Complete Cash Flow Summ

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 6E: Foamy Inc. manufactures shaving cream and uses the weighted average cost method. In November,...

Related questions

Question

100%

Complete Cash Flow Summary #1

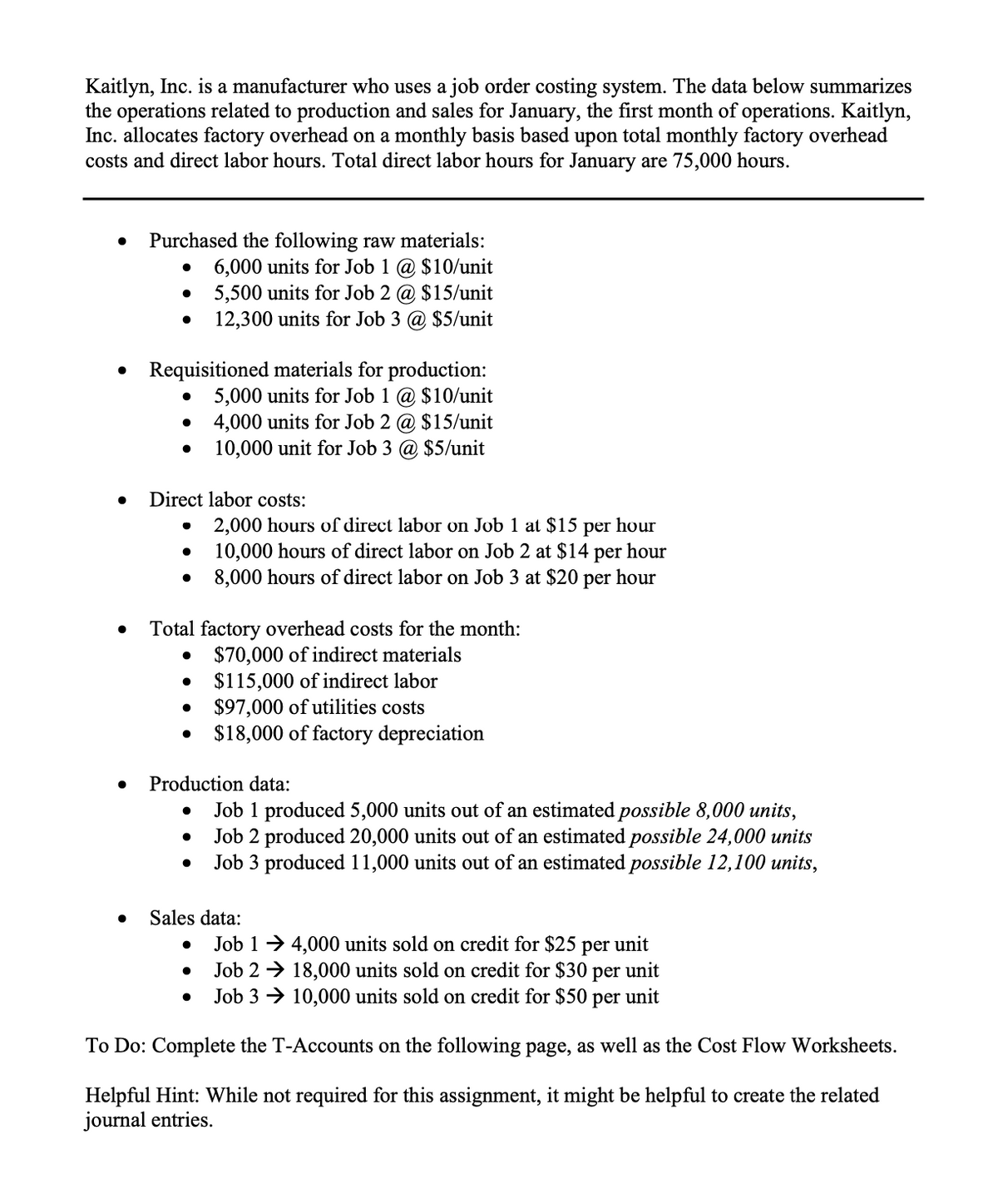

Transcribed Image Text:Kaitlyn, Inc. is a manufacturer who uses a job order costing system. The data below summarizes

the operations related to production and sales for January, the first month of operations. Kaitlyn,

Inc. allocates factory overhead on a monthly basis based upon total monthly factory overhead

costs and direct labor hours. Total direct labor hours for January are 75,000 hours.

Purchased the following raw materials:

6,000 units for Job 1 @ $10/unit

5,500 units for Job 2 @ $15/unit

12,300 units for Job 3 @ $5/unit

Requisitioned materials for production:

5,000 units for Job 1 @ $10/unit

4,000 units for Job 2 @ $15/unit

10,000 unit for Job 3 @ $5/unit

Direct labor costs:

2,000 hours of direct labor on Job 1 at $15 per hour

10,000 hours of direct labor on Job 2 at $14 per hour

8,000 hours of direct labor on Job 3 at $20 per hour

Total factory overhead costs for the month:

• $70,000 of indirect materials

$115,000 of indirect labor

$97,000 of utilities costs

$18,000 of factory depreciation

Production data:

Job 1 produced 5,000 units out of an estimated possible 8,000 units,

Job 2 produced 20,000 units out of an estimated possible 24,000 units

Job 3 produced 11,000 units out of an estimated possible 12,100 units,

Sales data:

Job 1 → 4,000 units sold on credit for $25

unit

per

Job 2 → 18,000 units sold on credit for $30 per unit

Job 3 → 10,000 units sold on credit for $50

реr

unit

To Do: Complete the T-Accounts on the following page, as well as the Cost Flow Worksheets.

Helpful Hint: While not required for this assignment, it might be helpful to create the related

journal entries.

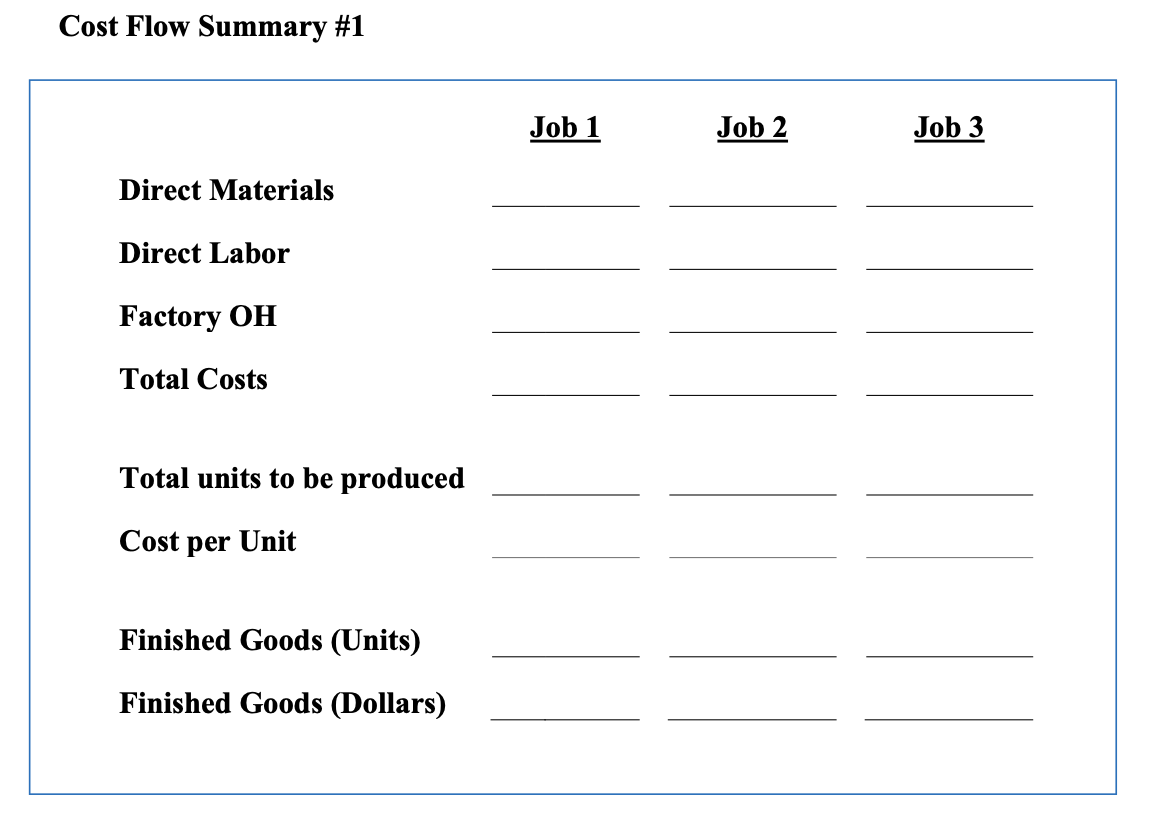

Transcribed Image Text:Cost Flow Summary #1

Job 1

Job 2

Job 3

Direct Materials

Direct Labor

Factory OH

Total Costs

Total units to be produced

Cost

per

Unit

Finished Goods (Units)

Finished Goods (Dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,