Which one of the following alternatives represents the new profit-sharing ratio after the admission of Mqithwa into the new partnership? A. 7:9:2 B. 2:2:1 C. 7:9:4 D. 3:1:4

Which one of the following alternatives represents the new profit-sharing ratio after the admission of Mqithwa into the new partnership? A. 7:9:2 B. 2:2:1 C. 7:9:4 D. 3:1:4

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter23: Accounting For Partnerships

Section: Chapter Questions

Problem 1CP

Related questions

Question

100%

Transcribed Image Text:QUESTION 1

Which one of the following alternatives represents the new profit-sharing ratio after the

admission of Mqithwa into the new partnership?

А. 7:9:2

В. 2:2:1

С. 7:9:4

D. 3:1:4

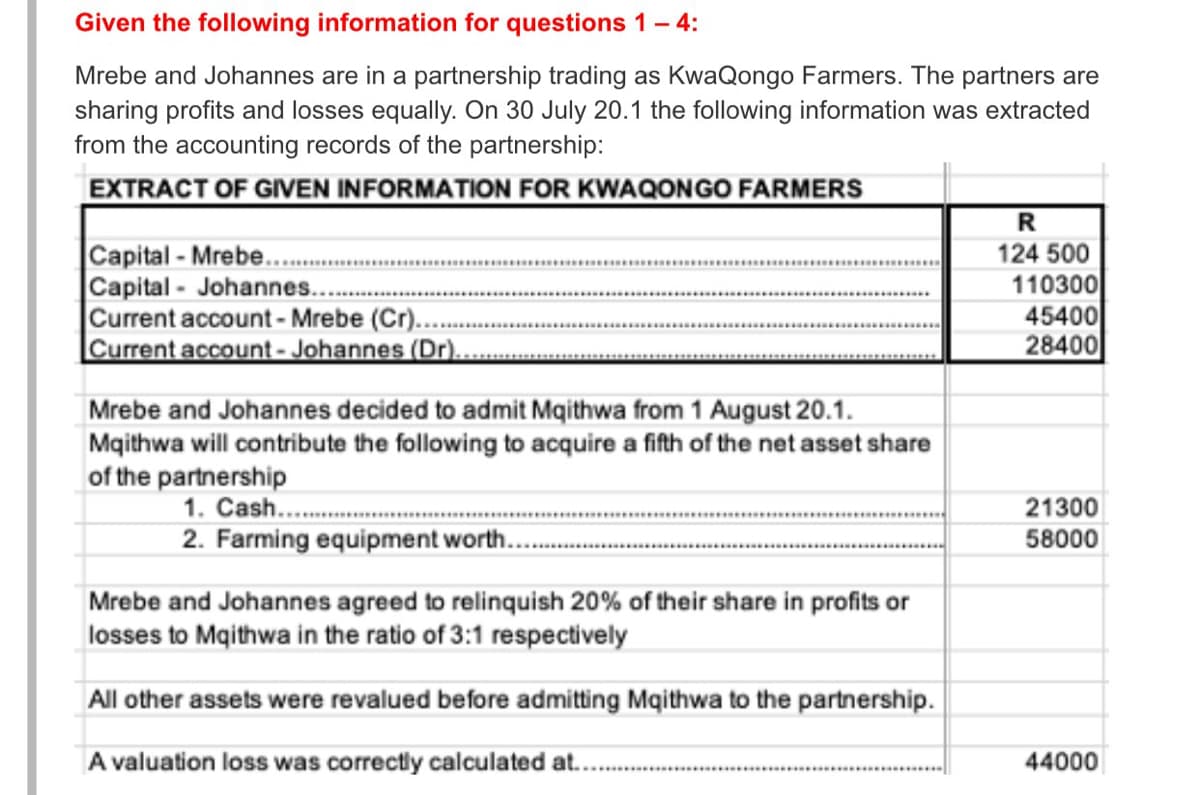

Transcribed Image Text:Given the following information for questions 1- 4:

Mrebe and Johannes are in a partnership trading as KwaQongo Farmers. The partners are

sharing profits and losses equally. On 30 July 20.1 the following information was extracted

from the accounting records of the partnership:

EXTRACT OF GIVEN INFORMATION FOR KWAQONGO FARMERS

R

Capital - Mrebe..

Capital - Johannes....

Current account - Mrebe (Cr)..

Current account - Johannes (Dr)..

124 500

110300

45400

28400

Mrebe and Johannes decided to admit Mqithwa from 1 August 20.1.

Maithwa will contribute the following to acquire a fifth of the net asset share

of the partnership

1. Cash...

2. Farming equipment worth..

21300

58000

Mrebe and Johannes agreed to relinquish 20% of their share in profits or

losses to Mqithwa in the ratio of 3:1 respectively

All other assets were revalued before admitting Mqithwa to the partnership.

A valuation loss was correctly calculated at.

44000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning