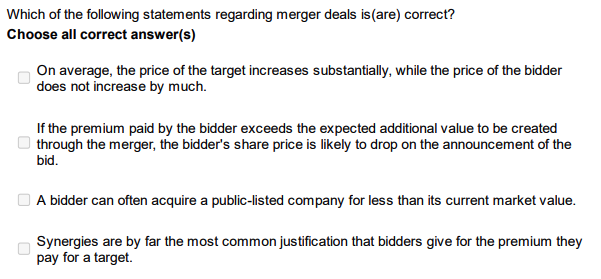

Which of the following statements regarding merger deals is (are) correct? Choose all correct answer(s) On average, the price of the target increases substantially, while the price of the bidder does not increase by much. If the premium paid by the bidder exceeds the expected additional value to be created through the merger, the bidder's share price is likely to drop on the announcement of the bid. A bidder can often acquire a public-listed company for less than its current market value. Synergies are by far the most common justification that bidders give for the premium they pay for a target.

Which of the following statements regarding merger deals is (are) correct? Choose all correct answer(s) On average, the price of the target increases substantially, while the price of the bidder does not increase by much. If the premium paid by the bidder exceeds the expected additional value to be created through the merger, the bidder's share price is likely to drop on the announcement of the bid. A bidder can often acquire a public-listed company for less than its current market value. Synergies are by far the most common justification that bidders give for the premium they pay for a target.

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Which of the following statements regarding merger deals is (are) correct?

Choose all correct answer(s)

On average, the price of the target increases substantially, while the price of the bidder

does not increase by much.

If the premium paid by the bidder exceeds the expected additional value to be created

through the merger, the bidder's share price is likely to drop on the announcement of the

bid.

A bidder can often acquire a public-listed company for less than its current market value.

Synergies are by far the most common justification that bidders give for the premium they

pay for a target.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning