Which type of taxpayer cannot be a partner in a partnership? a non-resident alien a C corporation a non-profit entity An S corporation All of these can be partners in a partnership

Which type of taxpayer cannot be a partner in a partnership? a non-resident alien a C corporation a non-profit entity An S corporation All of these can be partners in a partnership

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

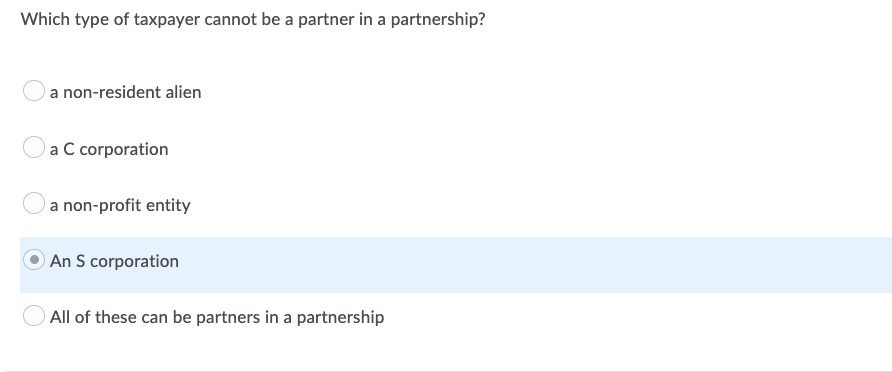

Transcribed Image Text:Which type of taxpayer cannot be a partner in a partnership?

a non-resident alien

a C corporation

a non-profit entity

An S corporation

All of these can be partners in a partnership

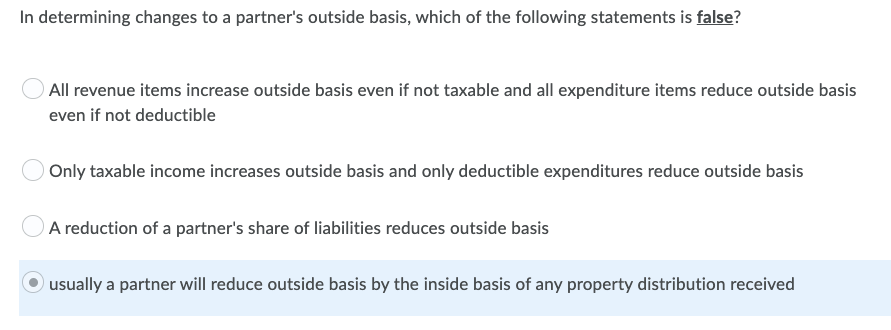

Transcribed Image Text:In determining changes to a partner's outside basis, which of the following statements is false?

All revenue items increase outside basis even if not taxable and all expenditure items reduce outside basis

even if not deductible

Only taxable income increases outside basis and only deductible expenditures reduce outside basis

A reduction of a partner's share of liabilities reduces outside basis

usually a partner will reduce outside basis by the inside basis of any property distribution received

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College