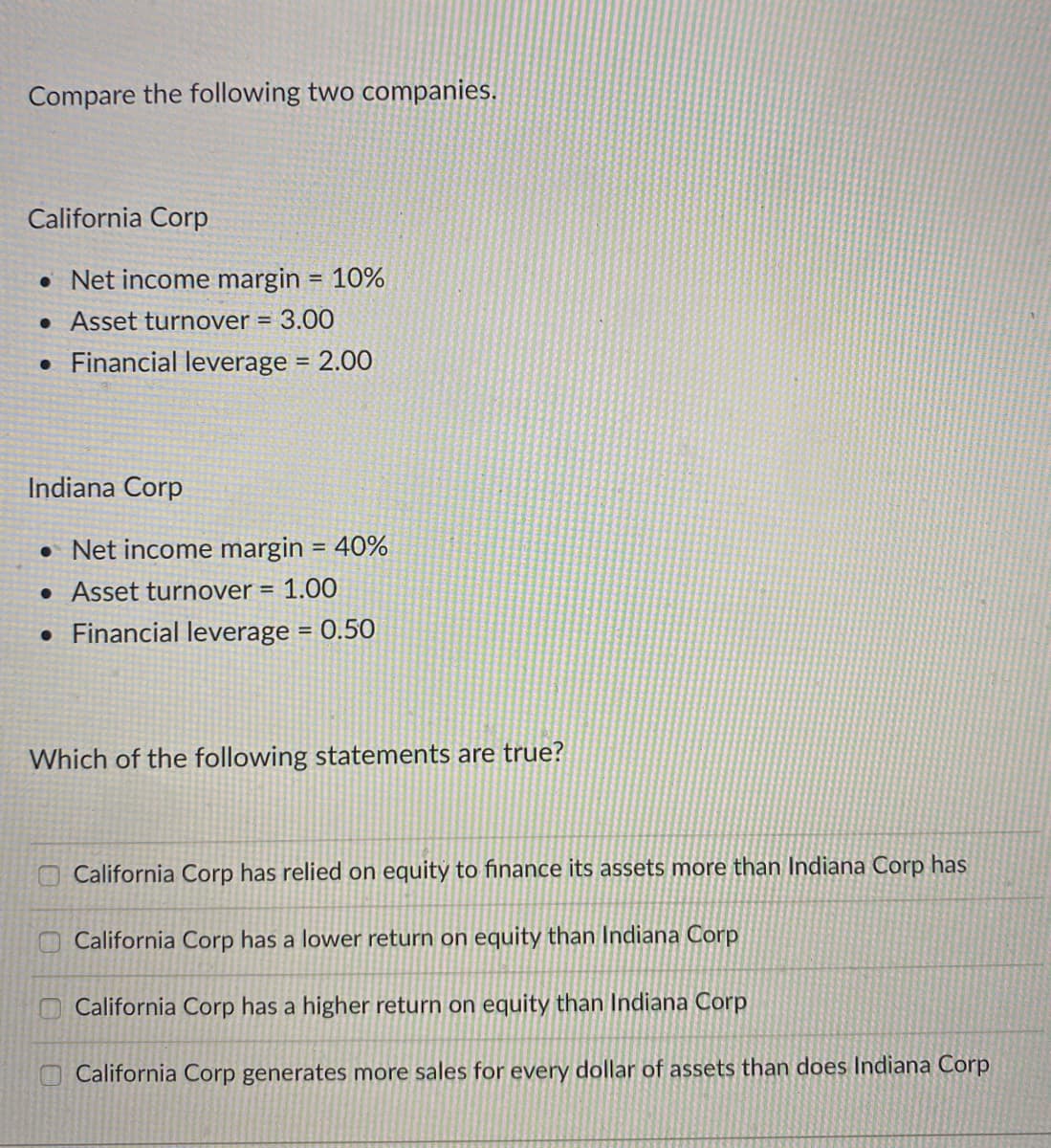

Transcribed Image Text:Compare the following two companies.

California Corp

• Net income margin = 10%

• Asset turnover = 3.00

• Financial leverage = 2.00

Indiana Corp

• Net income margin = 40%

• Asset turnover = 1.00

!3!

• Financial leverage = 0.50

Which of the following statements are true?

California Corp has relied on equitý to finance its assets more than Indiana Corp has

California Corp has a lower return on equity than Indiana Corp

OCalifornia Corp has a higher return on equity than Indiana Corp

California Corp generates more sales for every dollar of assets than does Indiana Corp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning