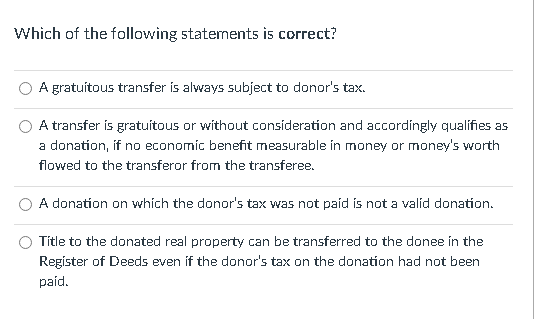

Which of the following statements is correct? A gratuítous transfer is always subject to donor's tax. A transfer is gratuítous or without consideration and accordingly qualifies as a donation, if no economic benefit measurable in money or money's worth flowed to the transferor from the transferee. A donation on which the donor's tax was not paíd is not a valíd donation. Títle to the donated real property can be transferred to the donee in the Register of Deeds even if the donor's tax on the donation had not been paíd.

Which of the following statements is correct? A gratuítous transfer is always subject to donor's tax. A transfer is gratuítous or without consideration and accordingly qualifies as a donation, if no economic benefit measurable in money or money's worth flowed to the transferor from the transferee. A donation on which the donor's tax was not paíd is not a valíd donation. Títle to the donated real property can be transferred to the donee in the Register of Deeds even if the donor's tax on the donation had not been paíd.

Chapter18: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

100%

timed task, need help, thanks

about transfer taxes

Transcribed Image Text:Which of the following statements is correct?

A gratuítous transfer is always subject to donor's tax.

A transfer is gratuítous or without consideration and accordingly qualifies as

a donation, if no economic benefit measurable in money or money's worth

flowed to the transferor from the transferee.

A donation on which the donor's tax was not paíd is not a valíd donation.

Títle to the donated real property can be transferred to the donee in the

Register of Deeds even if the donor's tax on the donation had not been

paíd.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT