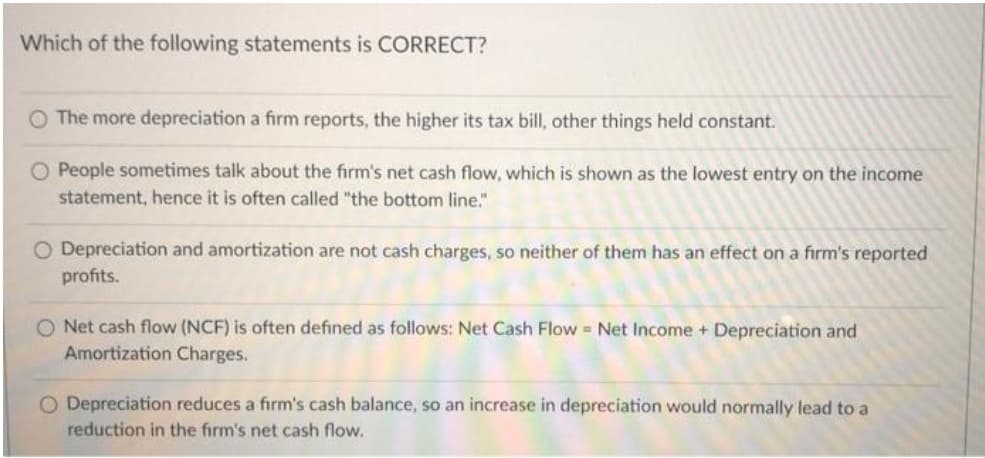

Which of the following statements is CORRECT? O The more depreciation a firm reports, the higher its tax bill, other things held constant. O People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income statement, hence it is often called "the bottom line." O Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits. O Net cash flow (NCF) is often defined as follows: Net Cash Flow Net Income + Depreciation and Amortization Charges. O Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

Which of the following statements is CORRECT? O The more depreciation a firm reports, the higher its tax bill, other things held constant. O People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income statement, hence it is often called "the bottom line." O Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits. O Net cash flow (NCF) is often defined as follows: Net Cash Flow Net Income + Depreciation and Amortization Charges. O Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter13: Valuation: Earnings-based Approach

Section: Chapter Questions

Problem 6QE

Related questions

Question

Transcribed Image Text:Which of the following statements is CORRECT?

O The more depreciation a firm reports, the higher its tax bill, other things held constant.

O People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income

statement, hence it is often called "the bottom line."

O Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported

profits.

O Net cash flow (NCF) is often defined as follows: Net Cash Flow = Net Income + Depreciation and

Amortization Charges.

O Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a

reduction in the firm's net cash flow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College