Which of the following statements is true? When investors' required rate of return is less than the bond's coupon rate, then market value of the bond will be greater than face value. a. O b. When investors' required rate of return exceeds the bond's coupon rate, then the market value of the bond will be greater than face value. When investors' required rate of return is less than the bond's coupon rate, then the market value of the bond will be less than face value. O d. When investors' required rate of return equals the bond's coupon rate, then the market value of the bond may be selling at face value. C.

Which of the following statements is true? When investors' required rate of return is less than the bond's coupon rate, then market value of the bond will be greater than face value. a. O b. When investors' required rate of return exceeds the bond's coupon rate, then the market value of the bond will be greater than face value. When investors' required rate of return is less than the bond's coupon rate, then the market value of the bond will be less than face value. O d. When investors' required rate of return equals the bond's coupon rate, then the market value of the bond may be selling at face value. C.

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9Q: In Chapter 7, we saw that if the market interest rate, rd, for a given bond increased, the price of...

Related questions

Question

mc attached

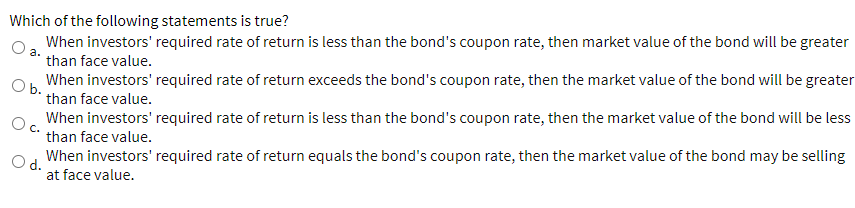

Transcribed Image Text:Which of the following statements is true?

When investors' required rate of return is less than the bond's coupon rate, then market value of the bond will be greater

than face value.

a.

O b.

When investors' required rate of return exceeds the bond's coupon rate, then the market value of the bond will be greater

than face value.

When investors' required rate of return is less than the bond's coupon rate, then the market value of the bond will be less

than face value.

O d.

When investors' required rate of return equals the bond's coupon rate, then the market value of the bond may be selling

at face value.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning