Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

WHY THE

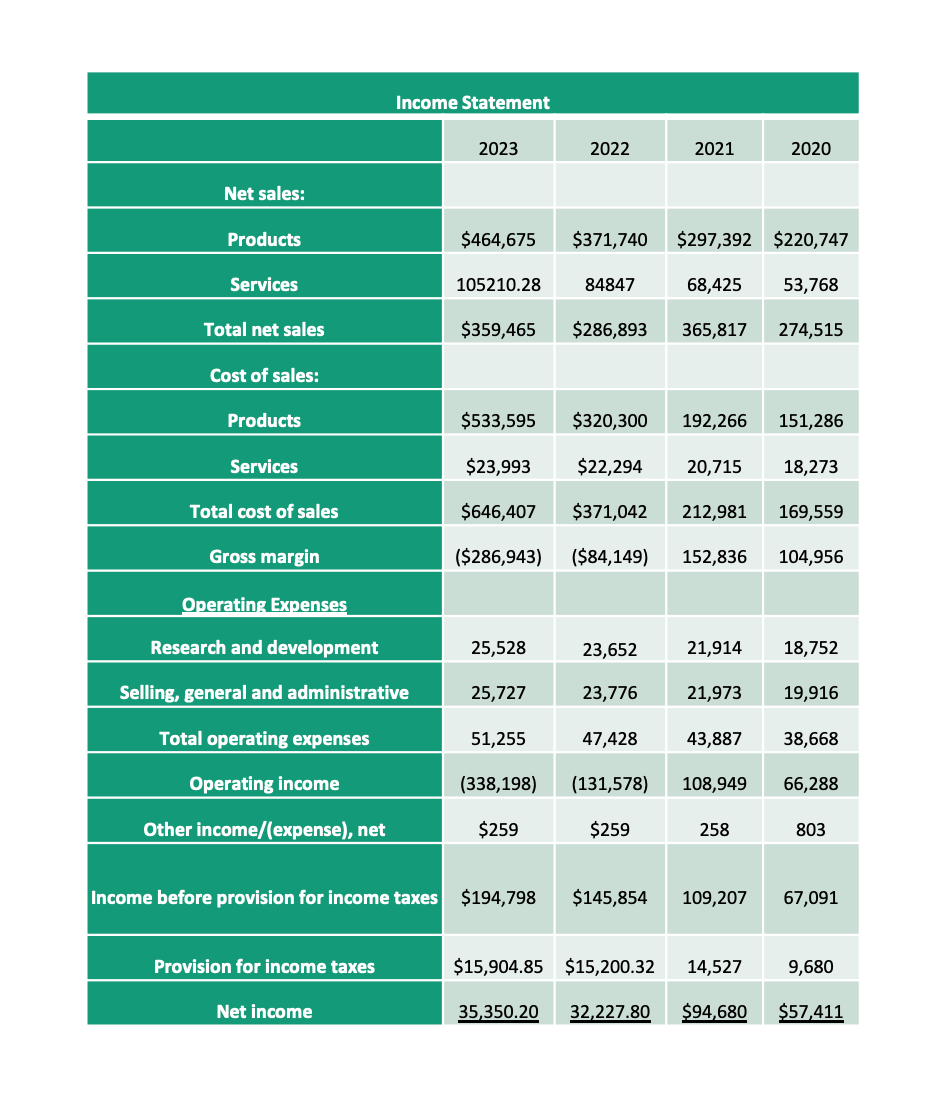

Transcribed Image Text:Income Statement

2023

2022

2021

2020

Net sales:

Products

$464,675

$371,740

$297,392 $220,747

Services

105210.28

84847

68,425

53,768

Total net sales

$359,465

$286,893

365,817

274,515

Cost of sales:

Products

$533,595

$320,300

192,266

151,286

Services

$23,993

$22,294

20,715

18,273

Total cost of sales

$646,407

$371,042

212,981

169,559

Gross margin

($286,943)

($84,149)

152,836

104,956

Operating Expenses

Research and development

25,528

23,652

21,914

18,752

Selling, general and administrative

25,727

23,776

21,973

19,916

Total operating expenses

51,255

47,428

43,887

38,668

Operating income

(338,198)

(131,578)

108,949

66,288

Other income/(expense), net

$259

$259

258

803

Income before provision for income taxes $194,798

$145,854

109,207

67,091

Provision for income taxes

$15,904.85 $15,200.32

14,527

9,680

Net income

35,350.20

32,227.80

$94,680

$57,411

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education