Which of the following statements is/are true? Statement I. Norvs and May are committed for a level needed for particular skills and translate the desired levels of competence into requisite knowledge and skills. Statement II. Norvs and May's lack of formal accounting training is compensated by the full responsibility provided to Red their general manager. Statement IlI. Norvs and May being the people allowed to sign company checks is a faulty control. O Statement IIl only O Statement I only O Statements I and II Statement I and III

Which of the following statements is/are true? Statement I. Norvs and May are committed for a level needed for particular skills and translate the desired levels of competence into requisite knowledge and skills. Statement II. Norvs and May's lack of formal accounting training is compensated by the full responsibility provided to Red their general manager. Statement IlI. Norvs and May being the people allowed to sign company checks is a faulty control. O Statement IIl only O Statement I only O Statements I and II Statement I and III

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 1A: BURTS BEES, Durham, North Carolina Burts Bees describes itself as an Earth-Friendly, Natural...

Related questions

Question

Transcribed Image Text:ph.instructure.com

C Home Chegg.com G Grammarly Viu C Home- Canva

OStudent Far Easter...

Netflix

Dashboard

0.0 Duolingo - The wor...

esis

eclol

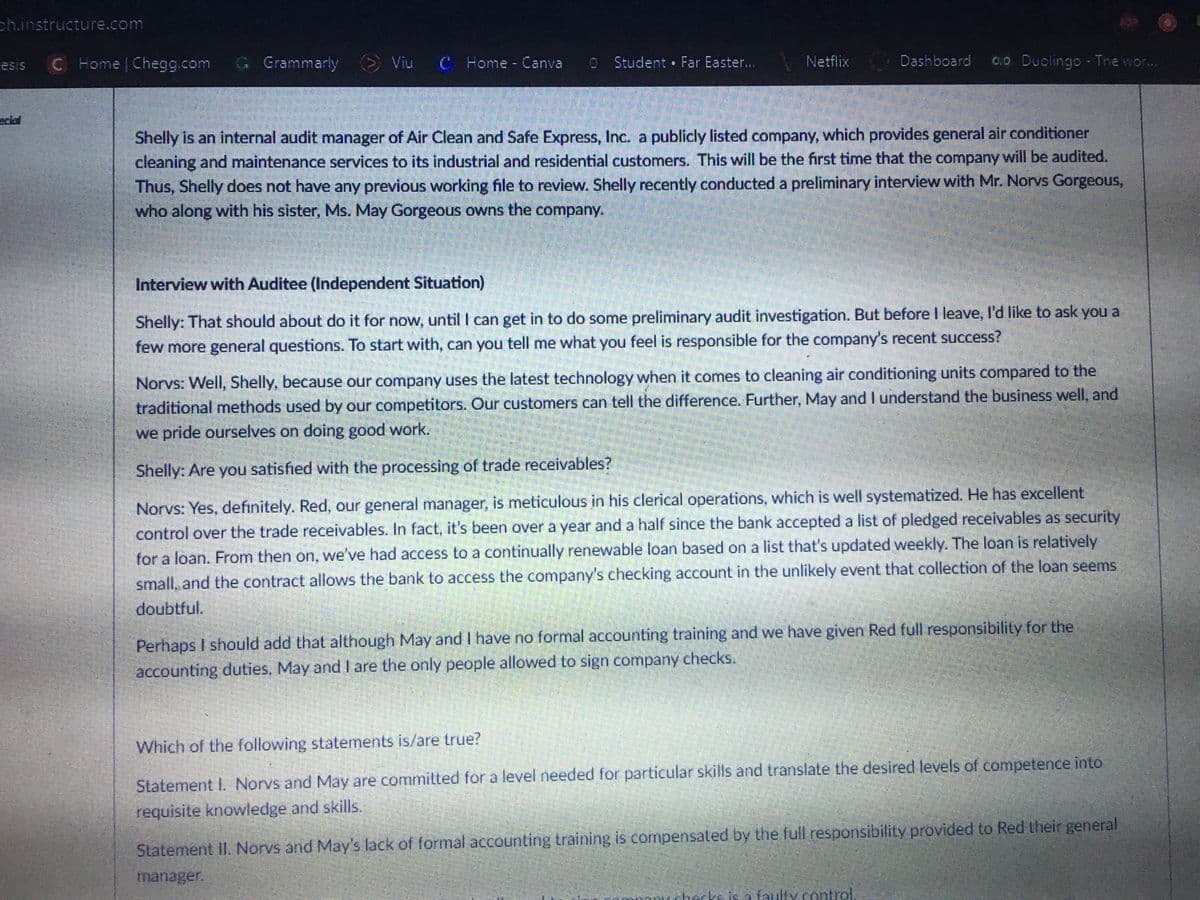

Shelly is an internal audit manager of Air Clean and Safe Express, Inc. a publicly listed company, which provides general air conditioner

cleaning and maintenance services to its industrial and residential customers. This will be the first time that the company will be audited.

Thus, Shelly does not have any previous working file to review. Shelly recently conducted a preliminary interview with Mr. Norvs Gorgeous,

who along with his sister, Ms. May Gorgeous owns the company.

Interview with Auditee (Independent Situation)

Shelly: That should about do it for now, until I can get in to do some preliminary audit investigation. But before I leave, l'd like to ask you a

few more general questions. To start with, can you tell me what you feel is responsible for the company's recent success?

Norvs: Well, Shelly, because our company uses the latest technology when it comes to cleaning air conditioning units compared to the

traditional methods used by our competitors. Our customers can tell the difference. Further, May and I understand the business well, and

we pride ourselves on doing good work.

Shelly: Are you satished with the processing of trade receivables?

Norvs: Yes, defınitely. Red, our general manager, is meticulous in his clerical operations, which is well systematized. He has excellent

control over the trade receivables. In fact, it's been over a year and a half since the bank accepted a list of pledged receivables as security

for a loan. From then on, we've had access to a continually renewable loan based on a list that's updated weekly. The loan is relatively

small, and the contract allows the bank to access the company's checking account in the unlikely event that collection of the loan seems

doubtful.

Perhaps I should add that although May and I have no formal accounting training and we have given Red full responsibility for the

accounting duties, May and I are the only people allowed to sign company checks.

Which of the following statements is/are true?

Statement I. Norvs and May are commilted for a level needed for particular skills and translate the desired levels of competence into

requisite knowledge and skills.

Statement II. Norvs and Mays lack of formal accounting training is compensated by the full responsibility provided to Red their general

manager.

checks is a faulty.control.

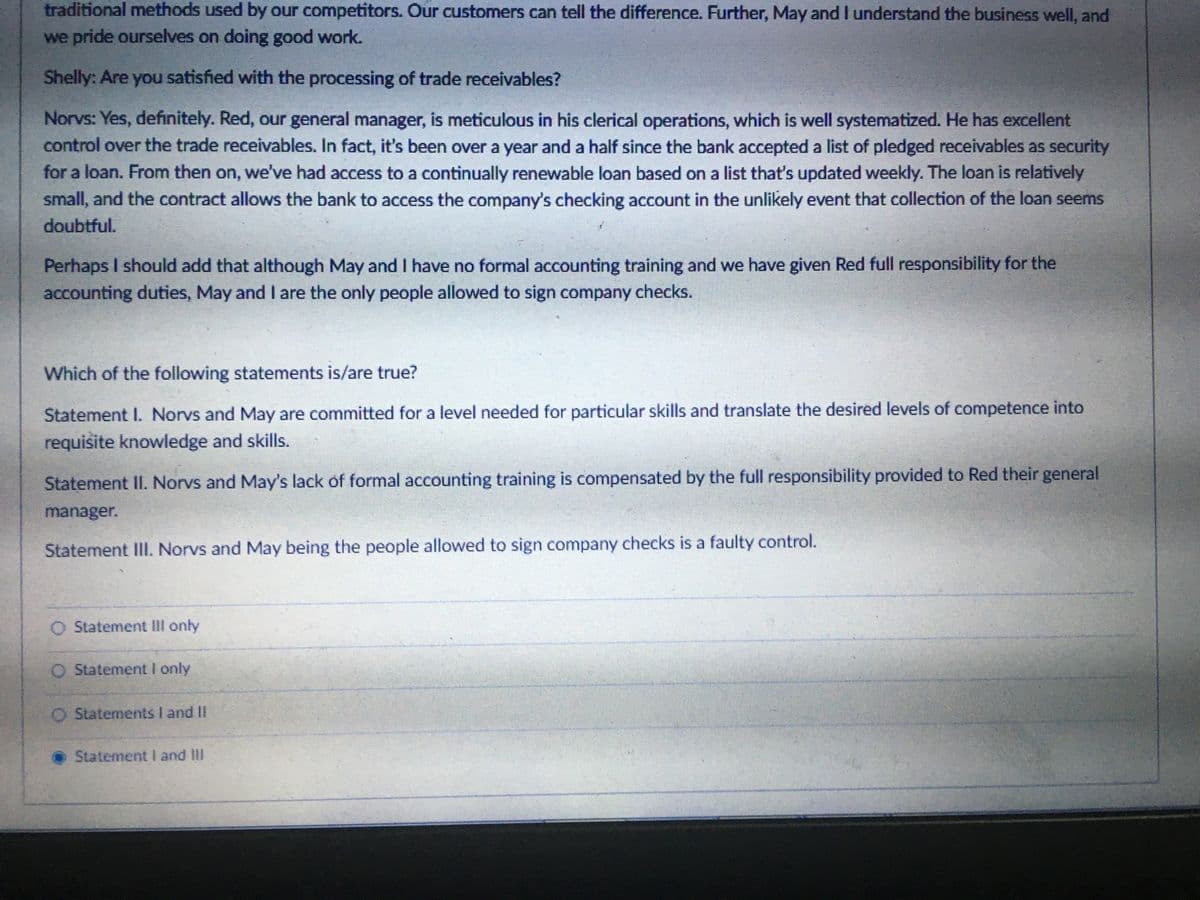

Transcribed Image Text:traditional methods used by our competitors. Our customers can tell the difference. Further, May and I understand the business well, and

we pride ourselves on doing good work.

Shelly: Are you satisfied with the processing of trade receivables?

Norvs: Yes, definitely. Red, our general manager, is meticulous in his clerical operations, which is well systematized. He has excellent

control over the trade receivables. In fact, it's been over a year and a half since the bank accepted a list of pledged receivables as security

for a loan. From then on, we've had access to a continually renewable loan based on a list that's updated weekly. The loan is relatively

small, and the contract allows the bank to access the company's checking account in the unlikely event that collection of the loan seems

doubtful.

Perhaps I should add that although May and I have no formal accounting training and we have given Red full responsibility for the

accounting duties, May and I are the only people allowed to sign company checks.

Which of the following statements is/are true?

Statement I. Norvs and May are committed for a level needed for particular skills and translate the desired levels of competence into

requisite knowledge and skills.

Statement II. Norvs and May's lack of formal accounting training is compensated by the full responsibility provided to Red their general

manager.

Statement IlI. Norvs and May being the people allowed to sign company checks is a faulty control.

O Statement IIl only

O Statement I only

O Statements I and II

Statement I and IlII

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning