Which of the risks identified in COH’s 2022 annual report will affect its beta? Which of the risks identified there will affect COH’s unsystematic risks?

Which of the risks identified in COH’s 2022 annual report will affect its beta? Which of the risks identified there will affect COH’s unsystematic risks?

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Which of the risks identified in COH’s 2022 annual report will affect its beta? Which of the risks identified there will affect COH’s unsystematic risks?

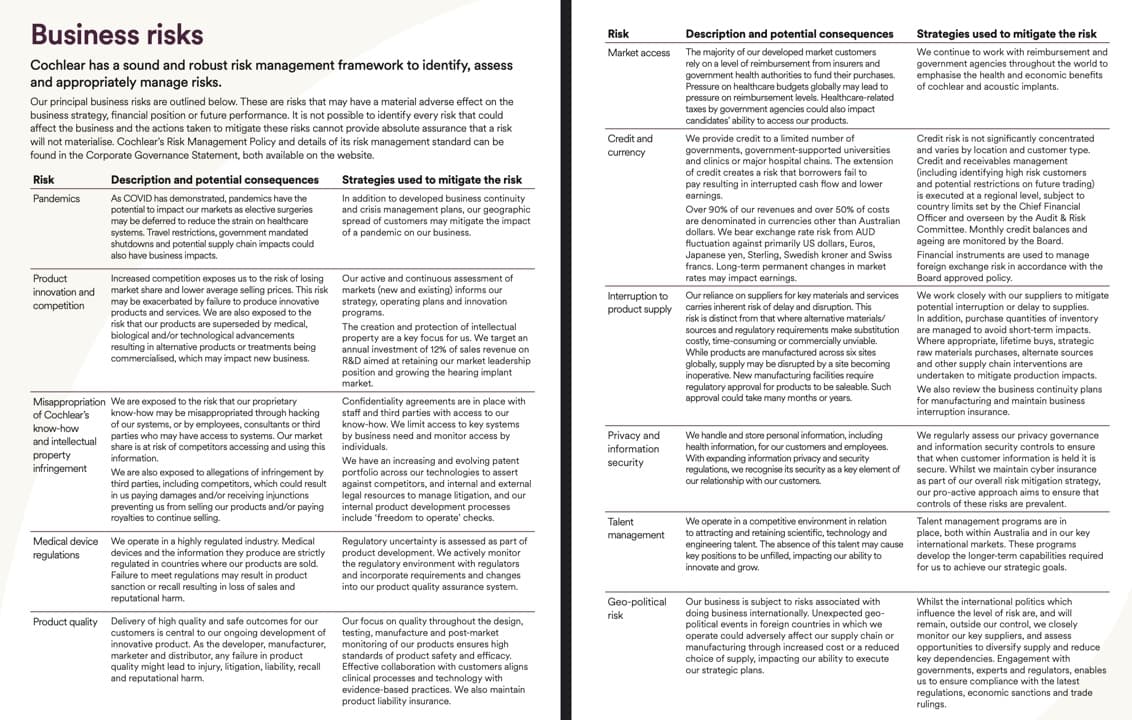

Transcribed Image Text:Business risks

Cochlear has a sound and robust risk management framework to identify, assess

and appropriately manage risks.

Our principal business risks are outlined below. These are risks that may have a material adverse effect on the

business strategy, financial position or future performance. It is not possible to identify every risk that could

affect the business and the actions taken to mitigate these risks cannot provide absolute assurance that a risk

will not materialise. Cochlear's Risk Management Policy and details of its risk management standard can be

found in the Corporate Governance Statement, both available on the website.

Risk

Pandemics

Product

innovation and

competition

Misappropriation

of Cochlear's

know-how

and intellectual

property

infringement

Medical device

regulations

Description and potential consequences

As COVID has demonstrated, pandemics have the

potential to impact our markets as elective surgeries

may be deferred to reduce the strain on healthcare

systems. Travel restrictions, government mandated

shutdowns and potential supply chain impacts could

also have business impacts.

Increased competition exposes us to the risk of losing

market share and lower average selling prices. This risk

may be exacerbated by failure to produce innovative

products and services. We are also exposed to the

risk that our products are superseded by medical,

biological and/or technological advancements

resulting in alternative products or treatments being

commercialised, which may impact new business.

We are exposed to the risk that our proprietary

know-how may be misappropriated through hacking

of our systems, or by employees, consultants or third

parties who may have access to systems. Our market

share is at risk of competitors accessing and using this

information.

We are also exposed to allegations of infringement by

third parties, including competitors, which could result

in us paying damages and/or receiving injunctions

preventing us from selling our products and/or paying

royalties to continue selling.

We operate in a highly regulated industry. Medical

devices and the information they produce are strictly

regulated in countries where our products are sold.

Failure to meet regulations may result in product

sanction or recall resulting in loss of sales and

reputational harm.

Product quality Delivery of high quality and safe outcomes for our

customers is central to our ongoing development of

innovative product. As the developer, manufacturer,

marketer and distributor, any failure in product

quality might lead to injury, litigation, liability, recall

and reputational harm.

Strategies used to mitigate the risk

In addition to developed business continuity

and crisis management plans, our geographic

spread of customers may mitigate the impact

of a pandemic on our business.

Our active and continuous assessment of

markets (new and existing) informs our

strategy, operating plans and innovation

programs.

The creation and protection of intellectual

property are a key focus for us. We target an

annual investment of 12% of sales revenue on

R&D aimed at retaining our market leadership

position and growing the hearing implant

market.

Confidentiality agreements are in place with

staff and third parties with access to our

know-how. We limit access to key systems

by business need and monitor access by

individuals.

We have an increasing and evolving patent

portfolio across our technologies to assert

against competitors, and internal and external

legal resources to manage litigation, and our

internal product development processes

include 'freedom to operate' checks.

Regulatory uncertainty is assessed as part of

product development. We actively monitor

the regulatory environment with regulators

and incorporate requirements and changes

into our product quality assurance system.

Our focus on quality throughout the design,

testing, manufacture and post-market

monitoring of our products ensures high

standards of product safety and efficacy.

Effective collaboration with customers aligns

clinical processes and technology with

evidence-based practices. We also maintain

product liability insurance.

Risk

Market access

Credit and

currency

Privacy and

information

security

Talent

management

Interruption to

Our reliance on suppliers for key materials and services

product supply carries inherent risk of delay and disruption. This

risk is distinct from that where alternative materials/

sources and regulatory requirements make substitution

costly, time-consuming or commercially unviable.

While products are manufactured across six sites

globally, supply may be disrupted by a site becoming

inoperative. New manufacturing facilities require

regulatory approval for products to be saleable. Such

approval could take many months or years.

Geo-political

Description and potential consequences

The majority of our developed market customers

rely on a level of reimbursement from insurers and

government health authorities to fund their purchases.

Pressure on healthcare budgets globally may lead to

pressure on reimbursement levels. Healthcare-related

taxes by government agencies could also impact

candidates' ability to access our products.

risk

We provide credit to a limited number of

governments, government-supported universities

and clinics or major hospital chains. The extension

of credit creates a risk that borrowers fail to

pay resulting in interrupted cash flow and lower

earnings.

Over 90% of our revenues and over 50% of costs

are denominated in currencies other than Australian

dollars. We bear exchange rate risk from AUD

fluctuation against primarily US dollars, Euros,

Japanese yen, Sterling, Swedish kroner and Swiss

francs. Long-term permanent changes in market

rates may impact earnings.

We handle and store personal information, including

health information, for our customers and employees.

With expanding information privacy and security

regulations, we recognise its security as a key element of

our relationship with our customers.

We operate in a competitive environment in relation

to attracting and retaining scientific, technology and

engineering talent. The absence of this talent may cause

key positions to be unfilled, impacting our ability to

innovate and grow.

Our business is subject to risks associated with

doing business internationally. Unexpected geo-

political events in foreign countries in which wer

operate could adversely affect our supply chain or

manufacturing through increased cost or a reduced

choice of supply, impacting our ability to execute

our strategic plans.

Strategies used to mitigate the risk

We continue to work with reimbursement and

government agencies throughout the world to

emphasise the health and economic benefits

of cochlear and acoustic implants.

Credit risk is not significantly concentrated

and varies by location and customer type.

Credit and receivables management

(including identifying high risk customers.

and potential restrictions on future trading)

is executed at a regional level, subject to

country limits set by the Chief Financial

Officer and overseen by the Audit & Risk

Committee. Monthly credit balances and

ageing are monitored by the Board.

Financial instruments are used to manage

foreign exchange risk in accordance with the

Board approved policy.

We work closely with our suppliers to mitigate

potential interruption or delay to supplies.

In addition, purchase quantities of inventory

are managed to avoid short-term impacts.

Where appropriate, lifetime buys, strategic

raw materials purchases, alternate sources

and other supply chain interventions are

undertaken to mitigate production impacts.

We also review the business continuity plans

for manufacturing and maintain business

interruption insurance.

We regularly assess our privacy governance

and information security controls to ensure

that when customer information is held it is

secure. Whilst we maintain cyber insurance

as part of our overall risk mitigation strategy,

our pro-active approach aims to ensure that

controls of these risks are prevalent.

Talent management programs are in

place, both within Australia and in our key

international markets. These programs

develop the longer-term capabilities required

for us to achieve our strategic goals.

Whilst the international politics which

influence the level of risk are, and will

remain, outside our control, we closely

monitor our key suppliers, and assess

opportunities to diversify supply and reduce

key dependencies. Engagement with

governments, experts and regulators, enables

us to ensure compliance with the latest

regulations, economic sanctions and trade

rulings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON