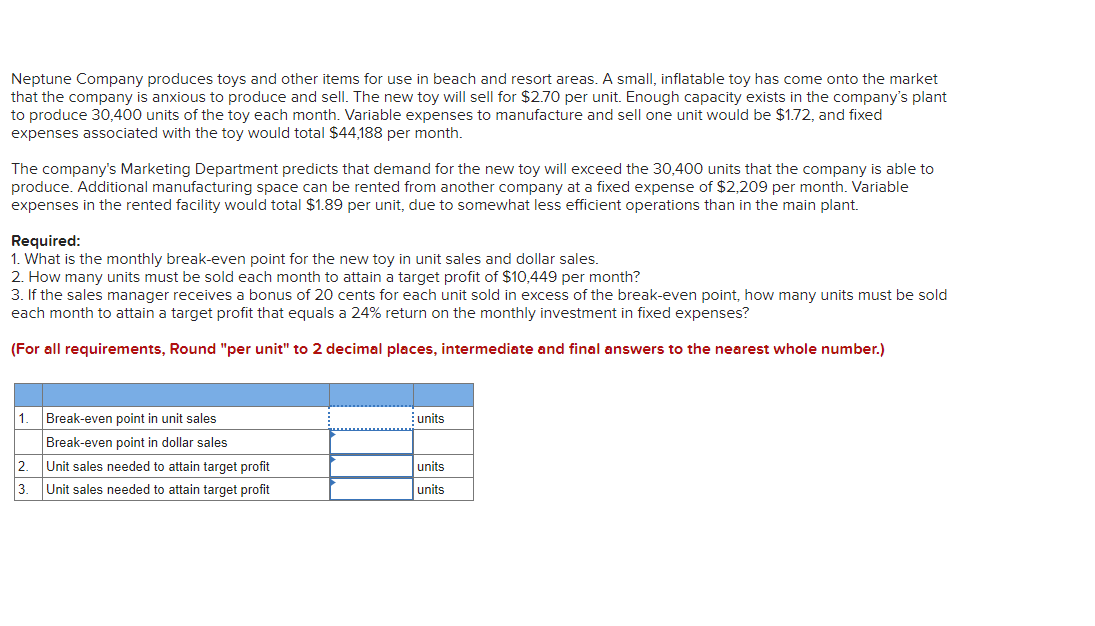

Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $2.70 per unit. Enough capacity exists in the company's plant to produce 30,400 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.72, and fixed expenses associated with the toy would total $44,188 per month. The company's Marketing Department predicts that demand for the new toy will exceed the 30,400 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,209 per month. Variable expenses in the rented facility would total $1.89 per unit, due to somewhat less efficient operations than in the main plant. Required: 1. What is the monthly break-even point for the new toy in unit sales and dollar sales. 2. How many units must be sold each month to attain a target profit of $10,449 per month? 3. If the sales manager receives a bonus of 20 cents for each unit sold in excess of the break-even point, how many units must be sold each month to attain a target profit that equals a 24% return on the monthly investment in fixed expenses? (For all requirements, Round "per unit" to 2 decimal places, intermediate and final answers to the nearest whole number.) 1 2 3. Break-even point in unit sales Break-even point in dollar sales Unit sales needed to attain target profit Unit sales needed to attain target profit units units units

Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $2.70 per unit. Enough capacity exists in the company's plant to produce 30,400 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.72, and fixed expenses associated with the toy would total $44,188 per month. The company's Marketing Department predicts that demand for the new toy will exceed the 30,400 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,209 per month. Variable expenses in the rented facility would total $1.89 per unit, due to somewhat less efficient operations than in the main plant. Required: 1. What is the monthly break-even point for the new toy in unit sales and dollar sales. 2. How many units must be sold each month to attain a target profit of $10,449 per month? 3. If the sales manager receives a bonus of 20 cents for each unit sold in excess of the break-even point, how many units must be sold each month to attain a target profit that equals a 24% return on the monthly investment in fixed expenses? (For all requirements, Round "per unit" to 2 decimal places, intermediate and final answers to the nearest whole number.) 1 2 3. Break-even point in unit sales Break-even point in dollar sales Unit sales needed to attain target profit Unit sales needed to attain target profit units units units

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 3CMA: Aril Industries is a multiproduct company that currently manufactures 30,000 units of Part 730 each...

Related questions

Question

Transcribed Image Text:Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market

that the company is anxious to produce and sell. The new toy will sell for $2.70 per unit. Enough capacity exists in the company's plant

to produce 30,400 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.72, and fixed

expenses associated with the toy would total $44,188 per month.

The company's Marketing Department predicts that demand for the new toy will exceed the 30,400 units that the company is able to

produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,209 per month. Variable

expenses in the rented facility would total $1.89 per unit, due to somewhat less efficient operations than in the main plant.

Required:

1. What is the monthly break-even point for the new toy in unit sales and dollar sales.

2. How many units must be sold each month to attain a target profit of $10,449 per month?

3. If the sales manager receives a bonus of 20 cents for each unit sold in excess of the break-even point, how many units must be sold

each month to attain a target profit that equals a 24% return on the monthly investment in fixed expenses?

(For all requirements, Round "per unit" to 2 decimal places, intermediate and final answers to the nearest whole number.)

1. Break-even point in unit sales

Break-even point in dollar sales

Unit sales needed to attain target profit

Unit sales needed to attain target profit

2.

3.

units

units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT