Which one of the following alternatives is correct? O A. To ensure that compliance is followed, the financial statements of partnerships must be prepared according to IFRS. O B. When recording the valuation adjustments, if the value of a liability is decreased, the valuation account credited with the amount of a decrease. C. The selling price of the partnership

Which one of the following alternatives is correct? O A. To ensure that compliance is followed, the financial statements of partnerships must be prepared according to IFRS. O B. When recording the valuation adjustments, if the value of a liability is decreased, the valuation account credited with the amount of a decrease. C. The selling price of the partnership

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

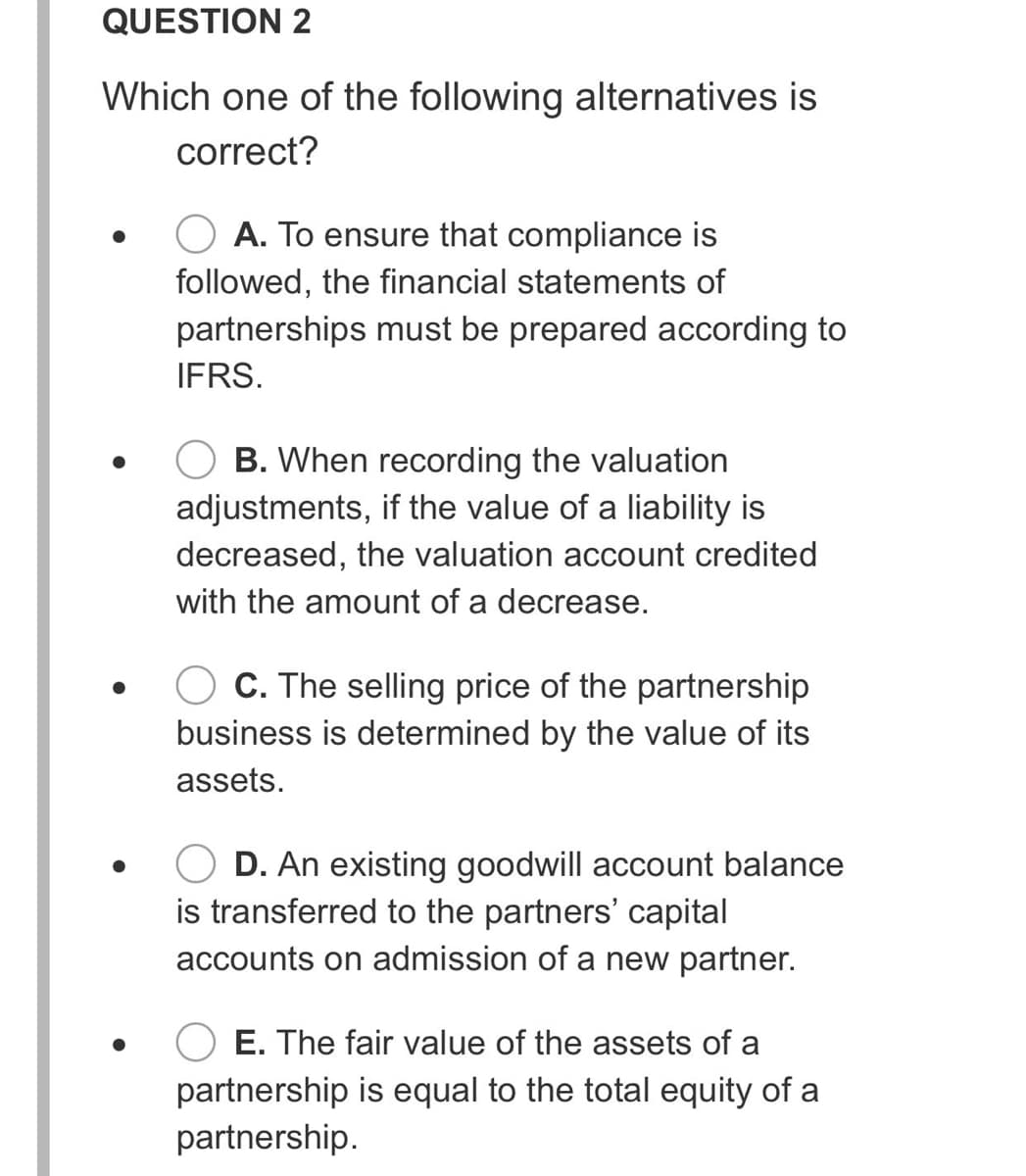

Transcribed Image Text:QUESTION 2

Which one of the following alternatives is

correct?

A. To ensure that compliance is

followed, the financial statements of

partnerships must be prepared according to

IFRS.

B. When recording the valuation

adjustments, if the value of a liability is

decreased, the valuation account credited

with the amount of a decrease.

C. The selling price of the partnership

business is determined by the value of its

assets.

D. An existing goodwill account balance

is transferred to the partners' capital

accounts on admission of a new partner.

E. The fair value of the assets of a

partnership is equal to the total equity of a

partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College