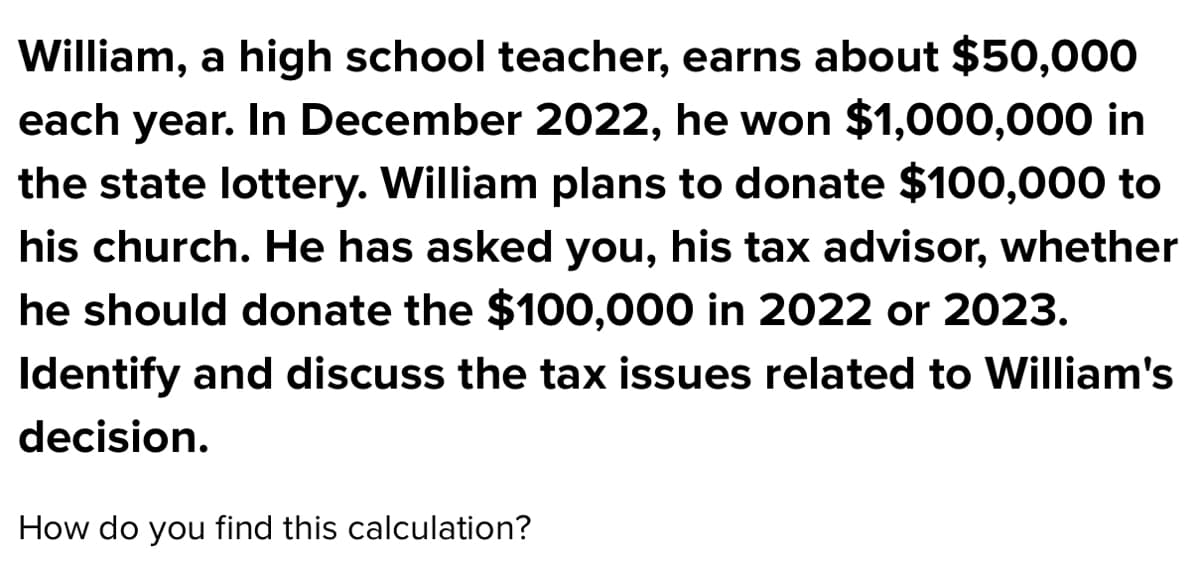

William, a high school teacher, earns about $50,000 each year. In December 2022, he won $1,000,000 in the state lottery. William plans to donate $100,000 to his church. He has asked you, his tax advisor, whether he should donate the $100,000 in 2022 or 2023. Identify and discuss the tax issues related to William's decision. How do you find this calculation?

William, a high school teacher, earns about $50,000 each year. In December 2022, he won $1,000,000 in the state lottery. William plans to donate $100,000 to his church. He has asked you, his tax advisor, whether he should donate the $100,000 in 2022 or 2023. Identify and discuss the tax issues related to William's decision. How do you find this calculation?

Chapter10: Deduct Ions And Losses: Certain Itemized Deduct Ions

Section: Chapter Questions

Problem 14DQ

Related questions

Question

I ioeoeowowoowowowowoeoekek

Transcribed Image Text:William, a high school teacher, earns about $50,000

each year. In December 2022, he won $1,000,000 in

the state lottery. William plans to donate $100,000 to

his church. He has asked you, his tax advisor, whether

he should donate the $100,000 in 2022 or 2023.

Identify and discuss the tax issues related to William's

decision.

How do you find this calculation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT